NUGGETS OF ALPHA

Bitcoin is not getting any softer and is draining off exchanges

74% of Bitcoin holders are now in profit

National Bank of Canada increased its shareholdings in MicroStrategy by 8.8%

BTC Whales recently started buying again to join in with the rest of the cohorts

Twitter partners with eToro to offer trading of assets on the social network

Musk is transforming Twitter into a "super app" with financial services features

Investors want to stake more ETH since the process has been de-risked (Shapella)

Solana’s Saga phone and Uniswap app are now launched

Solana is introducing an era of “mobile crypto first”

Over 1M compressed NFTs were minted on Solana in just one month

CleanSpark prints ~6.1% of their market cap every month in Bitcoin

The Coppock Buy signal triggered as it projects the end of a bearish equities cycle

The London Stock Exchange unit GFO-X was cleared for Bitcoin derivatives

China’s debt expanded by $3.81T or 36.18% more debt from the previous year

United States’ debt expanded by $1.3T or 4.28% more debt of the prior year

United States holds the highest national debt globally at $31.68T

Debt servicing will soon be the largest line item in the US Federal budget

Precious metals performance is still strengthening relative to the equity markets

People worldwide are waking up to an alternative to Gold -Bitcoin!

Today we will discuss the following:

Hard assets,

Why the world needs them,

The path the world is headed, and

Why will this make hard assets so popular!

US stocks rose on Thursday as inflation concerns eased:

Dow Jones Industrial Average climbed by 383 points or 1.1%

S&P 500 rose by 1.3%

Nasdaq Composite gained 2%

The rise was attributed to economic data showing inflation is softening, which could increase companies' profit margins. In addition, Wednesday's cooler-than-expected reading on consumer prices also added to investors' hopes that the Federal Reserve may stop hiking interest rates to curb inflation by reducing economic demand.

Bitcoin is not getting any softer as it is draining off exchanges.

The previous 1-year high of 73.704% was observed on March 24, 2023.

During the first quarter, the National Bank of Canada increased its shareholdings in MicroStrategy by 8.8%. This move puts the financial institution among many traditional firms investing in Bitcoin (BTC) through MicroStrategy shares.

Despite being a business intelligence company, MicroStrategy has become a significant holder of BTC through its numerous acquisitions. In addition, other financial giants like Fidelity, BlackRock, and Bank of America have also gained exposure to BTC by acquiring over $75 million worth of MicroStrategy stocks in the first quarter of 2023.

I had a theory on OCTA Tuesday that the 1-5K whales that sold are going to stack again. Here is proof that the whales are buying. They have started accumulating again, while all other cohorts slow down accumulation.

Whales buy value. Is $30k the new floor?

Following only one sentiment indicator can create an echo chamber that distorts reality and prevents exposure to different perspectives. This can create confirmation bias and polarization, leading to a narrow-minded perspective reflected in the toxic online environment. Blindly following a sentiment indicator can impede critical thinking and intellectual growth.

In an exclusive statement to CNBC, Twitter announced that users will now have the option to purchase and trade stocks and other assets through eToro, starting Thursday. This partnership is unique for Twitter, especially since Elon Musk became CEO after acquiring the platform for $44B last year. Musk has been pushing to transform Twitter into a "super app" that provides financial services to its users in addition to its existing social media features.

Warren had a conniption on live TV recently. I still have the utmost respect for Warren Buffett, I learned a lot from him over the years, but I think Warren needs to avoid subjects that he does not understand.

Notice the five names that CNBC put on the screen during the interview:

Bitcoin

Ether

Solana

XRP

Dogecoin

According to Will Clemente, US regulators are facing a significant dilemma. They can disrupt the US or drive Bitcoin/crypto activity, capital, and talent off-shore, resulting in less oversight and control. This is where decentralization comes into play, as Bitcoin/crypto is poised to succeed in either scenario.

Checkmate! You cannot kill Bitcoin, the cockroach.

This chart reveals what happens when people realize the ETH Shapella-dump FUD was a nothing burger. Investors want to stake more ETH since the process has been de-risked. This is a game changer, and it will be interesting to see how the market will react.

The Solana’s Saga phone and Uniswap app are now launched. So the era of “mobile crypto first” has begun. I remember being at Facebook headquarters over twelve years ago, and everywhere it was displayed that “we are a mobile-first company.”

Consider the importance of your digital wallet can be native to the mobile device that you have with you 24/7.

Solana just hit a significant milestone, and they are just getting started! Over 1M compressed NFTs were minted in just one month. NFTs in the future will be art and useful items such as plane tickets, bus passes, real estate deeds, etc.

Cardano, the seventh-largest cryptocurrency by market cap, is drawing the attention of traders and investors alike as it approaches a critical technical indicator that could trigger a significant price increase. Notably, crypto trading expert Ali Martinez has proposed that Cardano is ‘poised to confirm a head and shoulders pattern, which could ignite a 44% breakout, potentially propelling ADA’s price to $0.60.

Here is Ali Martinez’s chart indicating the potential price action for ADA.

CleanSpark prints ~6.1% of its market cap every month in Bitcoin. So imagine $100M in market cap; this company is printing $6.1M in the profit they get from Bitcoin sales! As the price of Bitcoin rises, these miners become more and more valuable.

