RECAP: ₿ITCOIN'S TREASURY MATH

🌟 Bitcoin Treasury Math: Transforming Balance Sheets 📈

Today’s Nuggets

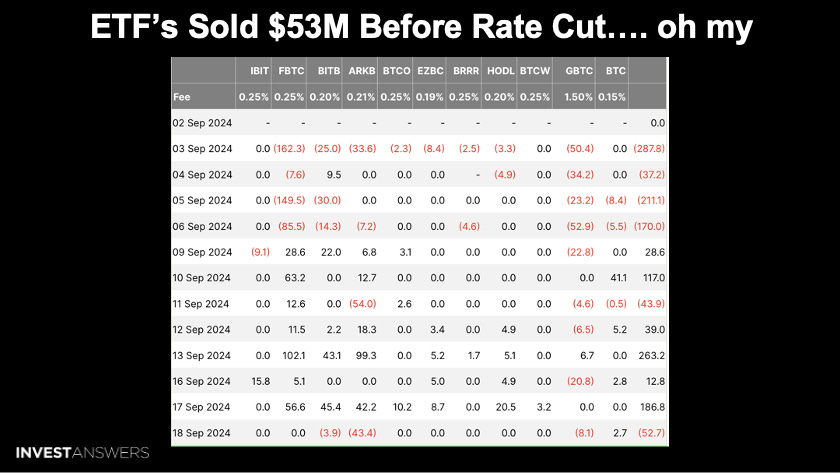

TradFi Sales Before the Pump

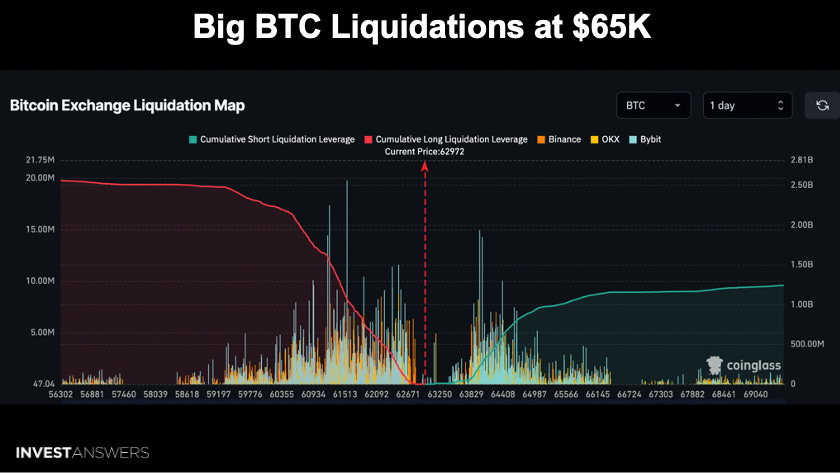

Big Bitcoin Liquidations at $65K

SPX Smashes New All-Time High

The “Best News in Years”

SATS per Share is the New Treasury Math

MSTR Upped the Ante Again

We will discuss the infinite money glitch and break down the math for putting Bitcoin on your balance sheet.

It is not hard and everybody can do it. We will dig into MicroStrategy to look at some ARB opportunities and some math, comparing it to Bitcoin and Ethereum to see how it outperforms. Then you will know why I believe in the infant money glitch and how I have been ‘ARBing’ this thing since September 2020.

The Fear and Greed is back to 49, up from 26 about a week ago.

Not too bad.

Somehow, people believed that Bitcoin would sell off but they knew a rate cut was coming.

I had been talking about it for months and it was clear as day.

This shows you how we - as retail investors - have the edge.

Here, you can see that a large portion of the dump came from ARK.

The rest came from the Grayscale bleedout.

The issue is that no one else bought it and I expect some big volume now.

If the $65K level gets breached, we could see half a billion dollars in liquidations.

The $64K level always serves as resistance.

We got here real fast, which shows you that the asset can move fast. We know Saylor is buying behind the scenes today, this weekend, or early next week. Maybe MSTR can

Keep reading with a 7-day free trial

Subscribe to InvestAnswers Newsletter to keep reading this post and get 7 days of free access to the full post archives.