NUGGETS OF ALPHA

The largest whales are in heavy accumulation, behaving inversely to the prevailing trend

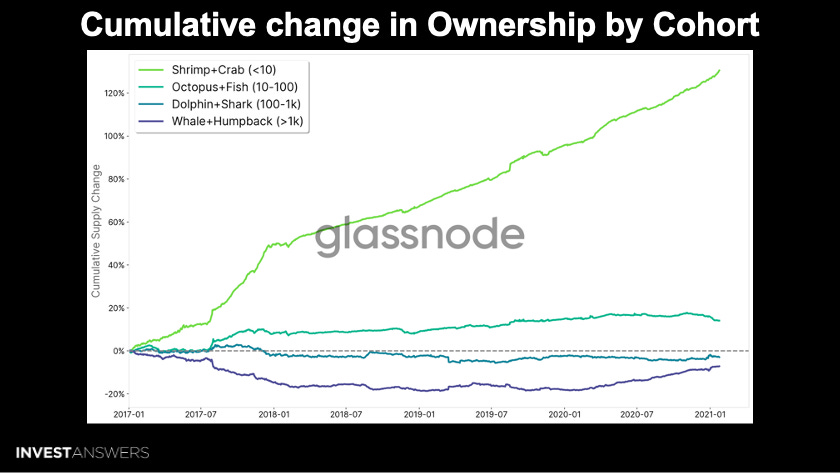

The smallest cohort absorbed the vast majority of the cumulative supply change since 2017

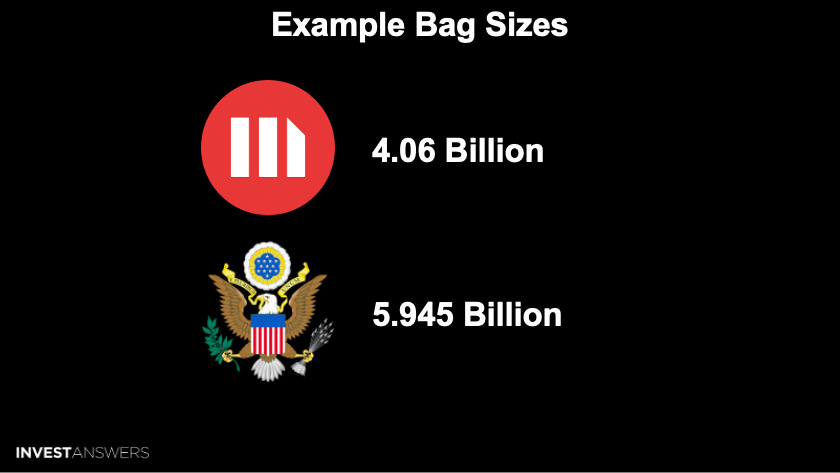

Microstrategy controls $4.06B worth of Bitcoin or 140,000 BTC (92.41 shares/BTC)

Grayscale Bitcoin Trust controls control $18B+ worth of Bitcoin or ~629,000 BTC (1094 shares/BTC)

We recommend never holding more than 10% of your Bitcoin position in a proxy eg GBTC, MSTR etc

The top 1% of individuals worldwide have a net worth of $7.9M in mid-2021

If Bitcoin was evenly distributed amongst humanity, then everyone would possess $71 worth

Overall, the supply of Bitcoin is becoming more distributed especially for those with 10 Bitcoin or less

The smallest cohorts of Bitcoin holders are growing in dominance

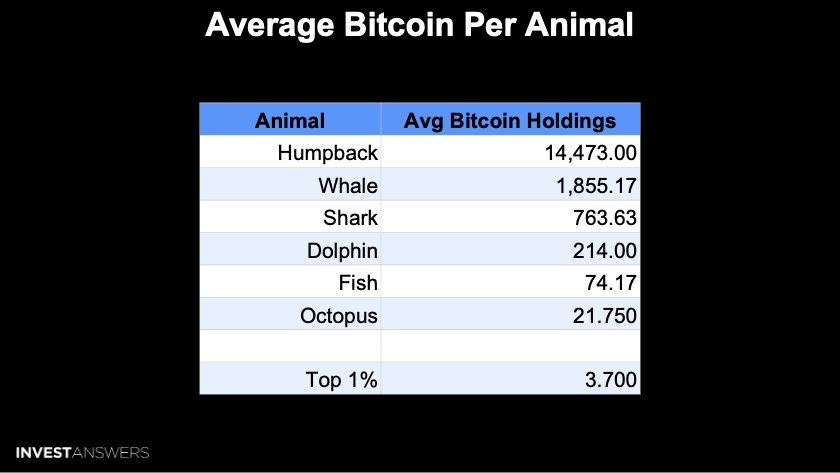

This outlines the cohort terminologies that we will use throughout our lesson.

