Today’s Nuggets

BTC Catching Up to AI Trend?

Is the $100K BTC by Halving Still in Play?

Coinbase Sees $1.4B Within Twelve Hours!

Liquidating Shorts!

Money Flow is Perking Up!

FIAT Frenzy!

Are We Too Late?

There is some weird stuff going on behind the scenes!

Today, I will recap where we are after eleven weeks with the Bitcoin ETFs. We will cover the two big flushes alongside the overall trajectory and point out some very unusual things that are happening on-chain.

For those interested in Bitcoin-only content then, the playlist is listed here:

https://www.youtube.com/playlist?list=PLWTRLGkkf1kTTbIDdv-P6ykul7a8iUXYf

Only three weeks out from the Bitcoin halving!

Weird stuff is happening, as we can observe the third-largest withdrawal of Bitcoin ever, from Coinbase.

Where is this BTC going?

When you see big inflows, that is a bad sign as it usually means it is being brought in to be sold.

That is why seeing these big outflows is good sign.

Let us jump to my two favourite categories: AI and Bitcoin

Bitcoin is beginning to catch up to AI in global trend search on Google. We know that leading up to the halving, a lot of hype will begin drawing in a lot of new investors and FOMO.

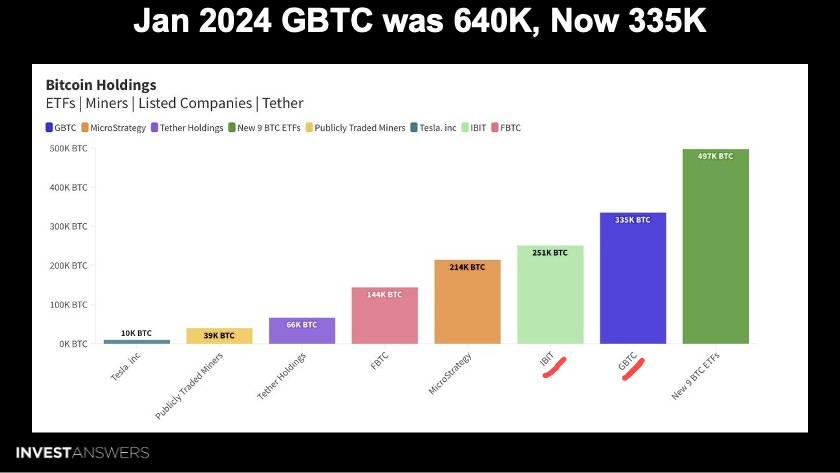

This chart helps break down what has happened this year with the Bitcoin ETFs.

At the beginning of the year, Grayscale held 640,000 BTC; now they have 335,000.

BlackRock holds 251,000 BTC, which is most of what Grayscale lost.

Tether - not to be sniffed at - has moved up to 66K BTC and are making 5% on $100B and buying Bitcoin with those returns.

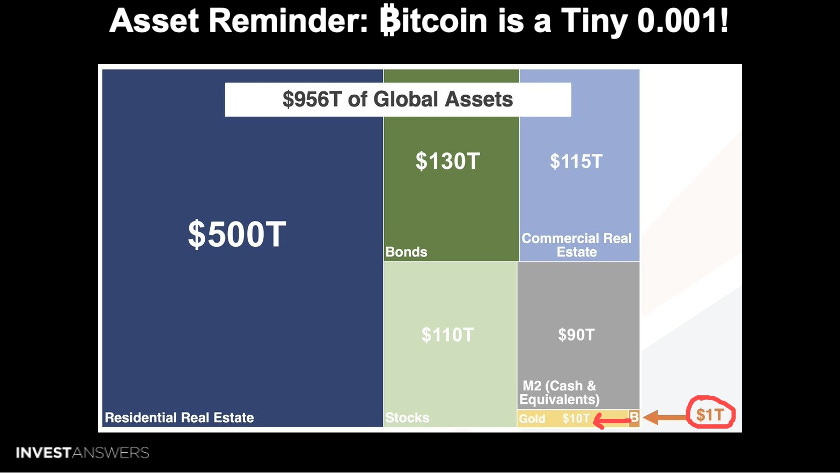

Here is some perspective on where we are in the Bitcoin world…

Right now, it is tiny! - .001 of all assets ie 0.1% of all assets - we have a long way to go.

It is amazing to think that bonds are a bigger asset class than stocks. I expect a big migration from the $130T of bonds into the tiny 0.001% box of Bitcoin.

*Note: these are approximations

Takeaway:

Keep reading with a 7-day free trial

Subscribe to InvestAnswers Newsletter to keep reading this post and get 7 days of free access to the full post archives.