Today’s Nuggets

Panic Selling and Whales are Buying

Germany Still Dumping, Only 36% Left

Bitcoin to the Rescue in Suriname

ByBit’s Crypto Exchange Exponential Growth

Ethereum is Close to Achieving Usability

Raydium Dethrones Uniswap & Dominates DeFi

Bears Getting Burnt

UAW Union in Hot Water Again

Real Estate is Impossibly Unaffordable

SPX Smashing ATR Levels

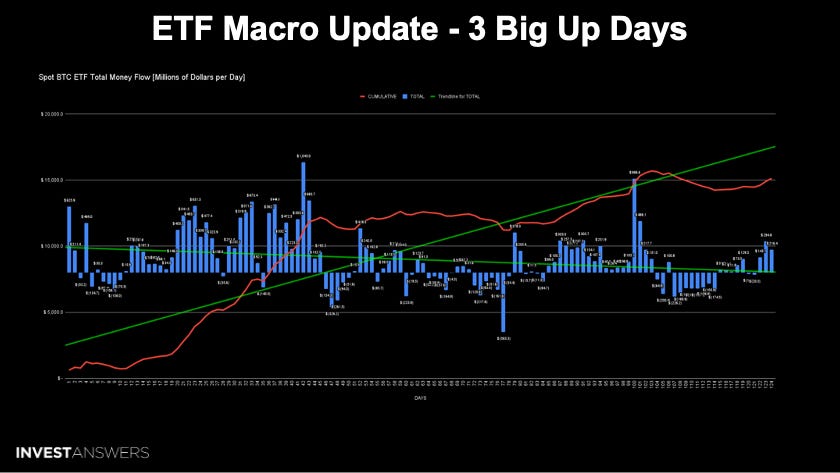

It may not appear like the markets are doing well but certain things are and others are about to pop. Bitcoin ETFs saw a huge inflow of $660 million in three days. BlackRock, the major player I have been suspicious of because they have done nothing for weeks, came back with a vengeance over the last three days.

Suddenly, the buys are happening…

Crypto Market Update:

The crypto market cap is higher than yesterday at about $2.15 trillion, with a 24-hour volume still around $65 billion.

The price of Bitcoin is $57,200, which is down because the Germans continue to dump.

The Fear & Greed Index is currently at 28, up a bit from yesterday.

The US BTC ETFs have recorded their third consecutive big up day.

BlackRock is back.

The bigger news is that we have a fourth positive day and nearly 12,000 Bitcoin were swallowed in three days - 26 times the daily issuance.

Many people are sad about Germany selling and it is taking the Bitcoin price down. You have to understand this is a good thing. Wipe out the clean hands.

Look at the amount of acquisition made by just the US ETFs, forgetting everybody else.

While many are panic selling, the long-term holders have accumulated 85,000 Bitcoin in the last 30 days. These wallets are not ETFs, miners, or exchanges.

During the same period, a bit flowed out of the Bitcoin ETFs.

From CryptoQuant, you can see how long-term holders are adding to their holdings at the fastest monthly rate since April 2023.

Bitcoin Whales have been increasing their holdings again at 6.3% - the fastest in a year and a half. This indicates a rising demand for Bitcoin despite what you may think is happening in the market.

All of the recent FUD is not stopping others from buying.

I know at least five people in the last two weeks that became whole coiners because of the panic sellers. Instead of paying $73,800 for a Bitcoin, they could pay $55,000.

Germany is still dumping.

As you can see, the German government sent another 5,100 Bitcoin, which dumped the price last night. Last night, we broke above $59K and the 200-day moving average. The German government decided to send 5,100 more Bitcoin - worth $300 million - to exchanges, which took the price back down to approximately $57K and some change.

They are still dumping right now, so it is still violent and rough out there. The good news is that Germany only has 36% of its bag left, or around 18,000 Bitcoin. This is the most stupid trade in history and will go down in infamy.

However, it gives other people

Keep reading with a 7-day free trial

Subscribe to InvestAnswers Newsletter to keep reading this post and get 7 days of free access to the full post archives.