RECAP: MINER-ITY REPORT

2025 Bitcoin Mining Shocker: Top Miners Revealed & Insights You MUST See!

Today, I will cover the Bitcoin miners, which I do every month.

It is the most expansive data you will ever see for Bitcoin miners, with ratios upon ratios and tons of statistics. I will review the state of the Bitcoin mining industry, what is happening globally, and the key public miners that should come out on top based on a composite score of over 50 different ratios.

Miners were wonderful in the bear market when you can buy things like CleanSpark for $2 and then they had a great time in early 2024.

Since then, they have been languishing a bit - just what happens. It is a cutthroat business, with an arms race to buy as many rigs as possible. Is there still money to be had? We shall see.

The total miner revenue reclaimed the 365 moving day average. In the bull markets, the miner revenue tends to peak above the rolling 365-day sum of mining revenue. In other words, we have a long way to go until this bull market ends.

However, this time is different and many thought that what the miners would do this time would be what they had done the previous time. It is much more competitive this time around.

The NUPL is now at 0.5 again amongst the miners.

When it gets above 0.75, the market starts to get heated. We are nowhere near such a level, so the bull market is nowhere near its conclusion.

We are in the middle of the road and have a long way to go.

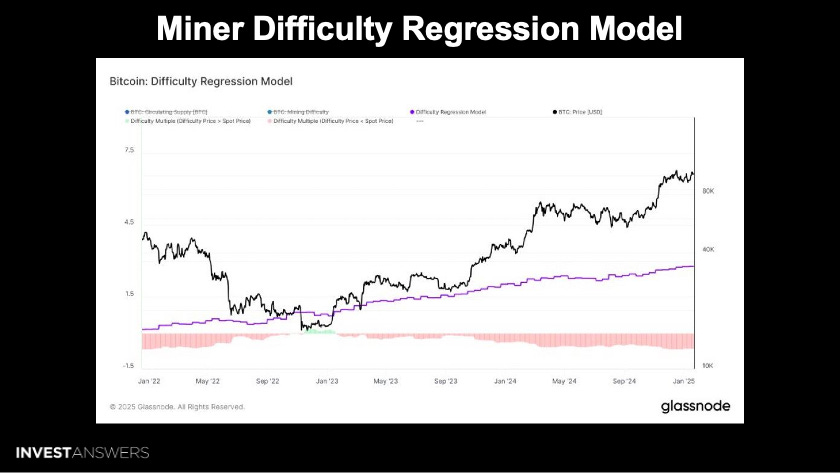

This estimates the cost to mine one Bitcoin on a regression model.

It estimates the cost to mine one Bitcoin at $33,900 but is currently trading at $106,000. That would be a 3x profit margin to showcase the miners' resilience.

However, that is not

Keep reading with a 7-day free trial

Subscribe to InvestAnswers Newsletter to keep reading this post and get 7 days of free access to the full post archives.