Today’s Nuggets

Bitcoin: Sold Out?

Doomsday for Shorts

Cathie At It Again

Morgan Stanley ETF Approvals

Why Asia Surpasses the U.S. in Bitcoin ETF Logic

Japan Desperately Needs Bitcoin

Supply Crunch on the Horizon

Reminder:

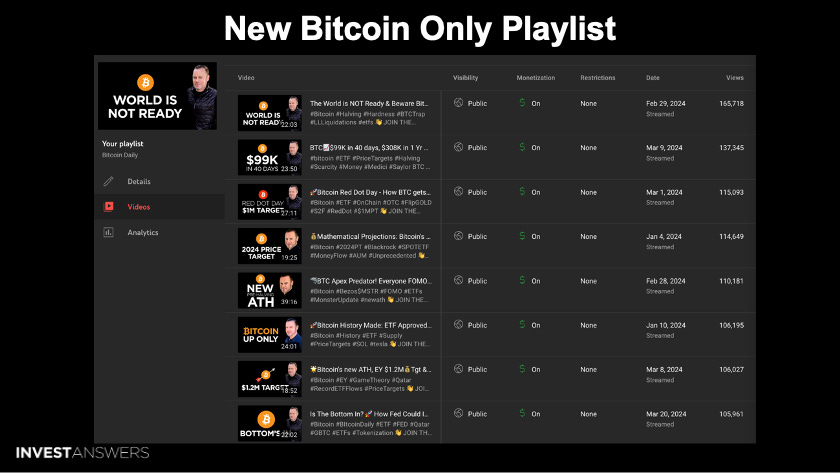

Bitcoin Daily Playlist:

https://www.youtube.com/playlist?list=PLWTRLGkkf1kTTbIDdv-P6ykul7a8iUXYf

I created this playlist, where I gathered all Bitcoin-related videos for your viewing convenience as I understand there are many out there whose only exposure to crypto is through Bitcoin and who prefer to keep it that way.

Where is the time going?!

It's hard to believe we are less than a month away from the halving!

It began with months…

To weeks…

Soon days!

Buckle up, these are exciting times.

… and speaking on the topic of where the time went, a huge shout-out to Ms. Cathie Wood, who - 10 years ago - spoke highly on Bitcoin, calling for dramatic increases in price, hype, and adoption.

At the time, she was met with harsh criticism after her call for a $500 Bitcoin. We all know how that played out!

10 years later, she now sees a $3.8 million Bitcoin in our future. Crazy? Time will tell…

Note: Cathie Wood sandbags a lot in her valuation predictions. Thus far - as it relates to Bitcoin - Cathie has nailed it, so credit must be given where credit is due.

The great thing about the Bitcoin ETFs is that you know there is a consistent bid every -single -day. BlackRock and Fidelity account for approximately 5,000 BTC every day. There are simply not enough coins to provide them with what they need to fill their bags at this pace.

BlackRock and Fidelity, alone, pull in more than 6x (soon to be 12x) the daily issuance of Bitcoin.

This is not sustainable as there is simply not enough to go around. The supply crunch I have been repeatedly referencing is coming.

Just wait until you see the charts further on below.

We saw several consecutive days of outflows this past week. However, this causes no concern…

On Tuesday, the ETFs - in one day - recovered half of the five trading-day outflows, erasing a massive amount of the Grayscale ‘dumpage’.

Recovery happens fast in this space.

The other night, I had made a call for Bitcoin to cross $71,000 imminently. Well, that did not happen until 5 a.m. later that night, when Bitcoin shot up to approximately $71,800.

However, within 40 minutes, it fell back down to approximately $68,700.

All things considered, that is violent volatility for Bitcoin.

That said, this is nothing new in the crypto space - specifically with Bitcoin. We have seen this occur many times, even over the past several weeks.

Which begs the question: Why does this happen? Who is doing this and what benefit does it serve?

Who? Whales.

Why?

Keep reading with a 7-day free trial

Subscribe to InvestAnswers Newsletter to keep reading this post and get 7 days of free access to the full post archives.