NUGGETS OF ALPHA

$INJ is trading at $8.01 at the time of this analysis

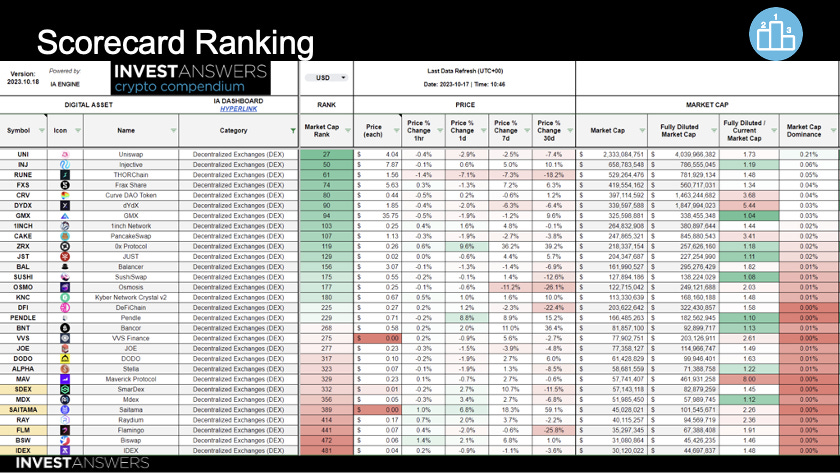

Injective is currently second in terms of DEX market cap behind Uniswap

54% of current INJ token holders are insiders

The adoption by retail of the token has been relatively low at only 5.9%

The inflation over the last year is 8.04%—six percent or lower is my preference

For INJ to thrive, it needs a lot more daily active users and trading activity

The current INJ staking rewards are at 15.92% APR with 125 INJ validators

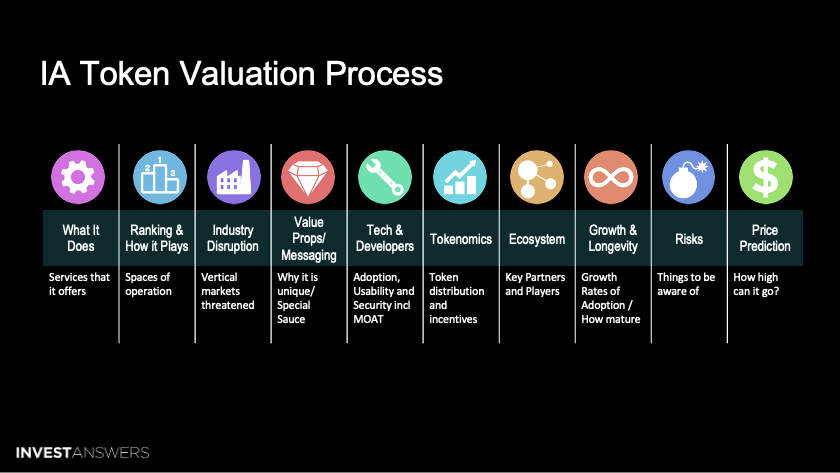

The IA Token Valuation Process consists of a ten-point process that provides a comprehensive analysis of how investible the token is.

These lessons aim to determine if INJ token is a keeper or not via a deep analysis on Injective Protocol.

Eric Chen and Albert Chon founded injective Protocol. Albert attended Stanford and Eric attended NYU; they became friends due to their early affinity for blockchain and have launched a decentralized exchange (DEX) that helps in front-running collisions in a trustless environment.

I have been searching for a DEX with the liquidity, depth, and assets I need. We may be finally getting close.

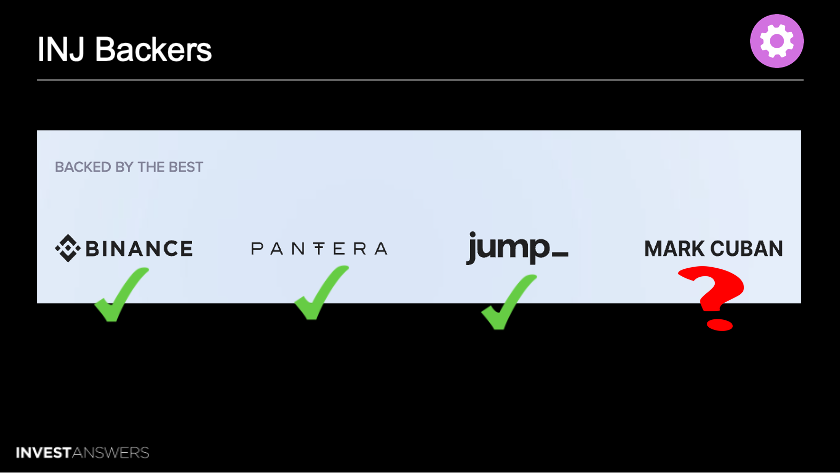

INJ has big-name backers. I find jump_ to be extremely interesting as they know what they are doing. Mark Cuban however has a poor track record in Crypto.

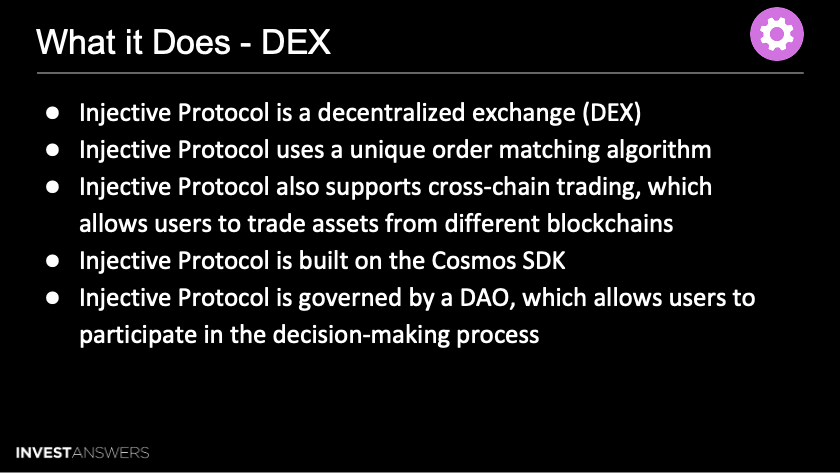

Injective protocol…

is a decentralized exchange (DEX) protocol that allows users to trade assets without having to trust a centralized intermediary

uses a unique order-matching algorithm that allows for faster and more efficient trades

supports cross-chain trading, allowing users to trade assets from blockchains on a single platform

is built on the Cosmos SDK, which makes it scalable and interoperable with other Cosmos-based projects up to 10K TPS

The DEX space has become very crowded. Injective is currently second in terms of market cap behind Uniswap. We spent a lot of time building out the Crypto Compendium over the last three years that tells us everything we need to know in the flick of a switch with real-time data fed by

Keep reading with a 7-day free trial

Subscribe to InvestAnswers Newsletter to keep reading this post and get 7 days of free access to the full post archives.