This question has been coming in frequently this year, and I try to address as many questions as possible.

I am not an ETH hater; it has made me a lot of money.

ETH was the second crypto I ever bought. I have been in Bitcoin since 2017 and did not buy ETH until one day in March 2020, when I bought all my positions. However, there is a thing called ‘tech debt’ and ‘age effect’ that is catching up to Ethereum.

Justin Bons is the Founder and Chief Investment Officer at Cyber Capital. He studied Philosophy at the University of Auckland in New Zealand and discovered crypto assets in 2012. He has been actively involved in this space, investing in crypto assets and establishing a private mining operation in 2014. He is also a full-time cryptocurrency researcher and a voting member of Bitcoin Unlimited.

He posted an 18-post diatribe that inspired this study. I decided to dig into this and break it all down, pulling out eight key points that I believe are my interpretation of what Justin was getting at.

We will go through each of these eight issues very quickly. Then, I will cover an updated face-off between Ethereum and Solana, which I have not done since 2023. We will break down all of the data and then get to my conclusion at the end.

I am all about being on the fastest horse. I do not care what it is. It just has to perform better. I also like disruption, which is why I like these two assets.

By prioritizing Layer 2 solutions, which aim to enhance transaction throughput and reduce fees without changing or modifying the base layer, the developers believe they can maintain the security and decentralization of the Ethereum mainnet.

However, this approach has led to criticisms that the L1 is being neglected, potentially hindering its competitive edge as a Layer 1 blockchain.

I think Layer 2s are band-aids that do not solve the core problem.

Ethereum as an L1 is robust: it always works, is dependable, and has strong security.

It goes back to the age-old question in tech: Can you change the wings of a plane when it is in the air? Vitalik and the team believe that they cannot.

Therefore, they are focusing all their investment on Layer 2s to help ETH scale.

However, that comes with different problems, which I will discuss shortly...

This got the whole Ethereum world excited about a month or two ago.

Ethereum advocates believe that they will be able to do 100,000 TPS on layer one, which will match what is coming from Firedancer from Solana.

By focusing the Mega ETH advancements on Layer 2, ETH's core developers aim to alleviate congestion and high fees on the mainnet.

L1 is out of juice and bandwidth, and this approach leaves the Layer 1 blockchain without any scaling improvements. All of the focus will be on prioritizing Layer 2s over Layer 1s.

I still have some old wrapped ETH on a hot Metamask wallet and tried to swap it and get it off. I had about 10 to 15 minutes and could not do it! I used to be able to do it in 2021 but now it is just so cumbersome and tricky.

The composability challenges across L2s are huge issues.

You do not have these problems with Solana.

Imagine you are Larry Fink and desire to tokenize a stock exchange or real-world assets like real estate across the US.

Ethereum simply cannot scale. Even if you have the Ethereum data availability, the number of transactions they will need to support every single minute of every single day will not fly.

Scalable L1s capture higher revenue by processing more transactions, which we have seen happen largely over the last six months.

As the revenues grow, it becomes a self-fulfilling prophecy.

I always talk of L1s as being a murderer's row. If you are not fast, cheap, secure, with a breadth of dApps, you are not going to make it.

Successful Layer 2s may eventually abandon Ethereum in favor of a more scalable Layer 1.

If ETH is not feeding them the revenue they need to survive or there is too much competition, they will bounce to another L1.

This shift could result in a significant loss of activity and value on the Ethereum network, exacerbating its scalability and adoption challenges.

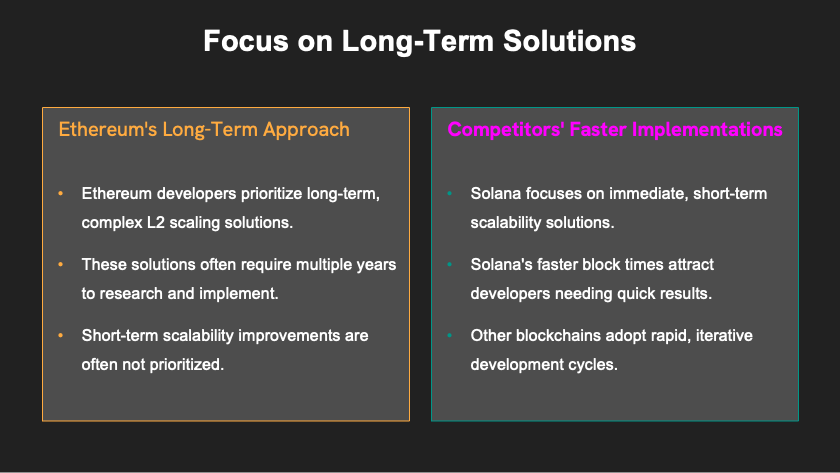

A new L1 could be spun up in weeks using AI and other technologies to pick the best of all the other L1s out there. The only problem is adoption. However, for Ethereum to modify and develop things, it takes years. Therefore, short-term scalability improvements are often not prioritized.

The world is moving too fast for the old tech solutions.

With Solana, you can see the speed at which they are spitting out products with very high product-market fit.

Solana is solving for both scalability and user experience.

A prime example is Base, which does a lot more than ETH does, and it is brand new.

Consequently, the Ethereum L1 is being overshadowed, as its high fees and slower speeds make it less attractive for new projects and users. This growing focus on L2s threatens to leave Ethereum's mainnet behind in the rapidly evolving blockchain space.

This space is moving at the speed of light.

Tactics like Vitalik writing a white paper over the weekend will not cut it. The people developing on Solana are doing crazy things like jump-spinning out 20 million meme coins a month.

Does Solana want to stop it? No, because

Keep reading with a 7-day free trial

Subscribe to InvestAnswers Newsletter to keep reading this post and get 7 days of free access to the full post archives.