The Bitcoin Trend Accumulation Score by Cohort has transitioned into a regime of moderate distribution, with all cohorts vigorously dispensing coins.

Since May, the largest of Whales (>10k) have once again deviated from the behavior of the other cohorts, shifting from a distributive regime to one of aggressive coin absorption. Remember, the Whales are correct 70-80% of the time.

When performing this type of analysis, you must take into account the lost Satoshi coins, the ancient coins that have not moved in a long-time, and the miners’ supply.

Assessing the change experienced by each cohort since Feb 2021, we can see that the smallest entities (Shrimps to Octopus) saw relative growth, as did the humpback whales (>5k) over this period. This forms a barbell-like growth of distribution, with the small and largest cohorts growing over the last two years.

Shrimp from 22M to 32M

Crabs from 560K to 740K

Octopus from 72K to 80K

Fish from 11K to 12K

Dolphins remained around 10K

Sharks from 1,500 to 1,450

Whales from 2,000 to 1,450

Humpback Whales from 220 to 190

This chart demonstrates that the smallest cohort has absorbed most of the cumulative supply change since 2017.

This chart helps to reveal the disparity in holdings versus the population of the cohorts that forms almost a smiley face pattern on this chart.

The distribution is neither linear nor normal, making cohorts tricky to study.

MicroStrategy controls $4.06B worth of Bitcoin or 140,000 BTC.

United States Federal Government controls $5.945B worth of Bitcoin or ~200,000 BTC.

Grayscale Bitcoin Trust controls control $18B+ worth of Bitcoin or ~629,000 BTC.

In terms of dollar value, all cohorts have risen except for Whales. The distribution in terms of dollar value is much more even across the cohorts as well.

Since 2020, the > 10 cohort has been flat. Therefore, all of the newly mined coins have been accumulated by those with less than 10 BTC.

It is a good sign for price when the big bag holders are buying more.

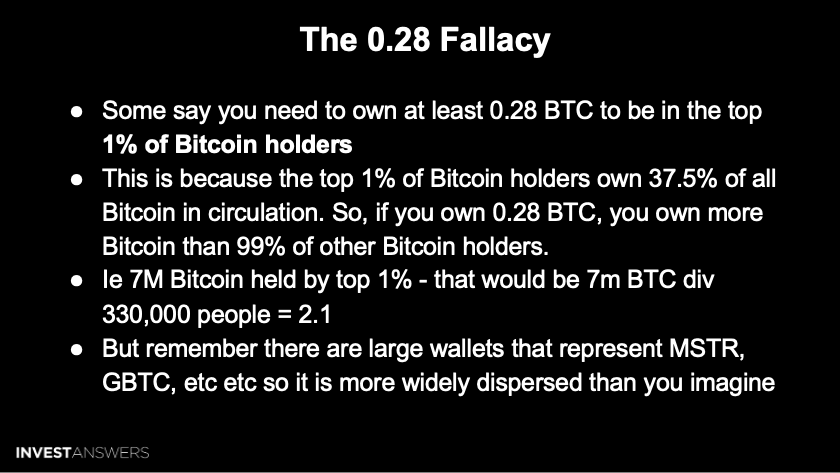

The difference between the top 1% and 2.5% is just over 1 BTC. Remember that the top 1,650 holders category is skewed when you factor in the largest holders, such as Grayscale, United States, and MicroStrategy.

Pure form is always best, and I never recommend holding over 10% of your Bitcoin position in a proxy.

It is important to note that this figure is based on estimates from survey data and may vary slightly depending on the specific methodology used. However, this provides a rough approximation of the wealth required to be in the upper echelon of the wealth distribution in the United States.

The last time I did the pyramid, it was 3.35 BTC to be in the top 1%. Institutions and large investors are moving into this space and buying more. Now you need more than 3.7 BTC to be in the top 1 percent of Bitcoin Holders. That would cost you $109,150 today.

The good news is that you are already ahead of 99.5% of Planet Earth, even if you own only a little BTC.

This is a scarce asset that few have discovered to date.

Bitcoin is technically more widely dispersed than the common simple math circulated on Twitter. As more people adopt Bitcoin, getting into the top 1% of Bitcoin holders will become more challenging. This is because the total supply of Bitcoin is limited to 21M coins, never more than 14M due to lost coins.

As more people adopt Bitcoin, the total number of Bitcoin holders will increase. As a result, it will take more Bitcoin to be in the top 1% of Bitcoin holders.

There were two behavioral turning points in recent history:

The March 2020 sell-off saw institutional investors enter the market

The mid-2022 deleveraging and FTX event led to a large increase in self-custody and exchange withdrawals

The smallest cohorts of Bitcoin holders (Shrimp and Crabs) are growing in dominance. Overall, the supply of Bitcoin is becoming more distributed, which is a healthy sign for the network.