TODAY’S TAKE

Tom Zhu best positioned to succeed Elon Musk as next Tesla CEO

During Investor Day, Tesla demonstrated its deep executive bench of talent

Gigafactory Mexico will serve as the blueprint for all new Tesla Gigafactories

Telsa’s Alloy patent can help make vehicles better, cheaper, faster

First Gen 3 vehicle forecasted to roll off production line in 18-24 months

Revolutionary “unboxed vehicle” manufacturing process revealed

Telsa building two Gigafactories in less than nine months

Giga Texas is largest building by footprint (10M sq ft)

TSLA most popular stock among retail investors today

Tesla maniacally focused on bringing prices down

Ten = max number of models Tesla intends to build

Today’s lesson will focus on the Tesla Investor Day held this past week to cover some of the things you might have missed and attributes about the strategy that demonstrates the magnitude of impact Tesla might have on the future. We will break down the announcements of the core essentials and stitch all that was present into ten takeaway points.

Many investors are concerned about the key man risk related to Elon Musk. Matthew Donegan-Ryan met with Tom Zhu one-on-one after Investor Day. During the interview, Zhu shared some critical information, not in the public domain. Matthew believes that the next CEO of Telsa could be Tom Zhu, who acts with a great sense of urgency, is charismatic, and is extremely intelligent.

First, I do not see Elon Musk leaving until after 2030. The IA community is positioning itself for the next eight years of Tesla.

The pace of change and development has entered an exponential age, which most humans fail to grasp.

Tom Zhu was compared to Tim Cook by Matthew Donegan-Ryan. I see Tim Cook as a caretaker managing Apple like it is in maintenance mode.

I, personally, like exponential growth. Apple has been far from it since 2017. Recently both revenue and earnings have started to fall for Apple.

Many believe that Telsa is all about Elon Musk’s innovation. Pictured here, Elon was flanked by sixteen executives, probably to convince shareholders that Tesla has a world-class team. What was noteworthy is how all sixteen work together, and there are no silos at Tesla.

Gigafactory Mexico will serve as the blueprint for all new Tesla Gigafactories.

Paint takes time to dry. Time is money.

The patent, titled “Die Cast Aluminum Alloys for Structural Components,” describes an aluminum alloy that is both extremely tough and ductile.

Telsa believes it can make it better, cheaper, faster, and harder.

This is a stunning statement.

This is describing a revolutionary vehicle manufacturing process…

The unboxed process changes the car assembly process so that the assembly is all at once.

MATCHBOX toy cars demonstrate conceptually how this will work.

This might be the most important point for today. Telsa will simultaneously build two Gigafactories, but the other location was not named. This is big news!

Stunning that it only took nine months to build such a large manufacturing facility.

This is a mind-blowing statement.

Giga Texas is the largest building by footprint in the world. And Tesla is building this with their team in under nine months.

This chart is Farzad’s breakdown of how Tesla will reach 20M vehicle manufacturing capacity by 2030. If you analyze the ramp-up roadmap of the model Y production, Tesla is almost 30% of the way to 20M.

The critical line to focus on in capacity ramp-up is the compact vehicle.

Tesla’s Investor Day was dropping lots of little easter eggs to the audience that flew over the heads of Wall Street sales analysts. Tesla is the most popular stock among retail investors today. More money has flowed into this stock from retail over the last two years than any other public company. Wall Street does not get it; retail does.

What does this statement from Elon mean? Let's find out...

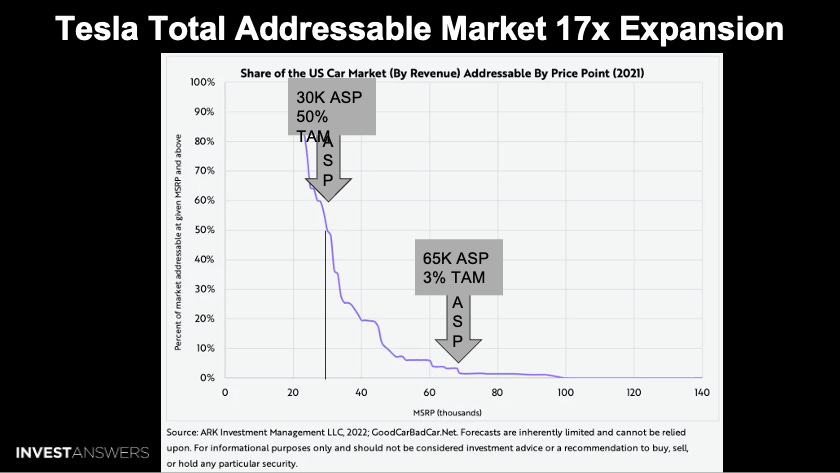

The chart from 2021 is a good illustration of how the total addressable market (TAM) increases as the price falls. Today, a Tesla's average selling price (ASP) is just over US$65K, including some cars that cost over US$100K. Tesla can effectively address only 3% of the TAM at this price range.

What happens if they can reduce the ASP to $30K?

This means that Tesla can address 50% of the TAM, increasing by 17x. Small price changes have a significant impact on demand. Tesla focuses on bringing costs down because once they do that, the market explodes. So, demand is a function of affordability, not desire.

This is what Wall Street does not understand.

Elon Musk has stated that ten is the maximum number of models Tesla intends to build. Tesla has proven that one good product can serve a vast market in cultures and countries worldwide - the Model Y.

Musk asked, “what happened to all of the flip mobile phones after the iPhone was released?” They all went extinct except for the iPhone and copies of it.

Sandy Monroe @teardowntitan, the teardown meister, stated that Telsa shares would be worth US$1,000/each, no problem. Tesla investors will make tons of money as they gobble up the market. He knows there is no other car manufacturer within six to eight years of where Tesla is today.

Tesla is maniacally focused on bringing their prices down, and demand goes to infinity - it’s that simple, ladies and gentlemen!

I stress that Tesla is the asymmetric bet of our lives. If Sandy’s forecast is correct, then Tesla will grow over five times from where we are today, which could happen within the next three to five years.