Today’s Take

The Fed’s rate increases are on record pace

Inflation is falling like a stone in most parts of the world

Markets believe the Fed will decrease from 50 to 25 basis points in February

Data that the Fed depends on to take action is always lagging and wrong

ISM Services broke below 50 for the first time since Jan '08

The average 30-year fixed mortgage rate has now climbed to 6.95%

Year-over-year crude oil price is negative for the first time in two years

Food prices are now down below where they started in 2022

4.6% annual wage growth in December was the lowest since Aug '21

Inflation is heading towards a three handle in 2023

2023 we will experience a hard-landing recession

Continue to harvest cash

Today’s story is about how the Federal Reserve measured and responded to inflation over the last twelve months.

According to Economic Cooperation and Development, inflation is falling like a stone in most parts of the world.

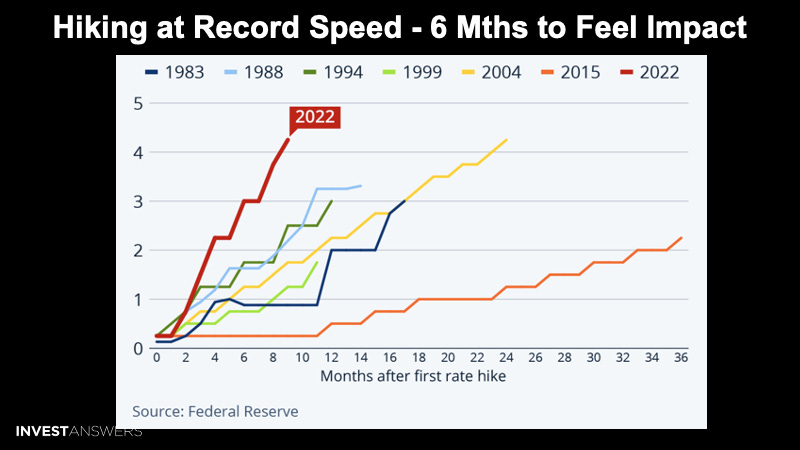

The Fed’s rate increases are on record pace, and it takes up to six months before the impacts of the hikes are fully felt in the economy.

I want to introduce the community to IA’s new macro indicators model, which is representative of the top 20 macro measurements I follow closest.

Ship Analogy:

Imagine a ship sailing on a voyage, and the Fed is firing cannonballs at it. The Fed fires the first couple of shots and causes some holes. However, the holes are small and will not affect the ship for a while. Then the Fed starts hiking 75 basis points at a time, causing larger holes in the ship.

Titanic Sink Analogy:

The Titanic hit an iceberg that tore a hole in its side, but for a significant time, the vessel experienced only slight negative buoyancy. However, due to the ship’s engineering, it took three and a half hours before it finally sunk.

The Hood Sink Analogy:

During the Battle of the Denmark Strait, the Hood took a plunging shot from the KMS Bismarck that went through her deck and into the aft magazine, detonating it, resulting in catastrophic damage and ripping the vessel in two. The result is that the ship sank in three minutes.

March 2022 was the first shot fired by the Fed, a small 25 basis points round that would not have such an impact on the ship.

Fed shot two more rounds (25 basis points each) for a cumulative 50 basis point rate hike in May 2022.

It’s clear now the ship has structural damage and that the holes will cause water to come on board (June 2022). Observers are looking into the water and telling the Fed, “that ship is pretty badly damaged; it looks like it might sink.”

The Fed says, “yeah, we still see a large ship (inflation),” but people are pointing to the holes and the fact that the ship is starting to sink slowly. The Fed then fires another couple of shots, further damaging the vessel.

The people on board (the economy) are still above water, but the ship is sinking now, so it’s evident that without help, they’ll soon be in the water. When the people are in the water and those that cannot swim drown, that’s the economy in recession.

Now it’s November 2022, and observers are telling the Fed, “ok, the ship is sinking (inflation is fading); you can stop firing holes.” But the Fed says, “but I can still see the ship.” So you try to explain that the ship is sinking and has structural damage beyond repair.

