NUGGETS OF ALPHA

The U.S. national debt added four million annual salaries in one week

Q4 debt increased by $833.7 billion, significantly larger than the GDP increase

The U.S. household debt reached $17.5 trillion in the fourth quarter of 2023

70% of the world’s debt is owned by emerging markets

U.S. banks' exposure to commercial real estate is at an all-time high of $3 trillion

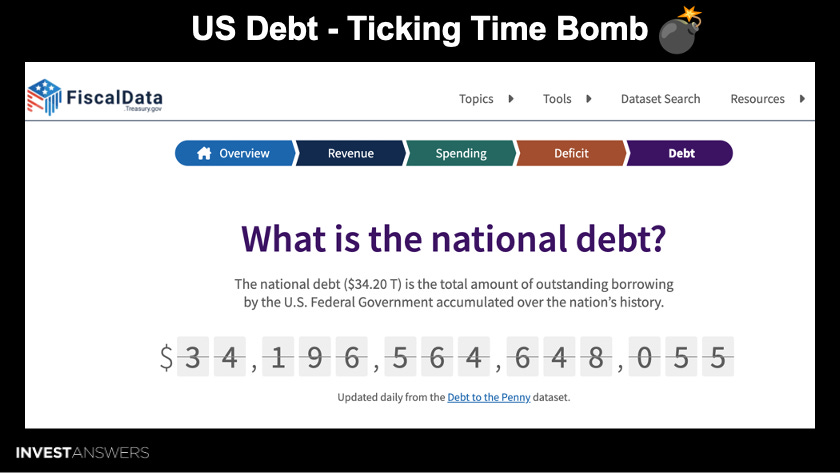

This story is about the dire debt situation, which is a ticking time bomb. Most of the data will be U.S.-centric, but the same stuff is happening all over the world.

The U.S. added $200 billion of debt in just one week or one-fifth of a trillion dollars. The average salary in the U.S. is $50,000, so the U.S. national debt added four million annual salaries in one week. Alarming.

Nassim Taleb is a Bitcoin hater, but he recently stated that the U.S. faces a death spiral of swelling debt. He is a respected voice in the old world.

Even Jerome Powell agreed with Nassim Taleb during a recent 60 Minutes interview. Jerome said the US economy is on a fiscally unsustainable path!

The markets around the world are off to a rough start. The global stock markets have performed poorly so far, except for India, Japan, and the United States, where indices have all reached historic highs.

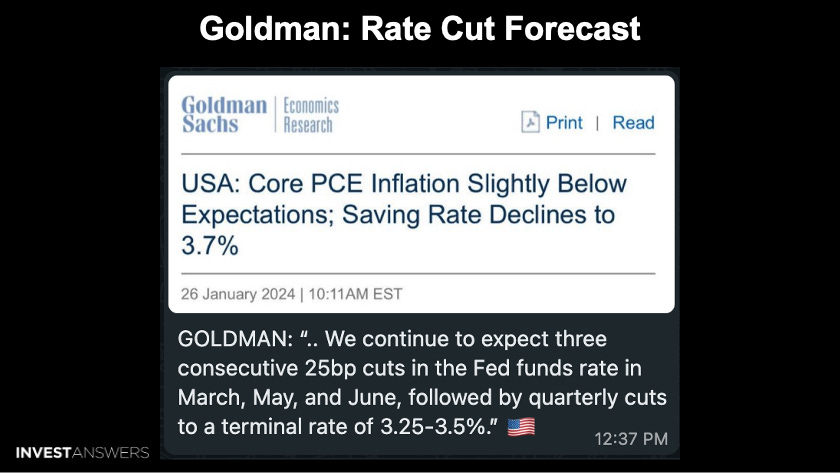

Despite Jerome Powell's jawboning, economic indicators are concerning. Goldman Sachs believes the Fed will cut interest rates by 25 basis points in March, May, and June.

Here is the CPI versus PCE since January 2019. The headline year-over-year change in core PCEs suggests that

Keep reading with a 7-day free trial

Subscribe to InvestAnswers Newsletter to keep reading this post and get 7 days of free access to the full post archives.