CLSK shot up 70% in three days just after our recent interview with Zachary Bradford, CEO of CleanSpark, who supplied good insight into Bitcoin mining:

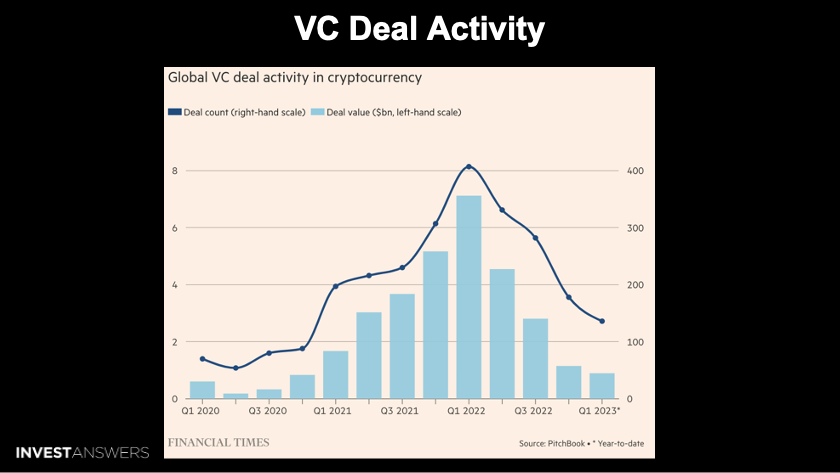

The venture capitalists have left the building. Industry start-ups’ fundraising fell by more than four-fifths in the first quarter of the year, according to PitchBook data. A hook is required to get venture capital backing out of the doldrums.

Recently, one very rare, technical-based buy signal called the Coppock has triggered, suggesting the long-term outlook for US stocks is constructive as the bottom is potentially already in. The Coppock Buy Signal is a TA indicator that identifies buying opportunities in the stock market developed by Edwin Sedgwick Coppock in 1962. It is based on the idea that significant buying opportunities arise at the end of a bearish cycle.

The indicator is calculated by adding the 11-month rate of change and 10-month weighted moving average of a stock market index and smoothed over time with a 14-month weighted moving average. When the smoothed indicator rises above zero, it generates a Coppock Buy Signal, indicating a buying opportunity. It is a long-term indicator best used with other technical indicators combined with fundamental analysis to make investment decisions.

Remember, technical analysis helps you determine when to get in and out of a position and not what to get in and out of.

You can see that the red tale of the Coppock Curve is turning up, indicating that the bottom is in, which is a rare occurrence. The last trigger on this indicator is to place back in the 2009-10 range. So this is a technical analysis piece of history that just transpired.

LSE's French clearinghouse unit signed a deal with UK-based GFO-X to offer trading in Bitcoin derivatives in a venture known as LCH DigitalAssetClear.

This clearing will be entirely separated from other operations, including a segregated default fund. The new contracts will be based on the GFO-X/Coin Metrics Bitcoin Reference Rate. The move comes in as Bitcoin's price has surged over 80% this year, renewing institutional interest despite regulatory actions and crypto bankruptcies.

Amazon's CEO wrote that the company is heavily investing in two areas that are "core to setting Amazon up to invent in every area of our business for many decades to come." He hinted that LLMs and Generative AI would be a game-changer for customers, shareholders, and Amazon. However, he did not provide further detail due to the vastness of the topic. Additionally, Amazon Web Services announced new generative AI tools to enhance usage.

China's remarkable economic growth in the last few decades has made it one of the world's largest economies. However, this growth has come at a cost.

As of April 12, according to data acquired by Finbold, China's national debt amounted to $14.34T, ranking second globally. This value reflects a year-over-year increase of $3.81T, or 36.18% more debt from the previous year. In comparison, the United States holds the highest national debt globally at $31.68T, representing a year-over-year increase of $1.3T or 4.28% debt increase.

Japan holds the third spot with a national debt of $13.36T, followed closely by the United Kingdom at $3.75T and Germany at $3.32T.

For the first three months of 2023, the deficit was a whopping $679B. This is an increase of 134% over Q1 2022, which was $291B.

The US is experiencing lower revenue and higher spending:

Receipts = $1,023B vs. $1,070B (-4.4%)

Spending = $1,702B vs. $1,361B (+25.1%)

Staggering how fast this is beginning to spiral out of control.

This means that it’s time to print - QE is incoming! The interest expense on US public debt rose to $812B over the past year, a record high. If it continues to increase at the current pace, it will soon be the largest line item in the Federal budget, surpassing Social Security.

It is fascinating how the gold-to-S&P 500 ratio continues to track its historical performance once again after major distortions across the US Treasury curve.

Our empirical analysis suggests that today's outperformance of precious metals relative to the overall equity market is still in its initial phase. Going back to 1970, this ratio tends to appreciate, on average, by 72% for the next two years after the US Treasury curve inverts by more than 70%. As shown in the yellow line, note the strong acceleration in return initiating at the 8th-month mark, implying the end of July in today's scenario.

People worldwide are waking up to an alternative hard asset to Gold, which is Bitcoin! Year-to-date, Gold is up 9%, and Bitcoin is up 83%. If this trend observed with Gold continues, it could make the last Bitcoin bull run look small, as we have all the Macro variables currently supporting this trend.

👋 JOIN THE FAMILY: http://www.patreon.com/investanswers

📈 IA MODELS: http://www.investanswers.io