Today, I will put together all of the elements of the BTC FUD to determine what is going on, why, and who could be behind it. Then, I will share my thoughts on why I chose Bitcoin.

A Chinese billionaire runs Matrixport, which builds Bitcoin miners. Yesterday, the company published an article with this headline: Bitcoin Spot ETF approval imminent, BTC to jump to $50,000.

Hours later, Matrixport published an article titled: Why the SEC will REJECT Bitcoin Spot ETFs again.

This shows you just how fickle the crypto world is. When people are easily led and fooled, it gives us buying opportunities.

This is a beautiful dip opportunity that was presented to us. Looking at the chart closely, you will notice a staggered drip, which reveals cascading liquidations.

This event served as a perfect opportunity for me to cover my hedge on my MicroStrategy position, buy a bunch of SOL, CLSK and TSLA.

This list does not include the Deribit investors. I guarantee you another $100 million plus in Deribit were wiped here. These are leveraged long investors who need to learn how margin works. You have got to be able to have what I call "the mattress" to be able to absorb a violent fluctuation.

They do this on purpose in crypto to steal your money. It is like a mugging down a dark alley at night. And the sooner people understand that, the better.

The Get Rich Quick (GRQ) approach to investing does not work. You must be in this game with a plan like going to sea with a boat. You need to be able to navigate any storm, or you will get shipwrecked.

This image displays what the hunters see when they prey on the leverage retail investor. The amount of premium on going leveraged long was through the roof. This has been obvious for many days, and it was only a matter of time before somebody mugged them all.

This was all triggered by the FUD questioning the spot BTC ETF being delayed in the U.S. Be careful who you listen to, and follow those qualified to give advice. Listen to people like Michael Saylor, who understands macro, he understands money, and he understands Bitcoin.

Most trusted sources believe the BTC ETF applications will be approved between January 8-10th.

This popped up in my feed today. If the SEC were going to reject the applicants, then this would not be taking place.

I am speculating here, but maybe they bought today, moving their $10 million dollar Bitcoin purchase from the 3rd of January, which is today, to the 5th of this Friday. They are already stacking, and this is proof.

BlackRock's rescheduling of its seeding of the Bitcoin ETF to January 5th has been verified.

In fact, perhaps this whole dip was orchestrated to prey on the Lettuce Hands? Flush em out so Wall St can stack?

The quote by Carl Jung, a renowned Swiss psychiatrist and psychoanalyst, suggests that events that may seem like mere coincidences are actually part of a larger pattern of meaningful connections called "synchronicity." Jung believed that these synchronistic events held personal and universal significance and were not simply random occurrences. The idea is that the universe is interconnected in mysterious ways, and these connections can manifest as meaningful coincidences in our lives.

By recognizing and embracing synchronicity, we can better understand ourselves and the world around us. I believe that is what is happening here. It's all part of a plan.

The GBTC discount is again rising as investors flip their GBTC into other assets like MSTR and BTC miners. This is a prudent move.

Grayscale's CEO, Michael Sonnenshein, emphasizes that if US regulators approve other spot-Bitcoin ETFs but not Grayscale's, it would significantly disadvantage investors in the Grayscale Bitcoin Trust. He advocates for the SEC to approve multiple spot Bitcoin ETFs simultaneously to ensure a level playing field.

Grayscale is prepared to list its product, GBTC, as an ETF and has committed to lowering its fee once it starts trading as an ETF. Currently, the trust has a 2% expense ratio. This change follows a pivotal ruling in Grayscale's favor against the SEC as it seeks to convert its trust into an ETF.

"The first to market gets the most." It would not surprise me if BlackRock got the approval first to go to market.

The Bitcoin Genesis Block, also known as Block 0, was the first block of the Bitcoin blockchain and was created on January 3, 2009. The message included in the block's transaction reads:

"The Times 03/Jan/2009 Chancellor on brink of second bailout for banks."

This message references a headline from The Times newspaper on that day, which reported on the UK government's plans to provide financial support to struggling banks during the global financial crisis. The inclusion of this message in the Genesis Block is widely seen as a commentary on the need for an alternative financial system that is not subject to the same vulnerabilities as traditional banking.

This is an image of me having fun on Twitter. By the way, the initial release of 0.01 Bitcoins happened on January 9th.

On its 15th birthday, Bitcoin has nearly 100,000 $1 million addresses. Do what the rich do and attack like the Bitcoin millionaires! Individuals and entities could own many of these wallets, so this does not diminish how rare it is to be a wholecoiner.

$34.001 trillion of U.S. debt only 3 months after we hit $33 trillion. For context, this is 2 years after we hit $30 trillion and just 4 years after we hit $24 trillion. The U.S. debt is an exponential S-curve growth trend.

In the next 12-14 weeks, the U.S. debt will be at $35T. In 1,200 days, the U.S. has added $10T more in debt.

The more the debt, the more debasement of your fiat!

