Today’s Nuggets

Ze Pamp Comes Next

No Big Deviation So Far

Gamestop Might Jump on the Bitcoin Bandwagon

Schwab Names Head of Digital Assets

Robinhood’s Net Income Rocketed

Deutsche Bank Tokenizing RWA on SOL

Tesla Robotaxi Cybercab Code is Now Visible

Ray Dalio Buys $62M Bag of TSLA

The VIX Lesson

Apple Goes Outside to Partner with BABA

D.C. Trying to Hide Their Bags

Happy Fire Friday!

Happy Valentine's Day to everybody out there too!

Do not forget to give the gift of Bitcoin, not flowers that will wither and die in a few days.

There is much to cover as we have so much news that happened over the last couple of hours.

The Crypto Market Fear & Greed Index is currently 48, in the neutral zone.

Nobody is too freaked out and everything is kind of cool.

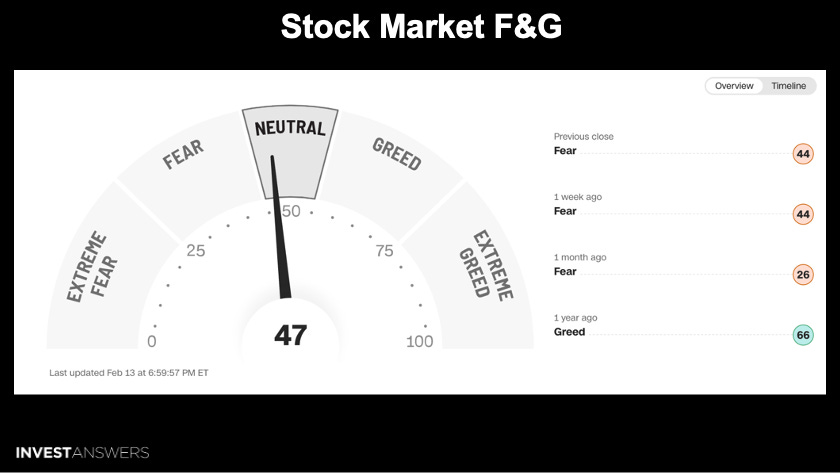

In the stock market, we are also neutral.

These two are rarely neutral at the same time. Remember, if you need to be a well-rounded investor, you must play all sides, not just one or the other.

The first chart of the day is the short-term holder sells side risk ratio and we know from history that every time the SSR is down at this level, Bitcoin is ready for the next big move.

This happens like clockwork. Short-term holders have reached their equilibrium and next, we go up.

The longer the chop-solidation, the bigger the pump.

This is the 200-week moving average on Bitcoin, and usually, the Bitcoin price stays above the 200-week moving average.

In 2022, we broke through it for the first time in history but this has been a great indicator for Bitcoin.

In the past cycles, there have been massive deviations from the 200 WMA. However, in the current cycle, there have been no massive deviations, nor any overheating per se.

As the asset gets larger,

Keep reading with a 7-day free trial

Subscribe to InvestAnswers Newsletter to keep reading this post and get 7 days of free access to the full post archives.