Today’s Nuggets

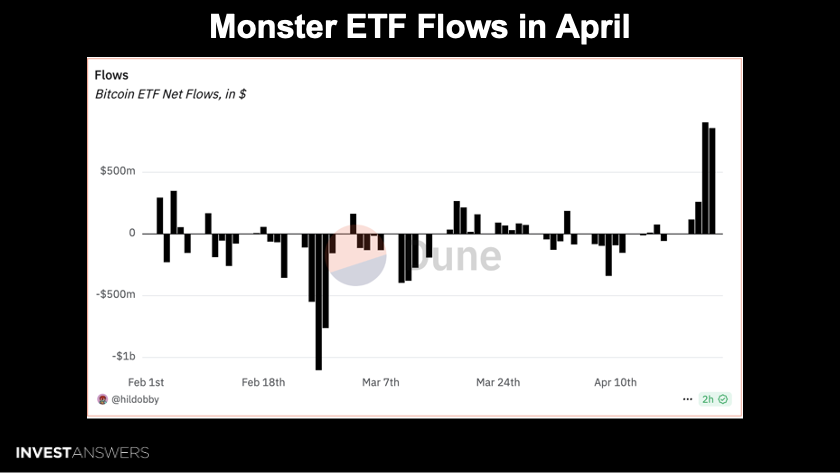

Monster ETF Flows in April

BTC Pumping Right on Cue with Global Liquidity

While You Were Scared

E-Trade To Offer BTC Buying and Selling

Fidelity Opens up Bitcoin/Crypto IRA

Dollar to Drop another 15 to 20%

“Big Tech will Embrace BTC” —Michael Saylor

BTC is a Tool Used by the CIA

This story is called More Pump on the Way, as Bitcoin has been on a crazy pump.

It is funny because I made a video back in March that has been watched over 100,000 times and focused on the correlation between global liquidity and Bitcoin. I forecasted that by May 1st, things would kick off, and here we are.

I spent the last 24 hours scouring the earth to find negative indicators for Bitcoin, but could not find any, which is a big part of today's story.

I want to pay attention to the ETFs because they have been on fire lately.

We had the third-biggest flow ever in the history of these ETFs, and it all happened in April.

BlackRock had a billion-dollar day last week. They are stacking like there is no tomorrow alongside MicroStrategy.

The Bitcoin ETFs now have 1.143 million Bitcoins, which is a lot!

The Bitcoin EFFs now have 111.1 billion dollars in on-chain holdings, and it was just amazing to capture that.

If you annualize the last 14 days of ETF absorption, some of those days were negative or flat, but the last 14 days alone would suck in 6.7% of the projected Bitcoin supply or 1.4 million BTC.

The U.S. government wants to

Keep reading with a 7-day free trial

Subscribe to InvestAnswers Newsletter to keep reading this post and get 7 days of free access to the full post archives.