RECAP: IS WORK OPTIONAL?

The End of Work? 🚨🌍 Is the World Ready for What’s Coming?

Today’s Nuggets

Record CAGR Never Seen Before

The European Union is Leaning into AI

xAI Grok Continues to Kill the Competition

25% of Tasks Already Automated by AI

Hyperdeflation of Intelligence

USA has Data Center Dominance and is Leaning in

Robotaxi Now Planned for 21 Cities

Saudi Arabia Building New Data Center 500 MW

This is the AI impact, as we discuss AI every Thursday.

This is the biggest asteroid ever to hit this planet, so be prepared. The subject we are going to touch on today is work becoming optional, and yes, I know crypto is taking a massive drawdown, but that is why we have been talking about AI for many years now.

We will talk about some of the MAG7 stocks and some of the big things happening in the space today.

It is very clear what the world has been doing for the last 18 months.

This series I do here is probably the most important. Forget everything else. These are my least-watched videos by far, but they are the ones that matter the most. This video series will be your first line of defense, and I will show you different ways to use different tools to do many incredible things.

Do not let your fear bias you away. Sometimes people are like ostriches and like to hide their heads in the sand when something scary is coming. Do not do that. Please do not look away, as this is very important and I would not stress that unless I absolutely meant it.

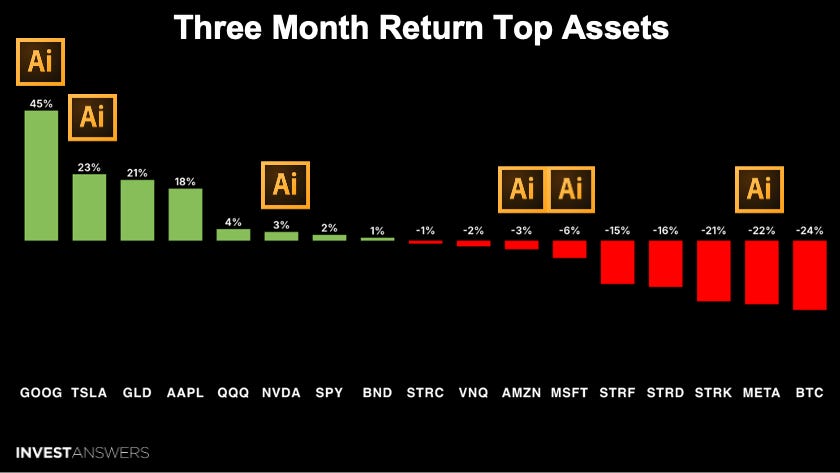

Let us check out the performance of the last three months.

The winner over the last three months is Google, which is up 45%. Number two is Tesla, up 23%. Gold comes in third at 21%. Apple is next at 18%. Nvidia is up 3% and had crazy good earnings. The QQQ is up 4%.

Amazon is down 3%. Microsoft is down 6%. I will talk about exactly why those two are down. I will show you the bottom of it. Meta is down 22%.

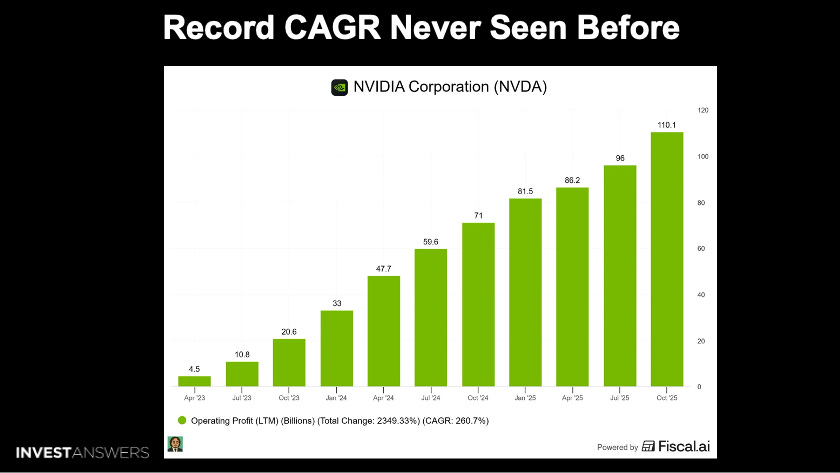

Never before in the history of the planet has a company this size had such a CAGR.

Nvidia has been around for 30 years, and the company’s CAGR since April 2023 is 260.7%. Nothing matters more than CAGR, especially if you have time in the market. The delta between 5%, 10%, and 12% CAGRs is massive.

The best CAGR in history on an average annual basis is Tesla.

A firm called Rothschild downgraded both Microsoft and Amazon to neutral.

The charts definitely approve of this, as both look extremely toppy. You got Microsoft coming off the top at $550 with a sell signal on the ATR model. Microsoft used to make about $17 billion per gigawatt of power from Azure. After pivoting to AI, it is now at $11 billion.

A gigawatt of power is very expensive to buy. Bringing a lot more compute to the market and making a lot less money is what has the analyst firm Rothschild very concerned. This is probably why the market is coming off the high as well.

Sometimes things get overheated and everything mean-reverts.

Amazon has a similar type of chart.

It is coming off the top of $260, and now it is around $220. Amazon is experiencing a similar type of problem to Microsoft. The economics do not make sense as their data centers now cost six times more than the old cloud systems, but they generate far less financial return.

For every $1 they spend on AI infrastructure, they only get about twenty cents of a return back. They used to get about 46 cents back in the old days with AWS, so they are being hurt, and perhaps it is one big race to the bottom?

All of these hyperscalers are jumping in and building so much compute as they are trying to outperform each other.

It is good to see that the European Union is leaning into AI.

Shout out to Michael Arouette, as his posts are just fantastic. A billion dollars will not get you anywhere when these hyperscalers are investing $1.4 trillion over the next couple of years. A billion is a spit in the bucket.

However, I am very proud of Europe for

Keep reading with a 7-day free trial

Subscribe to InvestAnswers Newsletter to keep reading this post and get 7 days of free access to the full post archives.