We will shake things up with our analysis of Bitcoin miners by discussing some of the crazy news. We are potentially halfway through this bull run and the question is:

Where do we go from here?

I have a fascinating new ratio that I have been thinking about for a long time but it took a while to put all the data together. We will also unveil our brand-new dilution model, which calculates the dilution of a stock at any point in time.

Analyzing Bitcoin miners is the hardest thing to do because there are many variables.

What we do here is we create ratios on ratios on ratios and give you all the data so you can make your own decision. Then, I have my model where I take certain weightings to determine what I consider most important for this stage of the bull run. A new ratio will look at how much dollars are generated per rig.

https://www.youtube.com/playlist?list=PLWTRLGkkf1kRSuLXLtI4aiC4jvzeE_Zxs

Most Bitcoin mining occurs in China, Kazakhstan, Malaysia, and the United States.

There are a few hot spots across Europe but that is where all the action currently happens.

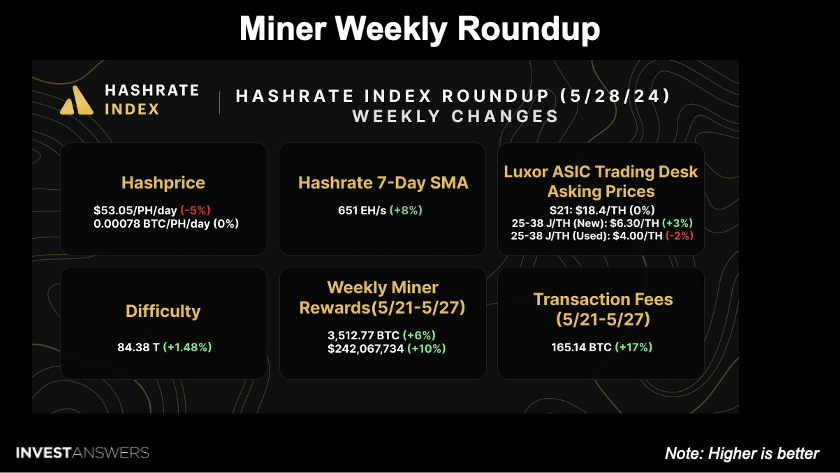

The seven-day simple moving average is 651 EH/s.

The hash price is $53.05/PH/day, which will change soon.

The difficulty is extremely high at 84.38T.

The transaction fees being up 17% is good.

Does the price follow the hash or vice versa?

We have seen an explosion in Bitcoin's hash rate which is good because, typically, miners would not jump into mining Bitcoin unless the price is going up and big enough to sustain the cost of securitizing the network.

Regardless of where it comes from, the current surge in hash rate will smack miners with a hefty upward difficulty adjustment in about seven days.

It is too early to say how large, but I estimate between 5% and 11%. If Bitcoin's price stays steady, the next adjustment will likely drive the hash price back below 50 PH/s, which impacts these miners.

Remember, mining is a cutthroat business.

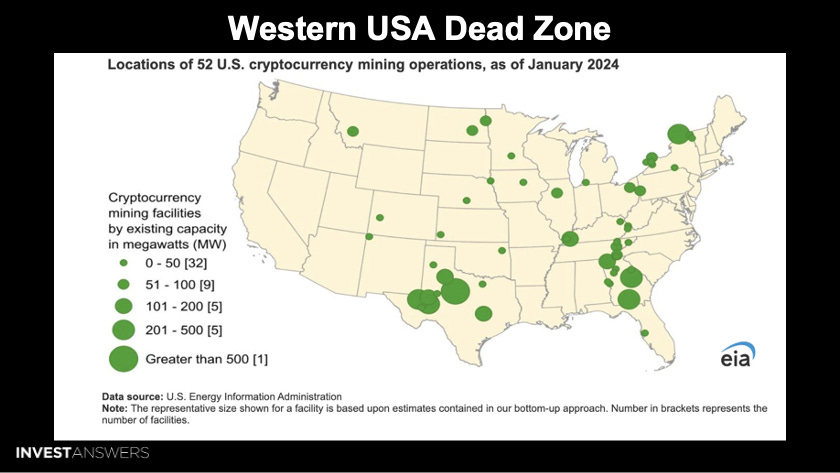

This map displays where Bitcoin mining operates in the U.S.

There is nothing on the West Coast or in Hawaii because electricity is expensive there, even though there is a fusion reactor in the sky.

The biggest concentrations are in Texas and near Atlanta, Georgia.

F2 Pool used to be the biggest in the world. Then, Ant Pool became the biggest.

Now, Foundry USA is the biggest pool for Bitcoin miners.

Here is the list ranked by the number of blocks mined:

Foundry USA = 292 blocks mined (due to public miners)

AntPool = 259 blocks (former #1)

F2Pool = 96 blocks (last cycle's largest pool)

I promised there would be a lot of M&A activity after the halving and it is already beginning…

Bitfarms said it considered a proposal from Riot Platforms that offered $2.30 per share. Bitfarms said, “nope, too low”. Riot still owns about 9% of Bitfarm stock, so this is super interesting and we will see where it goes…

Looking at numbers:

Because miners are so tricky, I spend a lot of time pulling in a lot of financial data. I look at two things in terms of how the business is structured: (1) how much debt it has and (2) how much SG&A it has. In addition, I focus on performance metrics such as:

how many rigs they have;

how much hash growth they have; and

and how effective and efficient they are.

During stages like this, halfway through the bull run, you must consider

Keep reading with a 7-day free trial

Subscribe to InvestAnswers Newsletter to keep reading this post and get 7 days of free access to the full post archives.