Today’s Nuggets

Historic BTC Conference in 13 Days

Auf Widersehen, German Government’s Bitcoin is Gone

Bitcoin Network Traffic is a Ghost Town

Senator Lummis states that Bitcoin is the Future

Worst BTC Post-Halving in History

$105K Bitcoin Options for Christmas

Miners Outperforming BTC & MSTR

94% Chance of a Rate Cut in September

Strong Week for BTC ETFs

Crypto Market Update:

Bitcoin was around $58K at the time of recording.

The Fear and Greed Index is still at 25, but it is a bit of a lagging indicator, so we ignore that.

July is still down 7%, a bit worse than June, down 6.8%, but we will make it through!

I will show you some things that prove that as well.

A lot of excitement is brewing around the Bitcoin conference.

In just 13 days, it will be the world's largest Bitcoin conference and kick off in Nashville, Tennessee. If I were closer, I would go myself. However, it is difficult for me, especially with my schedule. However, two presidential candidates are going, as Bitcoin is on the ballot for this presidential season, and it will be exciting to watch.

Will see if Trump still attends, given the recent events.

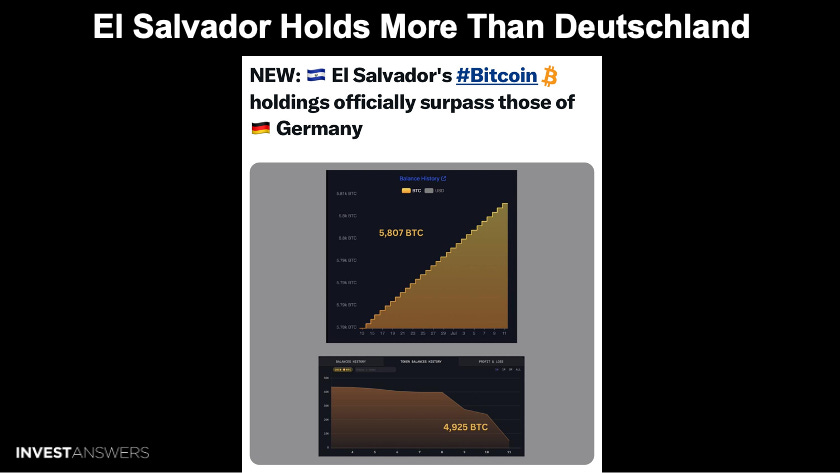

For a brief time, El Salvador held more Bitcoin than Germany. Better news regarding Germany is coming. El Salvador is still buying one Bitcoin a day.

Would it not be lovely to be able to stack one Bitcoin a day?

Auf Wiedersehen, German government: Bye-bye, see you later!

This government's selling took us below the 200-day moving average and the short-term holder cost basis. Germany gave us all a kick in the teeth - that is how crypto works.

Bitcoin did pump but is retracting back.

It could be a good weekend unless we get another headwind.

This is the behavior of somebody stacking, timing exactly when to buy and buying in very specific increments with great regularity. Again, I am 99% sure this is not a centralized exchange wallet.

Also, it is the top 10 wallet and has about $6 or $7 billion in it. Not many exchanges other than Binance could afford that. This wallet gets more aggressive stacking every time the price dips.

This story is about fear and people are very rattled.

This wallet, Genesis Trading, transferred $760 million worth of Bitcoin to Coinbase in the past month. It still holds $1.9 billion available to dump. Of course, when people see this, they get scared that it is another Germany.

This is part of a bankruptcy and is run by a financial shop that has connections to OTC desks and can do sidebar arrangements. It will not be dumped on the market. The release over the last month did not impact the price of Bitcoin.

Do not be too concerned.

The UK bank refuses to accept funds converted from Bitcoin.

They want an audit trail of where you got your cash and if you state that you sold Bitcoin to buy a house in the UK, they will deny you a mortgage or not let you buy the house.

Be careful who you bank with and work with a crypto-friendly bank.

Per Bitcoin Pro Magazine, the Bitcoin traffic is pretty much a ghost town right now.

The usage of inscriptions and runes is - again - disappearing, which could explain the drop in fees and the mempool activity. Again, these NFT and rune things are always fly by night.

Be careful if you play with them.

Bitcoin now has only 3,400 daily NFT traders, ranking fifth over the last 24 hours.

By the way, there were times this year when Bitcoin was number one, especially when things like runes and inscriptions were pumping. Now, it has fallen way below Polygon, Ethereum, and Base. Of course, Solana is still number one but there is no surprise there.

Senator Lummis stated her agenda on FoxNews. All of this can be done using digital assets.

Seeing politicians with power embracing crypto is refreshing because that is our life raft.

Embrace or die.

The SEC must be under weird pressure because they dropped their probe into Hiro Stacks, concluding its three-year investigation. This is three years of heavy tax dollars being spent on nothing. Well done.

This used to be a company called Blockstack, and they raised $70 million in token sales in 2019. The SEC decided not to recommend an enforcement action against Hiro Systems PBC.

For nearly two years, I have been saying that after months of on-chain profit-taking and coins being moved at a higher price than when they were acquired, we were on the cusp of enticing a regime of net realized losses. This is represented by the green line. When it turns red, that means there are net realized losses.

We are in the middle of a bull market shakeout. However, we have not gone red, which makes it a bit different.

The significance here is investors are weary of realizing losses during bull markets. During the 2016-17 and 2020-21 bull markets, there were multiple drawdowns. During these drawdowns, there were brief periods of net-realized losses, which consistently marked local bottoms.

In bull markets, investors are generally less fearful of losses. Previous patterns suggest that brief periods of losses often mark the bottom of price dips. Investors' reluctance to sell at a loss during a bull market can create buying opportunities and stabilize the price. Nobody likes to sell at a loss, especially during bull markets, prompting investors to come in and "buy the dip."

Per this rainbow chart, Bitcoin is going to $150,000 at a minimum.

When will it hit?

The arrow points to 2025 as the all-time high typically is 547 days after the halving. We are at 85 days now and it has been a weird one. We can blame it on

Keep reading with a 7-day free trial

Subscribe to InvestAnswers Newsletter to keep reading this post and get 7 days of free access to the full post archives.