Today’s conversation will center on where the world is going. We see S-Curves collide and the pace of development accelerating across AI and bots.

Farzad launched this last year his YouTube channel: youtube.com/@farzyness

Follow Razad on Twitter: @farzyness

AI/Bots - “The Robots is Coming” Topic:

The premise is based on the advancements in AI and the automation of robotics. This is something you can feel and see all around happening today.

This revolution became solidified once Tesla announced their Optimus robot project, which brings real-world automation to everyone’s homes to make humanity more efficient.

ChatGBT is beginning to blow peoples’ minds about what is possible with AI in the workplace. Such a game-changing technology set could create disruption unless we come together and think through it a little more deeply.

The Tesla Optimus bot project could add $1,180 to the share price since 2030.

Two main things related to Telsa Optimus’ go-to-market modeling:

Workforce Replacement

Reduce corporate overhead with bots. For example, if the average U.S. worker is paid US$35K/year, Tesla can manufacture a bot for US$15K and sell it for US$50K with a value proposition of approximately US$350K/job over a decade.Deflation of Labor

Removing the repetitive labor that needs to take place periodically. The rate of manual labor could be disrupted on a similar scale as computers that went from US$50K for corporate processing stations to US$500 for a mobile phone that is a million times more capable from a processing standpoint.

The potential of these two disrupters is almost impossible to conceptualize.

Who leads in this Robot Revolution? Telsa or a Competitor?

The question is which company will be able to capitalize on mass manufacturing of a robot that is helpful in real-life. For example, Boston Dynamics has created an exceptional demonstration of robots' capabilities, but is it useful that can contribute to the economy?

What attributes do you need to make a bot productive in the real world?

Hands or physical mechanisms that can facilitate work in the real world that is delivered reliably, risk, and is affordable without supervision.

Tesla is investing their R&D into hand mechanics, artificial general intelligence for perception, and the manufacturing process so it can be produced as repeatable as possible to reach the market demand.

Tesla’s prior execution track record supplies a strong indicator that they can lead in this robot revolution, but it is still very early.

Might Tesla spin off the battery pack or bot business into a separate company?

Farzad believes that Tesla will most likely keep all under one roof because of its engineering advantage. This will allow the talent to flow around the company freely.

What are your thoughts on AGI and technological similarity?

The recent development where the computer beat the best Go player in the world is a big development.

ChatGBT displacing software developers has a lot of implications.

The world could look completely different in 20 years. If you think back to pre-9/11 in the U.S. and now, our society is completely different in many aspects.

At InvestAnswers, we encourage people to pick a career that machines cannot do. Jobs that require creativity and ingenuity.

What word of advice would you give people entering the workforce or changing careers?

Be as helpful as humanly possible to humanity. What people value most is somebody helping them be happier or helpful in making their life easier. Those are the two big elements of value transfer when considering career advice.

Portfolio Allocation Section:

What is the breakdown of your portfolio?

100% Tesla in equity allocation

Real Estate is the majority of my net worth

A small allocation to BTC, DOGE, and other ALTs

Do you track government monetary policy and need a hard asset for your family?

I invest in Bitcoin because I think there is a lot of utility to its technology. So I have a family that is in Iran, which has a very unstable economy. The currency of the country cannot be trusted due to monetary policy. In such countries, Bitcoin has become a way for people to transact value and do so without a third party. All that you need is a phone and internet to do so.

Conceptually speaking, this is how I think about Bitcoin. The inherent value of Bitcoin is going up over time, and it is doing so reliably. This validates value. Bitcoin provides society with an asset that they feel is incorruptible and they can trust.

Humans are very corruptible, and we love power. So if we can come up with a solution that removes one of those potential risks of human nature by making a decentralized exchange of value, this is a powerful thing.

I do not think it will become the world’s reserve currency, but it will create a new standard of measuring value.

Why can the mainstream media and wall street analysis not properly value disruptive assets like Tesla and Bitcoin?

