Today’s Nuggets

AltSeason in Full Swing

BTC ETFs are Accelerating

Lummis & Sacks’ Pro Digital Asset Administration

The Third Great Supply Shock

The Growing Influence of U.S. Big Tech Globally

Trump Trade Now Record-Breaking

MSTR Bankruptcy Risk?

Tesla’s Dojo Chips for Optimus

European Union Thinks It Can Beat Space X

The Inside Trading Rules

Biden Paid Reuters $300M to Investigate Elon

In this edition of OCTA, we will examine money flows and the extent to which they can continue. The flows have been nuts like nothing we have ever seen.

Bitcoin spent quite a bit of time over $107,000 yesterday and based on the data, we are going higher.

Over the last seven days in the crypto market, Ethereum beat Bitcoin despite both having a good week.

XRP is the only noteworthy name in dark green. Solana and Tron were both in the green.

Bitcoin was up 0.2% on the week to ~$ $106,500;

XRP is up again on rumors of an ETF;

Ethereum is just shy of $4,000, which is up 6%; and

Solana was up about 4%.

This is from CoinShares displaying the digital asset investment product inflows. Last week, we saw another continuation of crazy inflows totaling over $3.2 billion. This marks the tenth consecutive week with inflows this year so far.

This makes for $45 billion coming in over ten weeks, mostly chasing a precious, scarce asset called Bitcoin.

Ethereum had its best week ever, with nearly $1.1 billion inflows;

Bitcoin experienced $2 billion of inflows, bringing its YTD to nearly $40 billion. This includes a huge amount of bleed from Grayscale; and

XRP had $145 million come in.

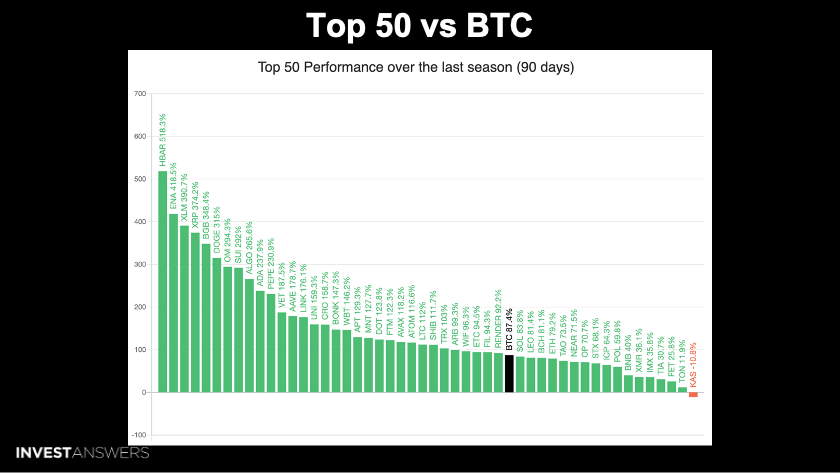

The AltSeason Index is now at 65 and went as high as nearly 90 a few days ago.

You may not feel it because it does not affect all assets simultaneously, but it is hitting some peculiar ones.

The winners are on the left with HBAR, ENA, XLM, and XRP.

All of the Xs that typically did poorly are now doing well, which is bizarre. Bitcoin and Solana almost tied up 87% for the last 90 days.

Everybody is making money unless you are holding Kasper, which is down 11%. Considering the bull market, it is very unusual for something to be down so hard.

The world's first gold ETF was launched around March 2003.

Then, the Spider Gold Shares was launched in 2004 - 21 years ago - on the New York Stock Exchange. The total funds within the gold ETF after 21 years is $128.8 billion. The nine BTC U.S. ETFs now have $129.25 billion and have already smoked the gold ETFs in only 11 months.

I wonder what Peter has to say about that?

The ETFs are not slowing down, which is even more bizarre.

The Bitcoin price is north of $100,000 and the speed of inflows is going vertical. It is crazy.

These are just big numbers, getting bigger every day. But it is not just

Keep reading with a 7-day free trial

Subscribe to InvestAnswers Newsletter to keep reading this post and get 7 days of free access to the full post archives.