December 2022, the Fed still sees some Inflation, so they gun it some more with two more rounds.

Heading into February 2023, the question is will they shoot one more bullet - i.e., 25 BPS? Unfortunately, the answer is probably yes.

The point is that the ship has already sunk.

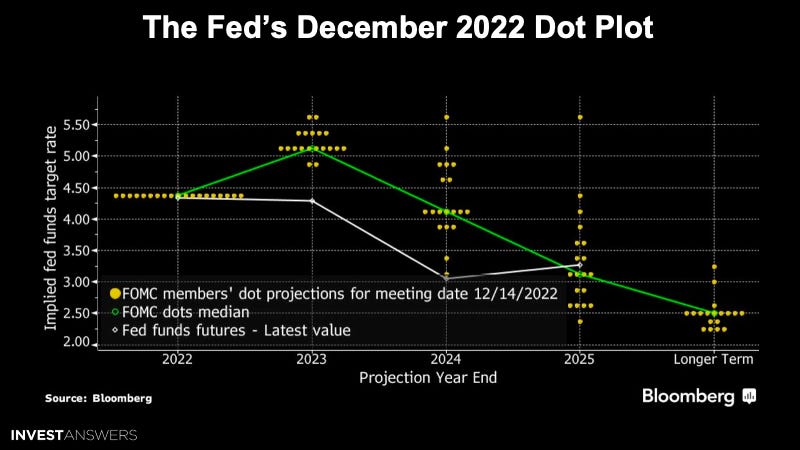

The markets believe the Fed will decrease from 50 to 25 basis points in February.

This speed of the rate increases is historical.

In December, officials issued a fresh forecast that demonstrates the FOMC expects to remain tight this year, with 17 out of 19 officials projecting rates above 5% by the end of 2023. No Fed official forecast rate cuts this year.

The Fed aims to bring down inflation, which is running well above its 2% target but has recently shown signs of easing. For example, the personal consumption expenditures price index, the US central bank’s preferred inflation gauge, clocked in at a year-on-year rate of 5.5% in November, down from a multi-decade high of 7% in June.

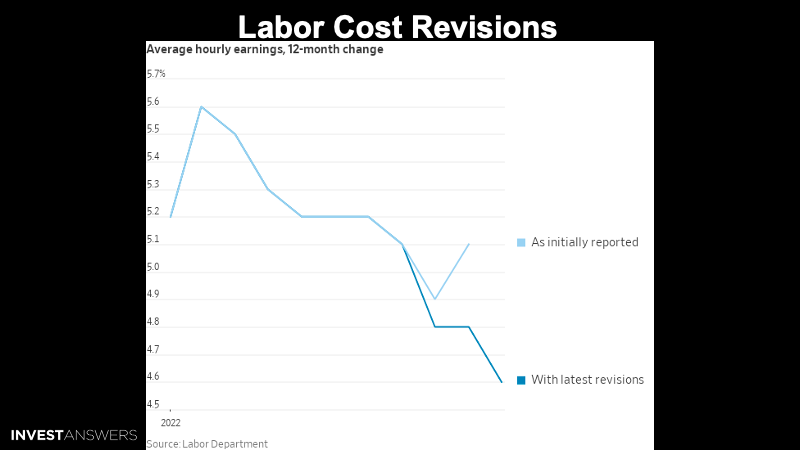

The data that serves as the basis for the Fed’s actions are always lagging and wrong.

Let’s check in on the damage on your path to financial armageddon…

Mega cap tech has been smashed since monetary tightening began.

In November 2022, The New York Times reported that Amazon planned to lay off about 10,000 employees. Recently, Amazon confirmed its layoffs would affect 18,000 employees, so it almost doubled its projection a few months ago. This trend is happening across the board in tech presently.