The Psychology of Money is a mind-blowing book that I recently began reading. The book examines why society can be on the opposite side of the narrative, such as Tesla. One of the possibilities is that we are “the greater fool.”

However, I think it is that people evaluate value from their lived experiences. When a disruptive company comes along, it is not believed until it has reached its full potential. Truly disruptive companies require a lot of due diligence to figure out what is happening within the company.

Tesla is so difficult to understand because what it is doing has never happened before. Ford’s Model T is the best analog to what Tesla is in the midst of creating today. Society went from horses to vehicles, and then everyone else began manufacturing vehicles. So analysts are forecasting now that Tesla has brought to market EVs now all the other ICE manufacturers will start producing EVs.

However, Tesla is so far ahead and accelerating their progress at such a rate that it will be far too late to compete. Legacy OEM ICE manufacturers do not have enough time and resources to perfect EV production and survive as a company through this EV transition of ramping up to 1M vehicles produced per year.

This implies that the vehicle market is completely up for grabs currently. The winner will become whoever can produce EVs at scale. The only companies I know can do this are Tesla (2M in ‘23) and BYD (1.5M in ‘23). The global total addressable market is 1.4B non-electric vehicles, and 97% of the earth’s fleet is gas-powered.

Today it is obvious that we as a society are moving to electricity. So the question is, how long will it take to replace our fleet? Probably, 20-30 years. Today only 1 in every eight people can afford to own a vehicle. What happens when eight out of eight people can afford a vehicle or gain access to a transportation unit? This is the line of thinking where the potential is being lost. By the time that Tesla becomes a has-been, Tesla will have transitioned from today’s market cap to what it will be in 30 years. Layer on energy, the bot, solar, and whatever else they invent then you start to understand the Tesla narrative and investment thesis.

How would you help people understand this exponentiality and colliding S-curves?

Why do I have so much conviction in the Tesla Narrative? Because there are 1.4B legacy gas vehicles on earth, and all of them will turn into electric vehicles because that is obviously the next-generation technology due to its economics (cheaper to fuel), no maintenance (removes hassle), and it is much more scaleable, meaning you can create a lot more units for the materials and energy you put into manufacturing.

So the economic force is understood, and now somebody must figure out how to make the units cheap enough to be affordable today. Tesla has done that. Now the question is, what is the ramp to replace the world's entire fleet of 1.4B legacy vehicles? Obviously, they must ramp up production exponentially.

So the next question is, does Tesla have a track record of execution? Can they do this?

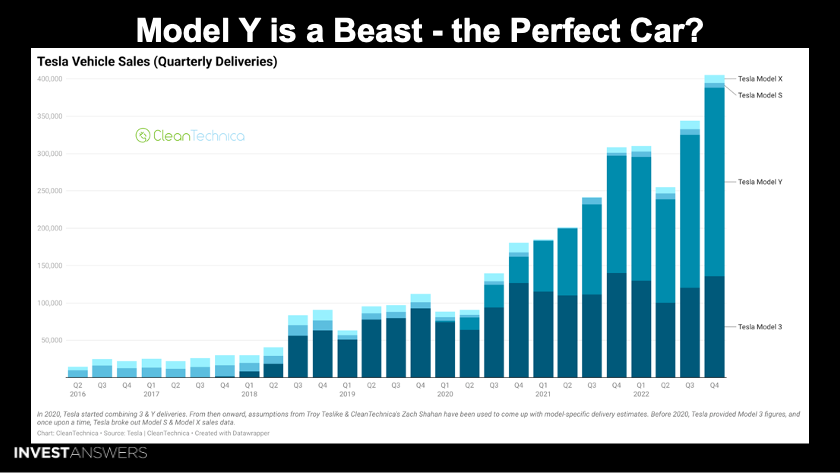

In 2010, Tesla sold approximately 1K EVs; in 2023, they will sell almost 2M EVs. Tesla is doing the most profitably than anyone on earth with zero advertising. This is a product that is selling itself. The runway ahead for this product is crazy.

