Today’s Nuggets

The Crypto Valley of Death

Maxed Out U.S. Borrowers are Defaulting

30 Hours of ETH Gains

DePin and Meme Coins Win

Bankrupt Mt. Gox Not Selling

Hash Rate On the Rise

ETPs are Live

ETH ETFs Offer Staking

WIF and BONK Takeover

Chainlink VIP Announcement Incoming

NVIDIA Makes Another Monsterous Move

Semler Scientific Announces Bitcoin Treasury Strategy

Global Energy Storage Market Tripled in 2023

Is Tesla the World Leader?

Today's topic is how March 2024 is very different from May 2024.

A lot has changed in two months…

Crypto Market Update:

ETH = ~$3,850

Bitcoin = ~$68,400

The Fear & Greed Index is currently at 72

I first did this segment, The Valley of Death, a couple of weeks ago and people liked it because it helped them reorganize their bags.

Occasionally, cryptos escape the red box, the penalty box, the sin bin, or whatever you want to call it. Often, they do not!

This dashboard supplies an analysis of multiple crypto markets over multiple bull markets. As we are probably halfway through this bull market, we have a lot of names that are still 60% or more from their all-time highs. This is not a favorable sign for investors.

I apologize if this offends everybody but this has worked in the past. I have back-tested it and it is highly effective in predicting the market trends of crypto winners and losers.

You do not want to be in the sin bin: Cardano, Avalanche, Bitcoin Cash, Cronos, Dogecoin, Ethereum Classic, Filecoin, Hedera, ICP, Lido, Litecoin, Matic, SHIB, THETA, Uniswap, V-chain, and all the X's.

Here is a weekly update on some nasty unlocks coming this week:

SUI = 65 million tokens unlocking on June 1st, or nearly 3% of the total supply

DYDX = 33.33 million tokens or 12% of the total supply

OP = 31.34 million tokens or 2.9% of the total supply

Be careful, be careful! I will show you later how this nonstop raining-down of tokens suppresses price, thereby suppressing market cap, meaning other assets will jump ahead.

The global liquidity took an ever-so-slight dip this week.

It is nothing much, but it does not qualify as good news.

Here is really sad news: This key chart looks at the high utilization borrowers, who are 90 to 100% of their capacity, as the maxed-out borrowers are increasing delinquency.

Be careful if you hold a lot of credit and are paying more than 20% in interest. Make sure you always make your minimum payments, or else the credit card companies will absolutely nail you to the wall.

Imagine you have a $10,000 credit card limit: If you are using 9,000 of that 10,000 (90% utilization), you will be in this blue category. Such individuals are defaulting like crazy. The trend indicates that borrowers max out their credit line limits and their delinquency likelihood increases sharply. Credit card delinquencies have risen above pre-pandemic levels, especially for maxed-out borrowers.

We have been warned about this for a long time…

It is going to get worse!

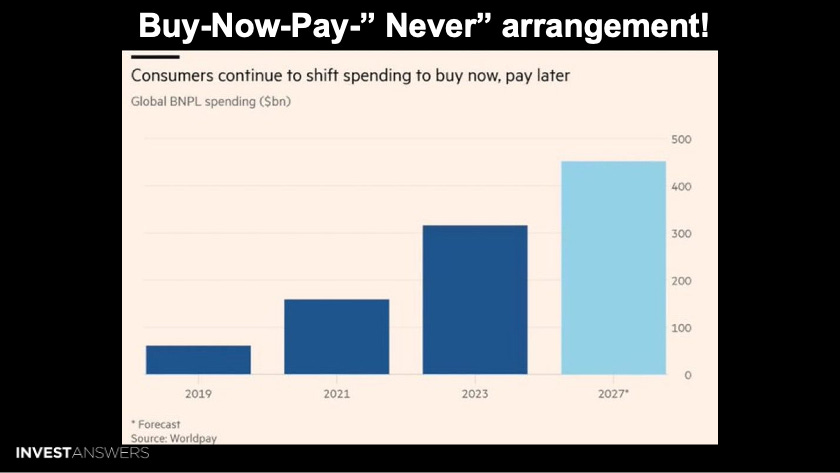

These companies target low-income consumers to overextend their credit.

They are assumed to pay installments over time, but many will never pay. The regulator has done a terrible job educating the consumer on the risk embedded in such products.

My question is, who will be left holding the bag?

As you can see, the U.S. is at the top of the list, followed by Australia, Canada, Germany, and the United Kingdom.

