Today’s Nuggets

Bitcoin Hits One-Month Low

U.S. Banks In Deep Trouble

All Crypto Sectors Down

The Crypto Risk-Reward Curve

Apple Seeking AI Help

Solana Connects the Internet

Blockchain Links Launched by Solana Foundation

Morgan Stanley: Tesla Will Rescue the U.S. from Crisis

Delaware Judge Kicked in the Teeth

Javier’s Chainsaw is Fixing Stuff

The markets are rebounding and a lot of good stuff is happening behind the scenes that we need to be aware of.

We just had a massive two weeks in crypto, not necessarily from a price action perspective but more from what things are being built under the cover.

Crypto Market Update:

The Crypto Fear & Greed Index is down to 30.

Bitcoin is back above $62,000.

It was a good week for some assets, beating Bitcoin by over 7.5%.

Bitcoin is down 8% for June.

A week ago, it was down 4%. From last Tuesday to now, the difference is only 4%.

However, looking at the sentiment, you would swear it was 400%.

We were back at this level in May…

We experienced a rough three consecutive days as many miners were selling alongside the carry trade capitulation. In a few days, Bitcoin went from $67K to nearly $58,400 yesterday but rebounded fast because people stepped in.

Every asset has a price - a price for people to sell and buy at.

The fact that we dipped below $60K and big money jumped in and grabbed it all was very impressive indeed.

These unlocks are brutal in 2024.

YGG is always there, always grabbing money. All of the new stuff is coming for your money.

Do not hold this garbage.

Do the work and look at the tokenomics.

Tether announced that USDT stablecoin would no longer be issued for use on the EOS and Algorand blockchains.

This is the first time that EOS or Algorand has been in the news for a long time because nothing is happening on those chains anymore…

They will stop supporting them as of June 24th, 2024. The goal for Tether is to allocate resources to enhance security and efficiency while continuing to support innovation across the crypto landscape.

I want people who follow me to be in the winning chains…

This is Algorand versus Solana since 2023.

This chart demonstrates why so many people who own these tokens are mad.

U.S. banks are already in serious trouble due to unrealized losses on securities they hold.

Cutting interest rates could soften the blow for these banks and prevent future bank failures. During the global financial crisis in 2009, you can see the available-for-sale securities and held-to-maturity securities on the left of the chart.

If you fast forward to today, the banks are over ten times that level, hitting $675 billion.

The banks are in serious trouble with these unrealized losses on securities they currently hold, which are underwater treasuries because of the hold duration exposure.

Again, cutting interest rates could soften the blow for these banks and prevent future bank failures. However, the Fed does not want to do that but instead is keeping the screws on and pretending to go after this magical 2% inflation while burning these banks to the ground.

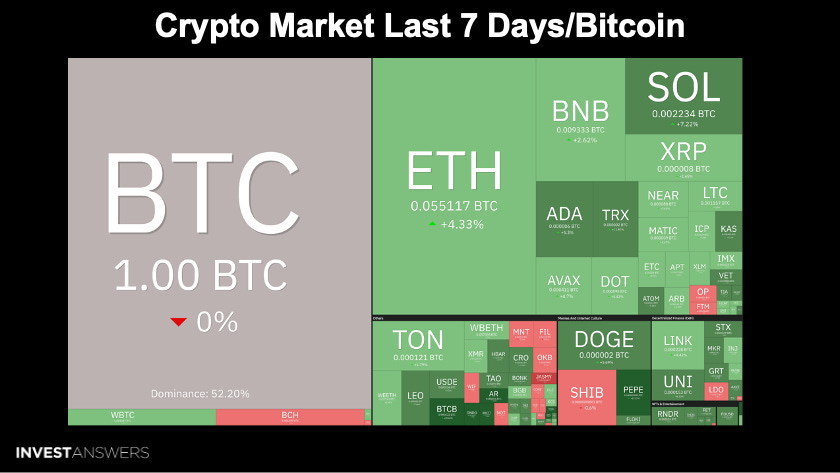

ETH beat BTC by 4%.

SOL beat BTC by 7.25%.

ADA even beat BTC alongside a few other names.

BTC is down 7%.

ETH is down 3%.

Solana is up 7%.

TON, PEPE, UNI, and many other names are up.

Could this be the sign of an alt season?

There is

Keep reading with a 7-day free trial

Subscribe to InvestAnswers Newsletter to keep reading this post and get 7 days of free access to the full post archives.