NUGGETS OF ALPHA

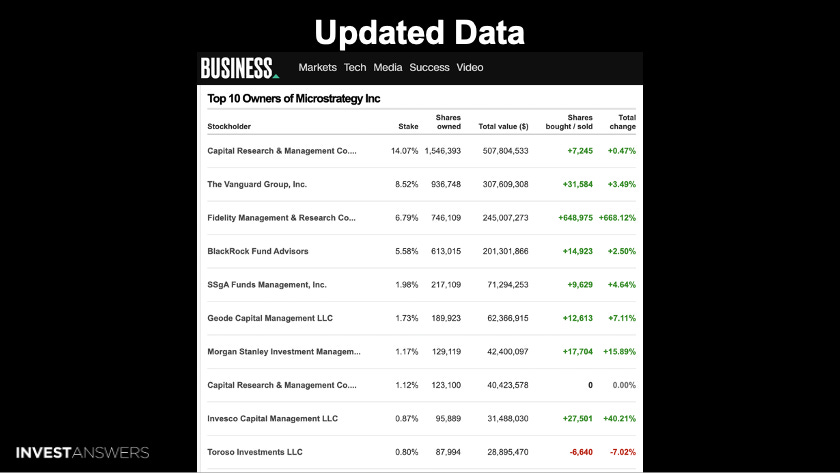

Vanguard owns 8.52%, Fidelity owns ~7%, BlackRock owns ~6% of Microstrategy

The sixth largest commercial banks in Canada has holdings in Microstrategy

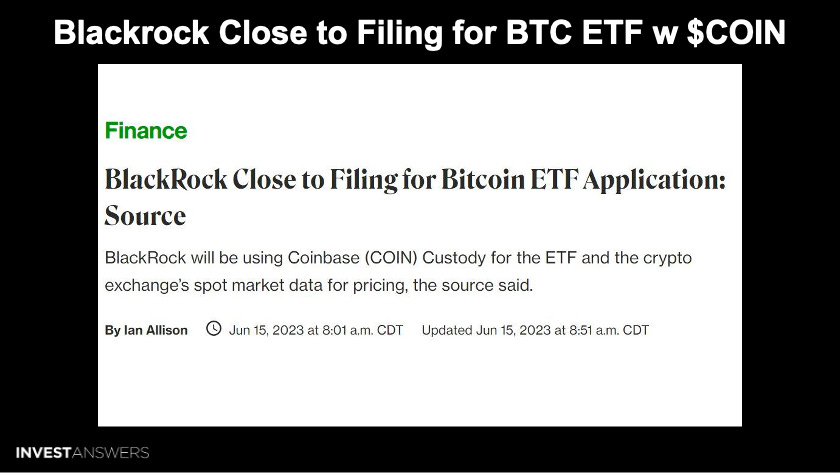

BlackRock is filing a BTC ETF application with Coinbase serving as the custodian and Nasdaq managing surveillance

Recently Bitcoin has experienced volatility similar to Google, Amazon, and oil

Microstrategy is far more volatile

Most of your bag needs to be pure form BTC with no more than 10% in a proxy

Investment choices depend on your age, risk tolerance, and financial goals

In a perfect world, you would have multiple bags for your retirement plan

IMHO the two asymmetric assets of our lives are Tesla and Bitcoin

Amplify your results by playing the arb between BTC and MSTR

Always balance risk with the reward for any investment

Build multiple paths to retirement, such as Tesla, Ethereum, Bitcoin, etc.

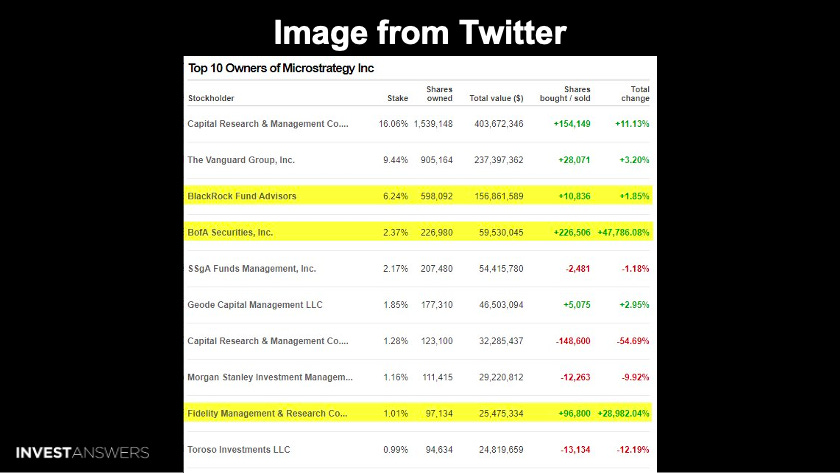

This image of the ten owners of Microstrategy inspired this lesson. A few noteworthy institutional investors that are increasing their exposure to MSTR:

BlackRock

Bank of America

Fidelity

Vanguard owns 8.52% of MSTR

Fidelity went from 0 to nearly 7% ownership of MSTR

BlackRock owns almost 6%

Why are these institutions buying Microstrategy?

Because they cannot buy Bitcoin directly so they buy the proxy.

If anyone can get a BTC EFT approved, it is BlackRock. Despite the recent SEC charges against Coinbase, Blackrock appear to be partnering with Coinbase to custody Bitcoin. BlackRock, the world's largest asset manager, has also partnered with Nasdaq to enter a surveillance-sharing agreement. This is a significant development in the world of Bitcoin ETFs, as it addresses one of the main concerns that the SEC has had with previous applications.

The six largest commercial bank in Canada have expanded their holdings of MicroStrategy. Large banks seek a way to hedge their bets and get onto the Bitcoin train.

A stunning statistic. The top 25 shareholders of MicroStrategy on 60% of the equity. This does not include mutual funds. Big players own a large chunk of this equity.

This is a profound statement. The SEC is suing Binance and Coinbase, meanwhile BlackRock has partnered with Coinbase. BlackRock and major US Banks are buying Bitcoin as much as they can through Microstrategy. Do not let them shake you out!

Mr. Saylor is Mr. Hopium. If you had asked me in 2017-19 where I would have thought the Bitcoin price would be, I would have

Keep reading with a 7-day free trial

Subscribe to InvestAnswers Newsletter to keep reading this post and get 7 days of free access to the full post archives.