Today’s Nuggets

Bitcoin at Key $60K Support

Two Negative Months

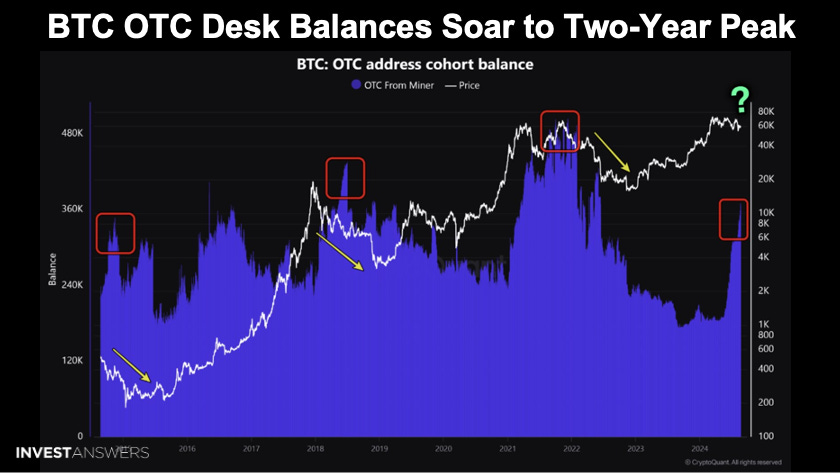

OTC Desk Balances Soar to Two-Year Peak

Exchange Reserves at 5-Year Lows

Bitcoin Restaking?

M2 & Gold Since 1994

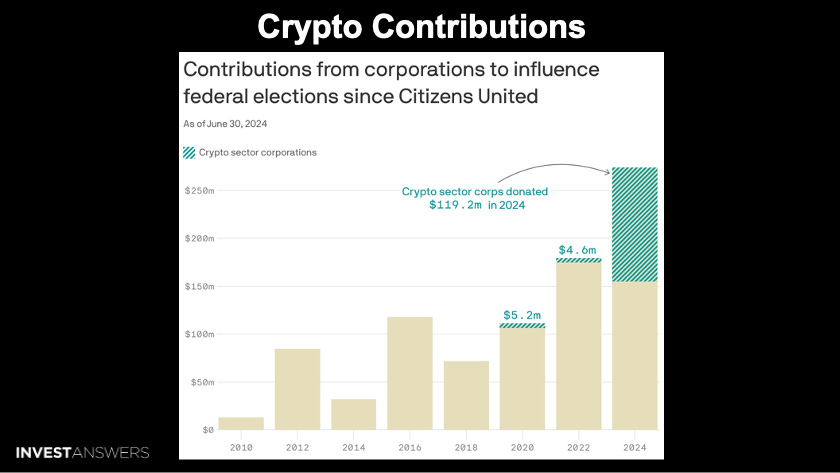

Crypto Political Contributions

Bitcoin Game Theory Alive and Well

$732M of DAO’s BTC Collateral on the Move

Egypt on the Verge of a Crisis

We will break down a bunch of charts. We are going to look at a key support level and a super duper support level. We will look at a key support level and a super support level. We will look at some monthly returns and analyze where we are so far this year to see if we can find any patterns in this bull year. Lastly, we will look at some miners to determine how they are performing.

The Fear & Greed Index is up to 39. It was at 26, only two days ago. It will be back up to 60 in no time.

The 200-week moving average is a critical level here.

This level is critical because we rarely go below the 200-week moving average during a bull market. We did in 2021-22, but it is rare. Right now, that level is about $38,000 and change.

For people hoping for us to get down to $40K Bitcoin, it is highly unlikely at this stage of the bull run. Sometimes, it is good to at least get part of your luggage on the train and not wait for these magical numbers because it is unlikely that they will hit.

Rekt Capital identified $60K as the key level of support for Bitcoin’s next move up.

What does this look like on chart?

The RektCap chart is for the monthly timeframe.