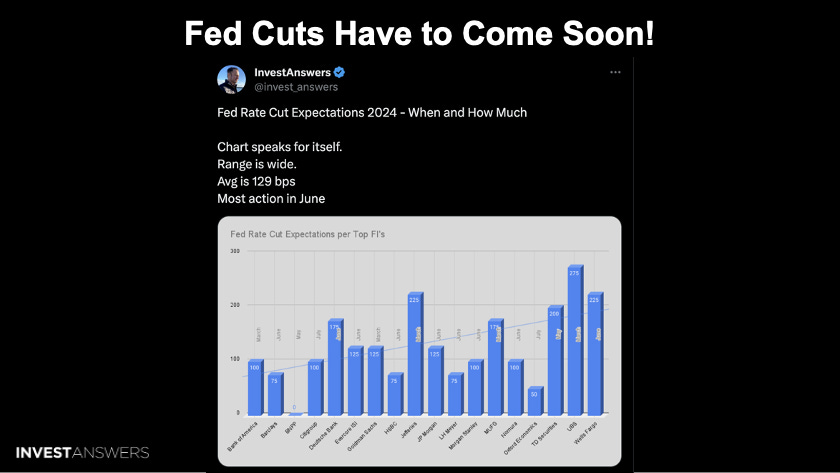

Wells Fargo expects a 225 basis point cut in 2024, and most of the action will happen by June. The median is about 129 basis points of cuts or five rate decreases. I expect the market to dip in February to early March and then the Fed to cut. This will send assets to blast off again.

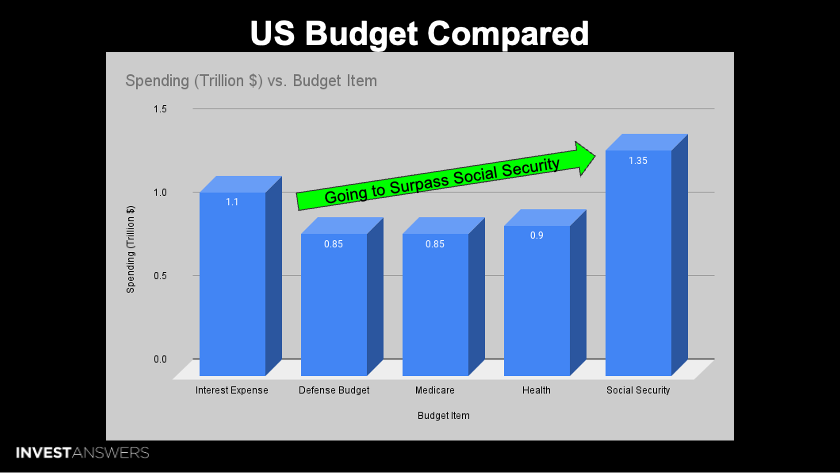

Not only is there a massive amount of debt, but there is also a ton of interest because the rates are so high. There is an inverse relationship between higher rates and asset value compression. The lower the rate, the more the value of assets explodes.

The U.S. is about to spend more on debt interest than social security. This means greater deficits, a faster debt spiral, and accelerating debasement.

Again, this dynamic is happening all around the world in nations like the United Kingdom and Australia.

You do not want to be holding cash! You must be in hard assets.

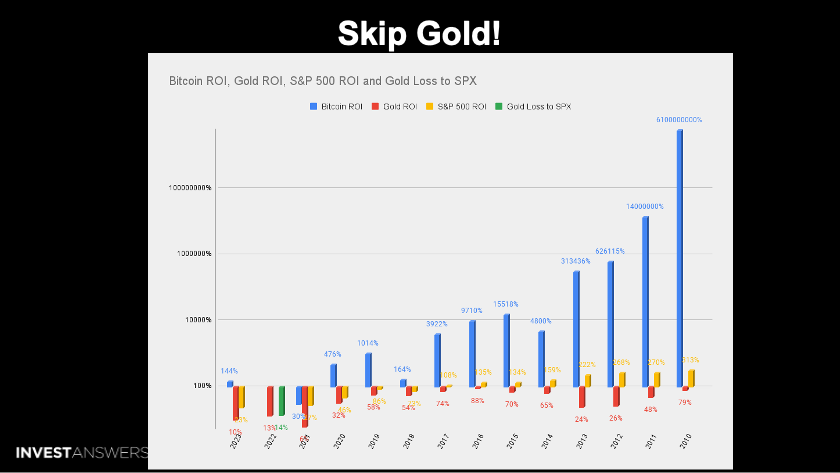

This chart reveals the opportunity cost of not investing in the right asset over time to demonstrate that Gold will not save you! Bitcoin is a delightful hedge against debasement despite its volatility.

If you were not in the stock market but were in Gold over the last 14 years, you lost a truckload of money.

Looking at the zoomed-out chart, you can see where we are right now. The price of Bitcoin is still trending upward in an impressive trajectory. You need to be along for the ride, as this is a rare opportunity.

REMEMBER THIS

If the 🇺🇸 SEC were to deny all spot #Bitcoin ETFs, the applicants would immediately sue and the D.C. Court of Appeals would again rule that the SEC was 'arbitrary & capricious'," says US securities lawyer James Murphy

This is not a coincidence and probably a plan. Do not believe the FUD, and stay the course!