Today’s Nuggets

Supreme Court Clears the Silk Road Bitcoin Path

Fighting Back Against Tyranny

JPMorgan Flips from Bear to Bull

Millennials’ Hold on Crypto

Crypto Adoption Faster than Internet and Cellphones

ETH Hit Hard, AI Still on Top

Standard Chartered’s Solana Predictions

Jupiter Mobile’s Built-in On-Ramp

FTX’s Bankruptcy Plan

The MicroStrategy Playbook Players

Is there another gray swan on the horizon? A lot of weird stuff is happening in the market, as things are going in opposite directions.

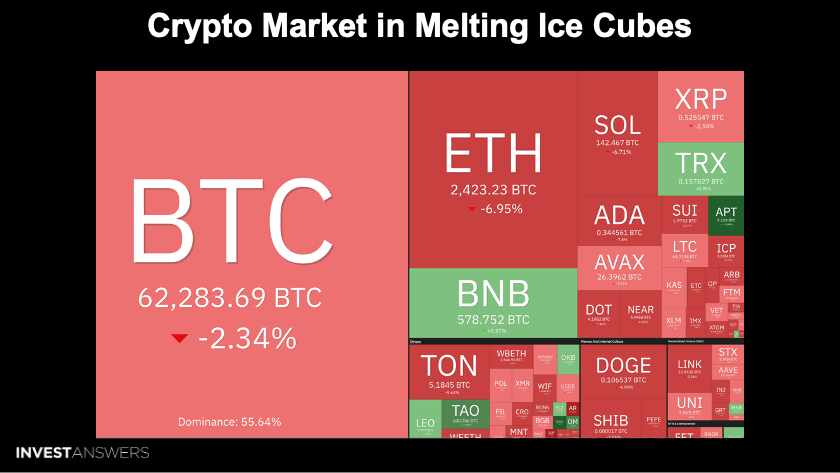

Crypto Market Update:

The crypto market cap is $2.16 billion and the average volume is $75 billion;

Ethereum is at $2,400 and its dominance is 13.5%;

The Fear and Greed is neutral at 49; and

MicroStrategy is up 5%, as it has been on fire lately. The last time MicroStrategy was at $200, Bitcoin was at $74K, and now there are more outstanding shares—this is bizarre.

XAI is on here every week and some big unlocks are coming this week;

OP has about $20 million, which is not too big;

IO has a $5.2 million unlock coming up;

APT will unlock $103 million but it has also been on fire; and

ADA has little unlock as well.

This is 20,000 BTC, bigger than the German Bitcoin bag sold this year.

The question is: Could this be the gray swan that could derail Uptober? We are not sure but they have cleared the way to dump it.

Much of the coins have been moved to places where they could be dumped or sold quickly, which could drive the price down.

When things like this dump, it can be pretty ugly and scary for some people. That is when we stack and hedge to protect against such downsides.

Considering some of the narratives spoken about during the Bitcoin conference, if the current party in power were to dump Bitcoin ahead of the election and we are 27 days to go, that would be a bad look.

They might sell 10,000 Bitcoin or something but not the whole bag.

All the SEC does is kick out Wells notices all the time. Who cares?

What is good is when firms like Ripple, Coinbase, and Crypto.com start fighting back.

These firms are now saying we are not dealing with this tyranny anymore. Shout out to Crypto.com for doing that.

I care about people, freedom, and financial freedom for the people in our community. The SEC is not here to protect you. If they were, they would have in 2021 and they did not.

Neutral is not that exciting but I threw it in here because I otherwise would not have enough bad news.

The crypto market over the last seven days was pretty bad. Most everything benchmarked against Bitcoin was down, including:

ETH -6.97%;

TON -9.65%;

ADA -7.84%; and

SOL -6.73%.

Bitcoin, in relative terms, had a pretty good week.

It was not a good week for crypto:

BTC -2.34%

ETH -6.95%

Digital asset fund flows were down but saw minor outflows, down about $147 million last week due to better-than-expected economic data.

This period is when

Keep reading with a 7-day free trial

Subscribe to InvestAnswers Newsletter to keep reading this post and get 7 days of free access to the full post archives.