The Model Y has become the number selling luxury vehicle by revenue in the world and the top-selling vehicle in Europe. Is this the perfect car?

Farzad believes it is a testament Tesla can produce the best-selling vehicle at a healthy margin today with zero advertising. The company has done basically nothing in traditional marketing for the product. The demand has happened organically.

The Model Y is disrupting what it means to purchase a US$50K vehicle because now you have traditionally bought a US$30K vehicle that will move up to the US$50K price point because the effective monthly expense of that vehicle is the same as a US$30K automobile. So there is a stretch in buyers coming up to purchase at this price point to obtain the utility of the Model &:

cabin room

super sporty

handles well

very comfortable

safety

Are we below ICE parity when you take into account the total cost of ownership?

In some cases, yes, we are. Recently, I analyzed the total cost of ownership of a Model 3 versus a Toyota Camera over eight years. The Model 3 proved cheaper over that time period with significantly better performance. This is without the new Generation 3 platform that Tesla is scheduled to launch in March.

What is the competition for the segment of the EV market?

Chevy Bolt does not really fit because they currently are unprofitable and currently capped at 100K units per year

Traditional ICE vehicles in this price point are certainly on parity with the Model 3 with the new Generation 3 rollout

Where do you see 2023 Tesla production going?

Farzad believes Tesla has unlimited demand as long as they have pricing power. So the real constraint today is production capacity.

In Q4 ‘22, Tesla produced 440K vehicles in a single quarter. At this pace in ‘23, it will achieve a 1.7M/year distribution capacity. If Tesla can ramp Austin and Germany with their battery (4680 cells) manufacturing capacity, it is possible to exceed 2M in ‘23.

So the question is, does Tesla have enough batter production to ramp the 4680 cells to 2M vehicles per year plus a ramping new mega pack that is coming online?

The overall story is that Tesla will continue to grow 40% year-over-year, and once they hit the compact car, they will be growing significantly more than that for some time.

In terms of the cyber truck, how long do you think it will take them to ramp?

The key thing to remember about Tesla is its core motive is to advance access to sustainable transport. They do that by maximizing the number of units they can produce on an annual basis. So the Model Y is the present priority, and whatever surplus bandwidth Tesla has, they move to the cyber truck.

In the U.S., approximately 2M pickup trucks are sold annually. Elon made a statement that Tesla is targeting 250K cyber trucks per year.

Does Tesla have an Achilles hill that could impact it in the future?

The short-term risks are associated with the Chinese government and global political developments. I think this is a low probability of transpiring related to Tesla specifically because of how impact Tesla has on China’s economy.

Keyman risk exists in some respect with Tesla. Elon's vision and culture greatly benefit the workforce and customer base. The longer Elon is at the company, the less this risk is because more of the culture is socked up by the team.

Do you believe there is a synergy between Twitter and Tesla?

Twitter supplies an enormous amount of visibility for the Tesla brand worldwide. The mainstream media in the U.S. tends to cover Tesla unfavorably, so Twitter becomes a balancing media outlet for the day-to-day developments in Tesla. I believe this is primarily because Tesla does not advertise with mainstream media, so the syndicates have zero incentive to supply favorable company coverage.

Twitter levels the playing field covering both the positive and negative developments happening with Tesla.

How do you view how the U.S. government panders to companies like General Motors? Do you think that could all change with a new DeSantis administration?

This current administration’s approach is certainly bothersome how Biden has handled GM and Tesla. The Biden administration has close ties to the United Auto Workers Union (UAW), which is a big lobbyist group that supported Biden. GM, Ford, and Stellantis operate on unionized workforces.

Now that Elon has a media that can bring a lot more fairness and open dialogue on these things, I expect the tone to shift quite a bit, especially as Twitter becomes a means for people to make a lot of money. I can feel a change underfoot.

What do you see as Tesla's biggest obstacle to achieving full FSD?

