Today’s Nuggets

Stark $21BN ATM Program

How Many Bitcoin Can MSTR Buy?

Saylor Has Enough to Buy the Next 1,145 Days of Issuance

1,110 Days Until Next Halving

CAGR Compounding Impact is Insane

Deutsche Bank Says BTC is a Hard Reserve Asset

Russian Central Bank to Allow BTC Buying

Bitwise Launch Bitcoin Hodler ETF 1K+ BTC

Long-term Holders are Done Selling

This story is called New Price Targets and will be interesting.

We will look into the miracle of compound annual growth rates and compounding with some new price targets for Bitcoin that go beyond 2032.

First, there is now a new way in which Michael Saylor and MicroStrategy are stacking more Bitcoin.

The new $STRK news came out a couple of days ago, in case you missed it. MSTR will issue $21 billion of preferred shares with an 8% coupon. I do not see them having any problem issuing this because insurance companies, institutions, and conservative pension funds love that 8% return.

These things are convertible down the line as well.

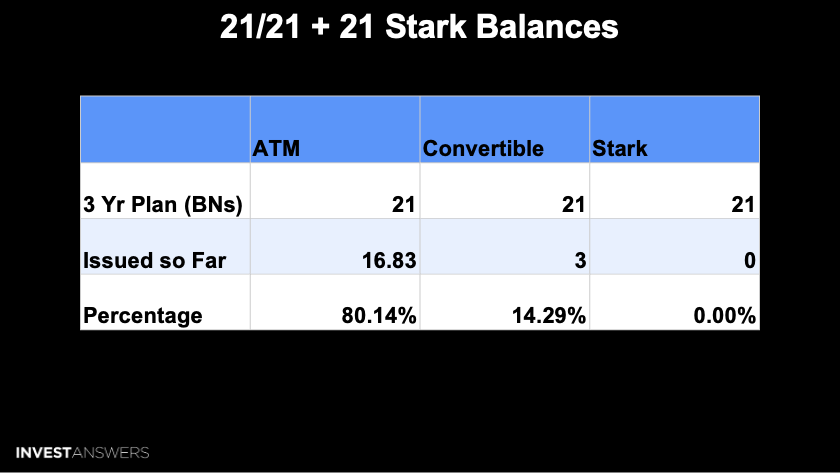

This is the 21/21 +21 plan broken down into a table I put together to try to break down how much is left of some of the other vehicles they have.

This plan consists of 21 billion of ATM, plus 21 billion of convertible stock and the new 21 billion of stock balances. Per my calculations, the ATM is about 80% issued, with ~$16.83 billion used to buy Bitcoin.

Convertibles are a little less, between $3-5 billion.

If you look at how much they have issued so far, you will see the ATM is almost tapped out, which is the first column of red from the limit of blue.

However, MSTR has been authorized to increase its shares if the team wants to. There could be

Keep reading with a 7-day free trial

Subscribe to InvestAnswers Newsletter to keep reading this post and get 7 days of free access to the full post archives.