Today’s Nuggets

5 Wall Street Firms Added to the Race!

Australia Gets First BTC ETF!

BlackRock Surges, GBTC Eases

Is Genesis All Flushed Out?

IBIT’s After Hours Shenanigans

ARK Strikes Back at Mr100!

The Magic Behind the BTC Illiquid Supply Growth

In today's lesson, we will delve into Wall Street's grand entrance and who has arrived right on schedule. We will break down the Assets Under Management (AUM) for key firms, forecasting the potential price impact from their investments, and I will explain the whole 90-day process.

We will examine what a one-percent allocation could mean for Bitcoin's price. Then, I will review all of the new ETF developments alongside the new ones that are coming.

In addition, we will talk about the final flush alongside some after-hours shenanigans that I have observed. And explore illiquid supply and how frightening it is when you look at what is going to happen after the halving.

As a reminder for those interested in Bitcoin-only content then, the playlist can be found here:

https://www.youtube.com/playlist?list=PLWTRLGkkf1kTTbIDdv-P6ykul7a8iUXYf

The estimated date for Bitcoin halving has shifted to April 20th (previously April 19th), putting us only two weeks away!

This will line up to be a Friday, and we will celebrate!

This is BIG!

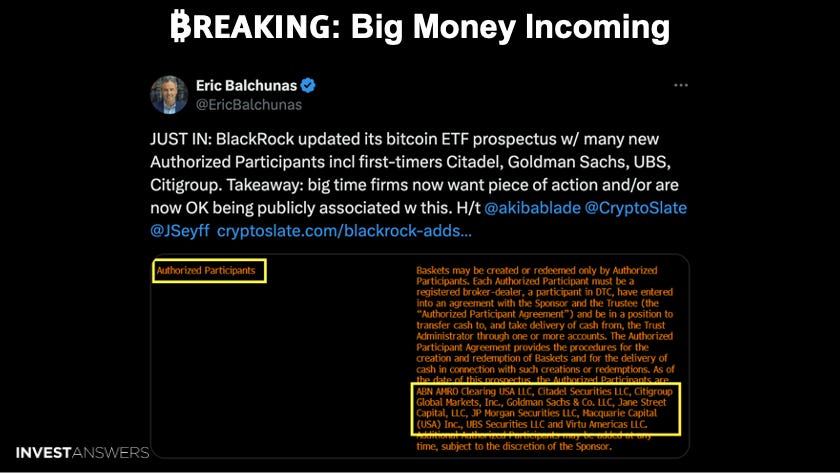

On April 5, BlackRock updated its Bitcoin exchange-traded fund (ETF) prospectus, adding five big Wall Street firms. The new members named in the document amending BlackRock's S-1 registration statement include ABN AMRO Clearing, Citadel Securities, Citigroup Global Markets, Goldman Sachs, and UBS Securities.

These firms must be FOMO-ing because they know the halving is happening in only two weeks.

Due Diligence Process: Investment firms commonly conduct a thorough due diligence process before allocating funds to new financial products, including ETFs. This process can take up to 90 days.

Risk Management: This allows firms to observe the ETF's performance under various market conditions and assess its impact on their portfolios. Hopefully, they have now figured out that adding Bitcoin is good for a portfolio.

Market Reaction Analysis: During this period, firms can observe the market's reaction to the Bitcoin ETF. They can gauge institutional and retail investor interest, trading volumes, and the ETF's effect on Bitcoin's price.

The firms have concluded that they need to get on the Bitcoin train as soon as possible!

Eric Balchunas shared the update from his Bloomberg terminal of the five newly named Wall Street firms named in BlackRock's ETF prospectus. These are now authorized participants in the Bitcoin party.

Better late than never!

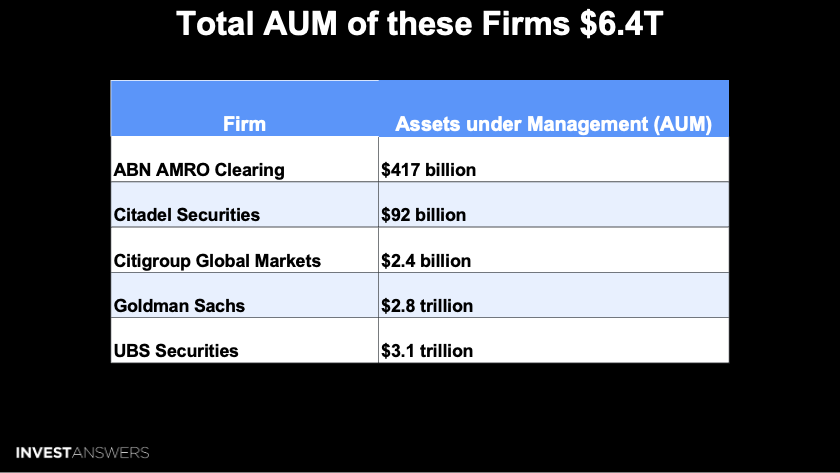

People have no idea how big these firms are… but I do! So, I ran some numbers for you as I figure you are wondering:

“What do they have as assets under management?”

Here they are!

The last two are monstrous, and the first three are big shops. If you add all five together, you arrive at $6.4T!

If you add the $6.4T of assets to what the already participating new BTC ETFs manage, you arrive at approximately $30T of assets under management.

What happens to the price of Bitcoin?

Keep reading with a 7-day free trial

Subscribe to InvestAnswers Newsletter to keep reading this post and get 7 days of free access to the full post archives.