NUGGETS OF ALPHA

A week of positive inflows into crypto totaling $125M, and $334M over two weeks

Bitcoin has been the primary focus for investors the last two weeks, with 98% of all flows

Ethereum inflows are down $66M year-to-date, probably due to staking

The Mayer multiple crossed over with the Bitcoin realized price

Bitcoin's profit percentage has reached 72.3%, equivalent to 10.8 million coins

Bitcoin's futures have been driven by demand from institutional investors

According to the futures, Bitcoin could be $45K level by Christmas

The difficulty of mining Bitcoin has decreased is back at Feb 2023 levels

Ethereum-powered Visa credit cards are exploding in popularity

The Shanghai hard fork has inspired a new wave of Ethereum staking deposits

The value of assets in staking protocols on Solana has increased 91% YTD

India’s GDP recently surpassed the U.K., becoming the 5th largest economy

Apple's net cash is down to ~1.7% of the market cap versus 28% in 2016

Apple appears to be overvalued by ~46.9%, with Debt/Equity at 176.3%

PPI and CPI are trending down fast toward a deflationary environment

Real imports turned negative in Q1 2023, the first time since 2007

~43mn Americans have student loans, but ~27M have not been making repayments

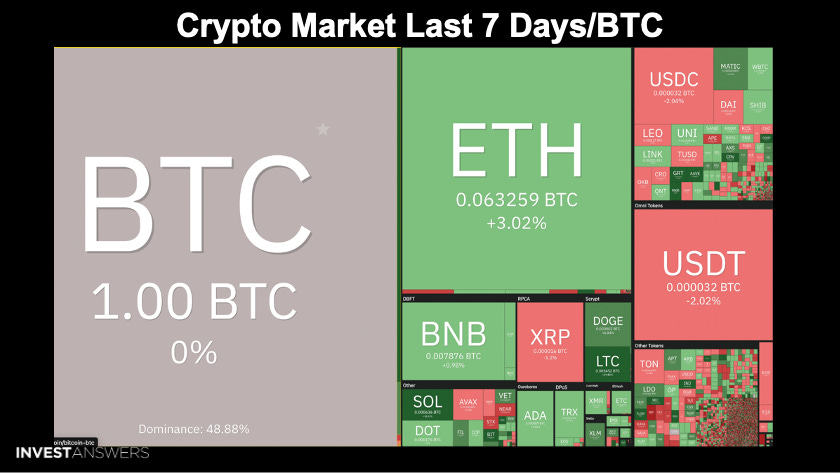

Ethereum outperformed Bitcoin by 3% last week, sending the BTC dominance down to the 48.88 level as some of the altcoins were rallying, depicted by the dark green:

SOL is up 16%

LTC is up 19%

Bitcoin is up 2.2%, Ethereum 5.2%, and SOL up nearly 20% for the week. It is nice to observe a rebound by altcoins, keeping Bitcoin's dominance under the 50% threshold.

The Fear & Greed Index continues to

Keep reading with a 7-day free trial

Subscribe to InvestAnswers Newsletter to keep reading this post and get 7 days of free access to the full post archives.