Amazingly, the Japanese are way down the list, which was stunning for me as they are one of the world's largest economies. The Japanese are typically associated with very high living standards and technological advancement.

If you are earning the average pay in the U.S. of around $80,000, then you are doing a lot better than most places worldwide!

Despite people feeling like the world is ending, Bitcoin is still up 12.2% in May, with three days to go.

The Mt. Gox unlock caused a little bit of cage rattling but we are going to make it through!

I have an update related to this news that I will share as well…

Let us look at the Ethereum monthly returns because the ETH ETF approval caused a lot of excitement this month.

All the gains happened in about 30 hours, reinforcing my mantra that "risk happens fast".

The Ethereum returns so far in May are a monstrous 26.94% versus the 17.3% loss in April.

Ethereum has been very lackluster for 18 months but it came back with a vengeance, which is great for the ETH holders.

I always say to follow the money and we saw massive inflows last week, making it the third consecutive week that the total has been $1.05 billion.

The cumulative flows hit an all-time record just shy of $15 billion at $14.9 billion so far for the year.

2024 has been an incredible year!

If you are in crypto, take a minute to reflect on how well you have done this year compared to traditional markets. We have come a long way in a short window of time.

Be grateful.

Most inflows, $1.01 billion, were in Bitcoin ETFs/ETPs. The short Bitcoin drainage is good but it is a bullish sign.

I think the investors interpreted the FOMC minutes and recent macro data as mildly dovish and an inkling to maybe cut in the future.

Ethereum pulled in $36 million for the week but the month is still negative so far for May (minus $11 million) and the year is negative at -$22 million.

Solana also had another great week. It pulled in $8 million for the week, $19 million for the month, and $29 million for the year. Remember, assets like ETFs and ETPs mostly do not exist for Solana. For that much to come through such small bags, it makes up a big percentage.

DePin is number one;

Meme coins are number two. Meme coins have been on fire and have been quite incredible; and

Bitcoin and Ethereum had good months to date in May.

Sui (1.8M) and Binance (1.1M) came right up the charts in a couple of weeks, nearly tripling;

BTC = 368K, been a bit dry lately; and

BASE = 283K; falling down the charts a bit.

Again, adoption is very, very important in blockchain (you could argue it is almost everything).

You can have the best chain in the world with no adoption and it will be nothing.

We are still in Bitcoin season with a score of 35.

Last week, this index was at 39, and the week before, it was 47.

Bitcoin is still in control.

This was just released on Crypto Slate after my video about the Mt. Gox shock that has startled everybody over the last 24 hours. The bankrupt Mt. Gox trustee said it is not selling Bitcoin.

The trustee moved everything to two new wallets, so there is no need for an immediate alarm right now.

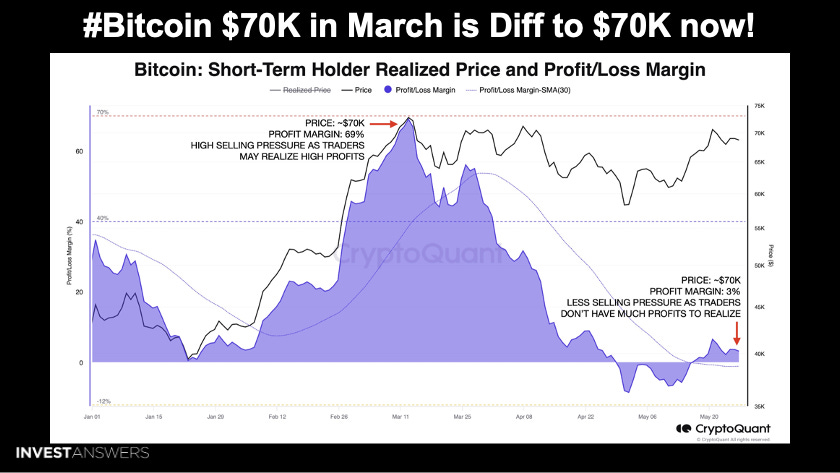

This chart is from Julio Moreno from CryptoQuant. It looks at the Bitcoin short-term holders' realized price and profit-loss margin together.

I find it fascinating as it shows the Bitcoin price at 70K in March and how different it is from 70K today.

The good news for us is

Keep reading with a 7-day free trial

Subscribe to InvestAnswers Newsletter to keep reading this post and get 7 days of free access to the full post archives.