TODAY’S TAKE

Altcoins strengthened against Bitcoin this week

Bitcoin is now 70% through the halving progress in this cycle

Bitcoin on-chain activity is growing due to demand for inscription transactions

The BTC Guppy indicator has flipped for the first time since November 2021

Solana’s price is up nearly 30% in a week

Retail is investing US$1.5M each day into US markets

European stocks are running hot and might be reaching overbought territory

Bloomberg’s MLIV Pulse survey found $3-5M is needed to retire today

U.S. state regulator recently launched a crypto scam tracker

Kimchi premium discount makes Korea the cheapest place to buy Bitcoin

Get on the trains that are moving in crypto

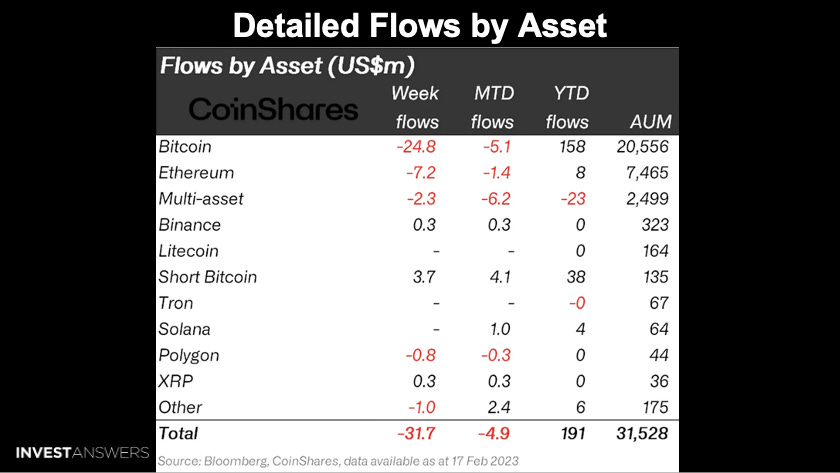

Digital asset investment products saw outflows totaling US$32M last week, the largest since late December 2022. Mid-way through last week, the outflows were much higher at US$62M, but sentiment improved by Friday. Bitcoin bore the brunt of the negative sentiment with nearly US$25M in outflows, while short-bitcoin investment products saw inflows of US$3.7M.

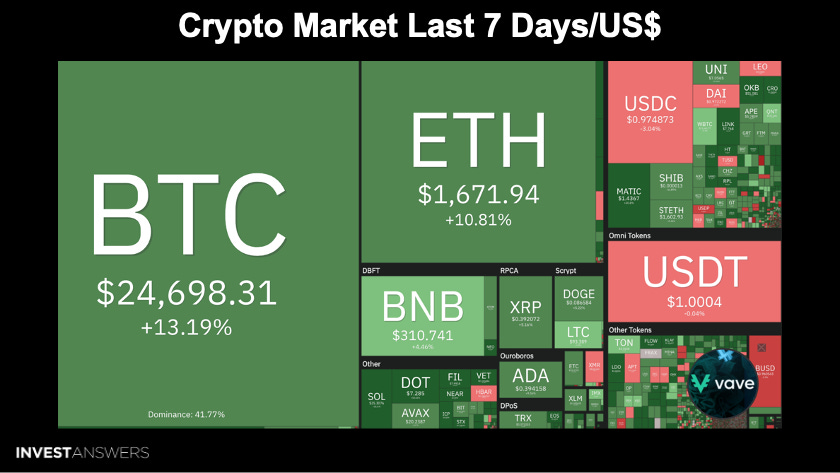

Lots of dark green indicating altcoins strengthened against Bitcoin.

The trend of ETH continuing to lag BTC is noteworthy. On the other hand, some of the altcoins were on fire, up over 30% for the week, such as SOL, etc.

If 75% of the Top 50 coins performed better than Bitcoin over the last season (90 days), it becomes Altcoin Season. We are still hovering around the same range as a week ago and have not arrived at an Altcoin season.

Bitcoin is now 70% through the halving progress in this cycle. Historically, prices have risen post this period into a cycle.

The current demand for inscription transactions has sent the Bitcoin Transaction Count Momentum to its highest level since January 2021. The rapid ascent in Transaction Count reflects a significant increase in the network activity as demand for on-chain transactions begins to return.

The santiment’s behavioral analysis platform points to a fairly high level of euphoria in BTC sentiment against the backdrop of BTC rising to an 8-month high. Combining this with the heavy call options buying activity points to an emerging bullish environment.

The Guppy has flipped for the first time since November 2021. The shorter-term moving averages (green) have flipped the longer-term moving averages (red) for the first time in over 12 months.

The Guppy is a trend-following technique comprising 12 exponential moving averages (EMAs). The multiple lines of the Guppy help traders see the strength or weakness in a trend better than if only using one or two EMAs.

The 12 EMAs are separated into two groups:

short-term

long-term

The trend is bullish for the Guppy indicator.

Solana currently has a market capitalization of $9.96B, making it the 11th largest digital asset by market cap, surpassing Polkadot (DOT) at $8.7B. Next on the list is the meme-inspired cryptocurrency Dogecoin (DOGE), which has an $11.73B market cap.

SOL has notably been outperforming DOGE.

The sentiment mixed last week, with Ethereum, Cosmos, Polygon, and Avalanche seeing outflows of US$7.2M, US$1.6M, US$0.8M, and US$0.5M, respectively. However, Aave, Fantom, XRP, Binance, and Decentraland saw inflows between US$0.36M — US$0.26M.

Blockchain equities saw inflows totaling US$9.6M last week and have seen six consecutive weeks of inflows highlighting a more constructive sentiment amongst investors.

Chainlink's largest transaction in 8 months occurred 12 hours ago. This transfer was four hours before the price topped out at $8.34, the highest since the FTX collapse.

Remember, Dogecoin can inflate to infinity.

Noteworthy names in green:

Tesla

Apple

Nvidia

Overall, a very mixed week in equities as it was in crypto.

Retail investors pour $1.5 Billion daily into US markets, the "Highest Amount Ever Recorded." Finally, contrary to popular belief, retail money market funds' net assets at an all-time high suggest that retail investors still have plenty of capital to allocate to riskier investments, provided that market conditions remain supportive.

Resilient macroeconomic data, the turnaround in Germany, the revival of Chinese demand, and the easing inflation have provided major tailwinds for markets. Cyclical stocks,

Keep reading with a 7-day free trial

Subscribe to InvestAnswers Newsletter to keep reading this post and get 7 days of free access to the full post archives.