The way I think about this is that FSD will be based on what regulators are comfortable with today. The government is incentivized to ensure the safety level of FSD can remove the chance of death as much as humanly possible. Regulators will likely ask for 1/10th or 1/50th of fatalities over current driver statistics. Maybe they will seek statistics closer to those of the airlines.

So what is that number going to be? And how far away is Tesla from achieving that number with their development?

We must remember that every vehicle adds to the global fleet helps improve their dataset and better computational power. Realistically, FSD will likely launch geo-fenced, a 50-mile radius of Austin downtown that runs for like a year. Then once they are able to prove the safety statistics are above the standard of what the regulators seek, then they flip the switch for larger territories.

Different states will handle the FSD issue with varying regulations and adoption rates.

What would be the best advice for legacy OEM ICE manufacturers on how to catch up with Tesla?

I do not want any legacy auto manufacturer to fail because many people will lose their jobs if they fail. The question is, do they have the correct production capacity to sell into the new cycle of demand in the industry without going bankrupt?

US$100B of debt for GM tied to ICE

US$90B of debt for Ford tired to ICE

US$200B of debt for Volkswagen tied to ICE

The assets and manufacturing of the ICE business are going to begin rapidly depreciating if we are truly in the midst of an industry disruption with EVs.

My guess is that the U.S. Federal government will bail out Ford and GM because of the UAW.

What do you think about Lucid and Rivian?

Lucid

I think Lucid makes it because they have infinite funding through the Saudi sovereign wealth fund. The luxury car market in that part of the world is huge. So Lucid will become a niche player like Maserati.

Rivian

I want them to succeed because they produce a great pickup truck solution. However, they lose a lot of money with only so much runway. If they cannot reach scale, I think they are taken private.

Will the U.S. grid be able to handle the electrification of vehicles?

It comes down to supply and demand. If the demand rises, then the supply will adjust. The electric grid is fixable and will be solved. There is basically unlimited demand for the grid upgrade worldwide, and Tesla could become a central supplier of solutions for it. Tesla is the company that makes the cheapest per kWh battery in the world.

What about lithium supplies and next-generation batteries?

Elon has stated that the availability of Lithium is plentiful, the issue is the refining process is the bottleneck. So it’s no shortage issue, but the refining ramp is the primary limiting factor.

For this subject, I highly recommend the following source:

The Limiting Factor

@thelimitingfactor

Tesla is moving as quickly as possible away from cobalt for their batteries.

What is your take on Tesla’s patent(s) philosophy?

Competition is the best mechanism for a company to get better over time.

Telsa holds on to their “secret sauce” patents, like the manufacturing process of the batteries. There is a “secret sauce” in how they built Dojo, their supercomputer for making full self-driving work overtime. They have patents for manufacturing drive trains and other components of their vehicles.

Tesla’s “all our patents belong to you” was really more of a marketing campaign. Doing the work is 99.99% of what it takes to have a successful business. So Tesla leverages this sentiment to recruit and employ the best talent in the space.

Tesla is the largest startup in the world. All of the focus and energy is on getting stuff done for the betterment of society and a 120,000 employee company.

Recommended Channel on this subject:

Munro Live

Model 3 starts at US$43K, and with the U.S. tax credit, it is down to US$37K today. For the new, more compact vehicle, Tesla publicly stated they want to decrease the input costs by 50%, equating closer to an MSRP of US$22K. This is all speculation.

How was your experience as a Tesla employee? How has it impacted your life?

I invested in the company in December 2012 and have been a fan for a very long time. I joined the company in July 2017 and was employed through December 2021 on the supply chain side. My role was to make the distribution channels as efficient as possible. By far my favorite and the hardest job of my life. I learned that you need much less than what you think to make something happen.

Think of everything from a first principals’ standpoint and what you are trying to achieve. Try to identify the core components of that outcome. Then start moving in that direction as fast as possible, accepting failure along the way.

Peter is working from datasets that do not apply to the Tesla story. I think he is completely wrong on this narrative.