Today’s Nuggets

Hedge Funds Played GBTC

BlackRock Suspiciously Stacking

Funding Rates Heading Down?

Open Interest Dropping?

Hedge Funds Hedging

Post-Halving Status Check

Liquidity Incoming Soon?

DXY Rejected at Range High

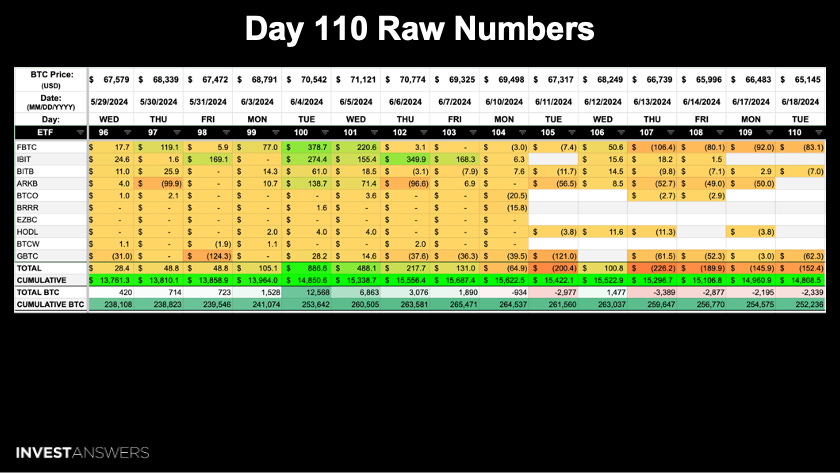

In this lesson, we will examine what is happening with the BTC ETFs.

There has been a big bleed of $900 million out, with outflows in six of the last seven days. Who is selling? What is going on?

I have a new theory about what might be happening in the Bitcoin world but you must remember, I am just a guy on the internet who looks at a lot of data.

Bitcoin is down 3.8% for June, which is not too bad. Yesterday was worse, at 4.1%.

We are holding tight at this short-term holder realized price, proving to be a good support level.

We had $900 million leave the ETFs in seven trading days.

Who is unwinding? Retail is not selling here, nor are the pension funds.

My theory is that the

Keep reading with a 7-day free trial

Subscribe to InvestAnswers Newsletter to keep reading this post and get 7 days of free access to the full post archives.