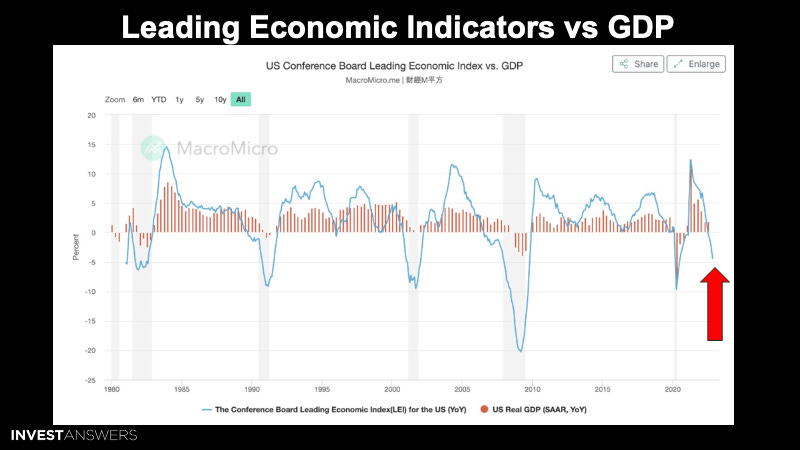

Observing the chart, anytime the blue line (LEI) crosses below the 0 percent horizontal axis, GDP always follows it. The Leading Economic Indicators are still falling.

Our new IA macro model hit a two-year low today. Remember, these indicators proceed what the Federal Reserve is observing that could lag up to a quarter behind.

This is an ugly chart.

ISM Services, which primarily measures factory orders, broke below 50 for the first time since Jan '08. This data suggest that earnings have a much further drop. We continue to see a disconnect between generationally tight labor markets and deteriorating ISM, manufacturing, and now services. This is an unfavorable mix for risk if the labor market keeps Fed tight even as economic conditions deteriorate.

The average 30-year fixed mortgage rate has now climbed to 6.95% crushing the U.S. real estate market. As a result, no one is purchasing homes because they cannot finance them.

If more labor supply does not come back, job creation needs to decrease. One of the main reasons is that the supply of labor is not coming back online: participation rate remains way below pre-pandemic levels - even when accounting for an aging population.

Per Ian Watt, much of the decline in Labor Force Participation is a compositional effect. The Baby Boomers are aging out of the workforce, Gen Z is joining the labor force, and the Millenials are a much smaller demographic set than the previous generation. By age group, the big decline is for those aged 70 and over.

So we are losing the most experienced and productive people with a much smaller cohort with less experience.

From Jamie McGeever, the year-on-year Brent crude oil price is now negative for the first time in two years. Oil is following similar moves in energy and commodities like natural gas, copper, and wheat. The base effects are in play and will likely intensify in the coming months, putting strong downward pressure on inflation.

This serves as another early warning sign that inflation is coming down.

Food prices are now down below where they started in 2022. This was a concerning front for me in 2022 due to the Russian and Ukraine war, and glad to see the food price index back on a downward trend.

Revisions to average hourly earnings data paint a marginally less worrisome picture for the Fed on wages than the November report. The upturn in wage growth in November, initially reported as +0.6%, was revised to +0.4%.

The 4.6% annual wage growth in December was the lowest since Aug '21.

For markets, the bottom line is that the days of jumbo rate increases by the Fed are probably over. Money markets show that the central bank is likely to raise its target for overnight loans between banks by only a quarter of a percentage point to a range of 4.50% to 4.75% when policymakers next meet at the start of February.

Smaller increases mean less disruption in the broader economy, giving investors more confidence to step into riskier assets.

A story about how the government says 1,047,000 jobs, but this translates to only 10,500 jobs.

It is natural for surveys to be thrown out of kilter by extreme changes of the kind we’ve lived through over the last three years. And measuring unemployment has always been deceptively noisy and imprecise.

I believe that oil will continue to decline in the days ahead.

This is good. People can eat!

Cooper is a crucial indicator of economic activity that is also down.

I believe we will experience significant declines in inflation throughout 2023.

All of the economic indicators continue to point toward an economic recession.

Summary

Fed Damage is done and visible everywhere

Recession is in the cards

More impact to be felt (the ship has more to sink)

Government data is BS; wrong and continually revised

I sense even the Fed now sees the damage and hope they understand the analogy

If the Fed Pivots in 2023, this could be a good year

Continue to harvest cash, remain safe, and be careful.