Today’s Nuggets

V for Perp Victory!

Tether FUD

Who is Staking Stablecoins?

ETH Hits Multi-Year Low

SOL TEV All-Time High

Tesla FSD Improvement Scaling

Tesla’s New Megapactory

NVIDIA Market Cap Versus Market Cap of G7 Countries

NYSE Going to 22 Hours a Day

Gold Soaring, FIAT Going to Zero

Chinese PBOC Continues to Cut

This is Friday Fire, which covers this week's important events. Of course, a bull market is not a bull market without some FUD.

Crypto Market Update:

The crypto market is still at $2.31 trillion;

The volume is $75 billion, which is pretty good; and

Bitcoin is just shy of $68K.

This is the V-shaped recovery, which is dipping a little bit again.

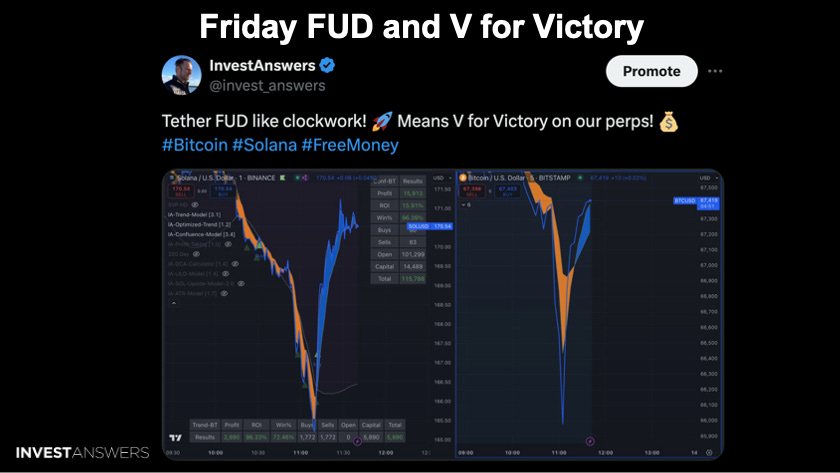

The Solana chart is on the left and Bitcoin is on the right. They mirror each other exactly. However, both have dipped a little bit again because there is more FUD out there in the ‘cryptoverse’.

Ivan always says to buy when Tether prints. You also buy when there is Tether FUD.

Shout out to everybody who got into the perp trade not too long ago!

Here is the recent bull market Tether FUD. According to the Wall Street Journal, the U.S. Treasury has considered sanctioning Tether. The U.S. Treasury should be very grateful that Tether exists because it's the seventh largest buyer of bonds. Of course, government regulators can lose their way, just like the SEC.

However, the Wall Street Journal is regurgitating old noise, and there is no indication that Tether is under investigation. Wall Street just made up some FUD to manipulate markets.

Perhaps there is always market manipulation which is why I have made a career out of "running into burning buildings." If you know me, that is what I do.

You can see Tether's dominance in green.

It still is the clear leader in stablecoin transactions. Although USDC is doing more transactions now, it handles more micro-nano transactions with small dollar amounts, whereas Tether tends to be the higher dollar denomination transactions.

This chart is interesting…

You can see that Japan is number one and Germany - at the far right - is the least exposed. Then you have stablecoins in green versus the top holders of treasuries.

Again, the U.S. treasury needs Tether more than they know and hopefully, they will wake up to that one day soon as well.

CryptoQuant tweeted earlier today that they believe Bitcoin will likely be used as a currency in 2030.

This chart shares the Bitcoin hash rate, which reflects the intensity of competition amongst miners. The hash rate has been up nearly 400% over the past three years.

In the old days, you could mine 50 Bitcoin with a simple crappy old PC from 2009. Now, you need an army of ASICs to be able to do the same thing.

Ethereum hit a multi-year low against Bitcoin for the ETH bag holders, erasing all gains since April 2021.

By the way, April 2021 was when the bull market kicked off last cycle. Again, it is very important, as we always stress here, to be on the right horses at the right time. This is not Ethereum's run; it is an older technology from previous cycles.

Many ETH maxis are extremely bullish on Ethereum but I have not been myself.

What is super interesting about this chart is it used to cost four units of Solana (SOL) to buy one Cardana (ADA) at the beginning of this chart. Now, it is 501 Cardana (ADA) per 1 unit of Solana (SOL).

This is

Keep reading with a 7-day free trial

Subscribe to InvestAnswers Newsletter to keep reading this post and get 7 days of free access to the full post archives.