Today’s Nuggets

New 13F Bitcoin Stackers

Wisconsin Investment Board Buys More IBIT

The U.S. Government Bitcoin on the Move

Will New FASB Rules Drive New BTC Treasuries?

A Giant Call Option on Inflation

Eggs Denominated in Bitcoin

We had some good news but experienced a sell-off in the market.

Sometimes, it is darkest before dawn. We know so far, there is a lot of selling with Mt. Gox, Grayscale, miners, and we had the German government. We now have a bit from the U.S. government.

We will also cover the U.S. inflation number and the call option against U.S. inflation.

Crypto Market Update:

The crypto market cap is at $2.1T.

The Bitcoin price is $59.5K.

The Fear & Greed Index is at 30.

The Fear & Greed Index is at 30 and no longer in the extreme fear zone as it was a few days ago.

25 is the number you have to look for, which usually supplies a good buying indicator.

The 13F filings are out for Q2 2024 and we have seen a lot of interesting stuff.

Major banks are now munching on Bitcoin and Morgan Stanley is unleashing 15,000 salespeople to buy it.

This is a very short list of some of the new 13F Bitcoin stackers.

Now you know all of the stuff that has been happening despite the heavy selling. These large asset managers are munching on Bitcoin.

While the prices are low, Michael Saylor and MARA are raising funds.

MSTR is issuing shares to buy $2 billion worth of Bitcoin over the next ten days. They turn things around real fast and Saylor knows it is a game of time.

If you add those two together, it is $2.25 billion or 38,000 Bitcoin worth of buying pressure.

Who is selling? We will get to that in a minute...

They will be sucking up a huge part of this year's actual Bitcoin issuance.

Wisconsin Pension Fund buys more Bitcoin.

They just snagged a big bunch more and are not stopping. This will put them way over the 3% allocation to Bitcoin.

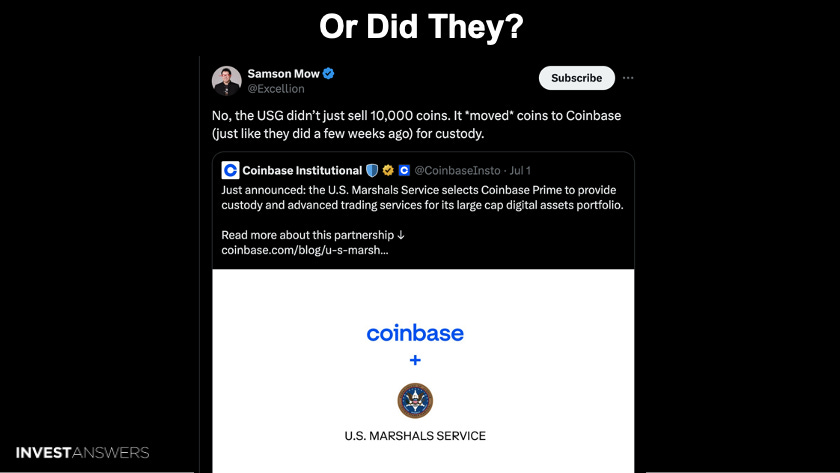

It seems like every day, there is another kick in the teeth to scare investors. This time, it is the U.S. government moving 10,000 Bitcoin from Silk Road wallets.

We have verified that it is indeed true.

This is worth about $650 million.

A few weeks ago, the U.S. moved 10,000 Bitcoin and the U.S. Marshal Service chose Coinbase Prime to provide custody.

Does that mean they will hold it or will they kick it to Coinbase to sell on their behalf?

We do not know what is happening…

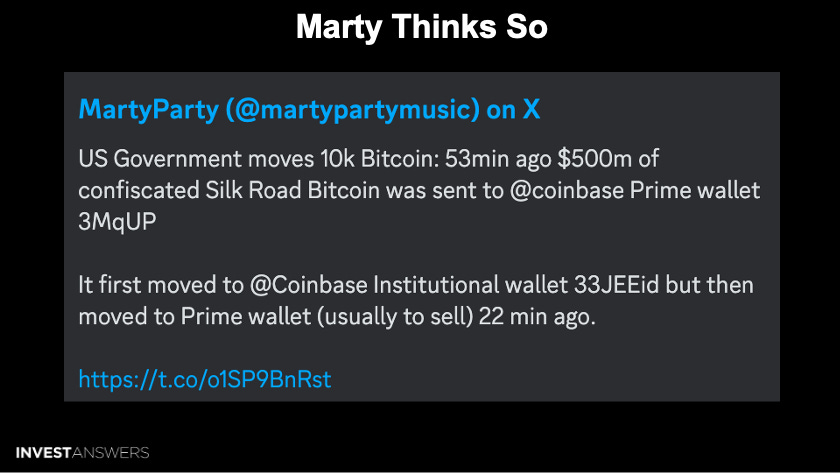

MartyParty believes that the 10K Bitcoin is to be sold by the U.S. government.

We will find out either way but the market is rattled, which impacts the price.

We have seen a huge trend towards treasuries coming.

We hope the Financial Accounting Standards Board (FASB) will launch its new fair value accounting for Bitcoin beginning after December 15th, 2024. Hopefully, this will also be a real catalyst for Bitcoin.

A handful of the 50,000 corporations on the planet are currently doing this, so it is so early!

The grey box represents the floor and the roof (BTC all-time high) alongside the 90-day period after the halving.

Normally, things kick off 90 days after halving. However, this has not happened, as we have had a lacklustre volume in August.

The red line going up and to the right is the 200-day moving average. We did pierce that briefly the other day and then it fell right down below it again. It is proving to be a little bit of resistance, which is not good. The trend is down and that is not good.

The only good news from this box is that we are above the floor of ~$59K - we will take that as a small win.

We did have that little moment where the top and bottom indicator flipped orange for the first time this bull run but it reverted back.

Remember, this is based on on-chain data across 21 different indicators with a composite score on a daily basis. This was probably due to a lot of old coins moving and transferring wallets from Mt. Gox.

The point is that we are back in the yellow zone and accumulation is fine. You know who else is accumulating, as we just covered that.

$60,000 is still a good level to accumulate.

We rarely talk about dominance but there is a very simple answer as to why Bitcoin's dominance is so strong.

First of all, we have extreme Bitcoin dominance now - up around 56% - which is up from 40% about a year ago. Much of it can be explained by the ETH dominance going down. Green is Bitcoin dominance on the left and the reverse mirror image is of ETH dominance on the right, falling from 205 down to about 15%.

You can see the spot cumulative volume delta CVD across all exchanges here. We had a large sell-side rebound regime post the all-time high with heavy selling led by:

Grayscale

Miners

Long-term holders are taking some lifestyle chips off of the table

Germany

Is the U.S. becoming like Germany? Are they going to sell? We will watch that carefully…

The sell-side regime explains why - despite the inflows into the ETFs - there has been a bustle against some of the other big sellers out there.

This is why the price appreciation has not gone where people were. My target last year for the halving price was $42K and we hit $73K.

To put things back into perspective,

Keep reading with a 7-day free trial

Subscribe to InvestAnswers Newsletter to keep reading this post and get 7 days of free access to the full post archives.