$60K was the resistance back in the day, as can be seen in April 2021 and November 2021. After that, we reverted back. Bitcoin has been performing this retest for six months now. We have eight days left in August and will see if we can close above the $60K level.

We are down 6% for the month of August. We were up 4% in July, down 6.8% in June, and down 14% in April. February was good, up nearly 44%.

What is critical to focus on is the green-marked years of 2012, 2016, 2020, and 2024. How many negative months do we have during those bull run years?

In 2012, we had two.

In 2016, we had four.

In 2020, we had four.

So far, in 2024, we have had three.

However, this time is different. Not only are things happening sooner but Bitcoin is also now a bonafide asset class and real money is coming into the space. Not just retail shekels, but real big dollars.

Things should really kick off in the latter part of this year. The next four months, September, October, November, and December could be fire.

August and September are the only months of the year that are negative for Bitcoin.

We should basically, on average, be positive overall. This is for the average of Bitcoin's life, not just bull runs. The bull run will go into 2025, no doubt about that.

The Bitcoin OTC desk balances are now at two-year peaks.

Historically, this is the key that is spooking a few people, as increases in Bitcoin OTC desk balances have been associated with declines in Bitcoin prices. Again, perhaps this time is different.

The ETFs are getting their bags here. Michael Saylor and Microstrategy have to buy a 30,000 Bitcoin bag with his $2 billion share issuance. There are a lot more draws from these OTC desks than ever before.

The counterbalance to the OTC spiking to a two-year high is displayed in this chart. The exchange reserves are at five-year lows. This shows you how Bitcoin's makeup is very different. The market makers and OTC desks are now more formidable than ever before, and they have to be.

This new venture is a Bitcoin restaking platform built on Babylon that is launching today.

In full disclosure, restaking makes me nervous. I do not do it as I would rather preserve my bag and not pick up pennies in front of a steam roller. However, seeing more DeFi and creativity on top of the Bitcoin layer is good.

People are rushing to stake Bitcoin, which can be seen in the transaction fees skyrocketing from 50 cents to over $137. This is good for the miners who are making a lot of money right now. We have not had spikes that big since the ordinal stuff that happened earlier this year.

Bitcoin used to be two times the size of ETH and even went as low as ~1.75 times the size of ETH. It is now nearly four times as big.

According to Nick Bhatia, Speaking of ugly and death, it is a perfect time to check in on Ethereum. The price of the second largest digital asset by market value has lagged Bitcoin hard, and the size of Bitcoin continues to grow relative to ETH.

He believes much of it is around the proof of stake investment thesis, which has not held up too well so far.

For the last 30 years, the U.S. M2 money supply and gold prices have been tracking almost identically.

Sometimes, gold goes on a big spike like it is right now because it senses something bad is happening.

I know the gold bugs are very excited but if you go back exactly 30 years and divide gold by the growth in the M2 money supply, you get a 4% return over 30 years.

This level of performance is definitely drowning hard. Gold has been on a rampage and is smelling a crisis right now, which is why it is so strong right now.

If you held gold for 30 years, you have lost big time compared to holding the S&P 500 or something else.

Crypto corporations have contributed 48% of the quarter of a million in corporate donations to influence federal elections in 2024. Fairshake is the leading crypto pack, and they have raised an impressive $202 million, with $114 million coming directly from crypto corporate backers.

The crypto sector is breaking traditional partisan alignments here by supporting candidates from both parties based on their stance on cryptocurrency issues. They have endorsed equal numbers of Democrat and Republican candidates in House races and key Senate races.

This is the big job news that took the world by storm yesterday. As a wise Irishman noted, it is so funny that the market looks so closely at the job numbers every month, and then it turns out to be off by 30%. I mean, can you gaslight people worse?

The BLS is

Keep reading with a 7-day free trial

Subscribe to InvestAnswers Newsletter to keep reading this post and get 7 days of free access to the full post archives.