NUGGETS OF ALPHA

FTX dumpage impact varies by asset after adjusting for weekly trading volumes

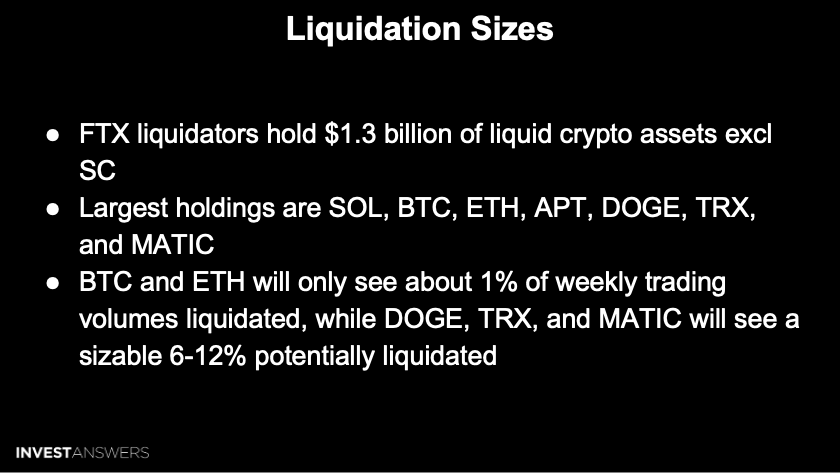

SOL, APT, and TRX will have the highest sell pressure ratios based on weekly trading volume

Nothing has structurally changed in the crypto market over the last 7 days

The earliest FTX distribution is scheduled for Q4 ‘2024

Solana has led the FTX major assets in negative price action

FTX monthly unlock schedule results in $9.2M worth every week until Jan ‘28

The scheduled SOL FTX unlocks are only 1.2% of the weekly trading volumes

Today we’ll discuss how fear sells and how investors can be misled. My job is to share the truth with numbers to back it up.

This lesson will focus on:

The real impact of the FTX developments this week

The token dumpage resulting from the liquidations

The FTX bankruptcy and odds of recovery

How much the estimated recovery is

When you take the time to dig into the data, you’ll find there is no need for concern.

This is a typical piece of media related to FTX developments. The article forecasts that FTX will dump their Solana and Bitcoin and that action will crash the price to $3,000 BTC and $3 Solana. I have heard of $3 Solana targets for weeks because of this story.

YouTubers are also parroting this story, which is causing panic. They do this because fear sells.

This is a summary list of key points that I’ve uncovered in my research. To understand the impact of this development, you must put the value being dumped over any given period into the perspective of its average trading volume levels.

FTX's largest holdings currently are

Keep reading with a 7-day free trial

Subscribe to InvestAnswers Newsletter to keep reading this post and get 7 days of free access to the full post archives.