NUGGETS OF ALPHA

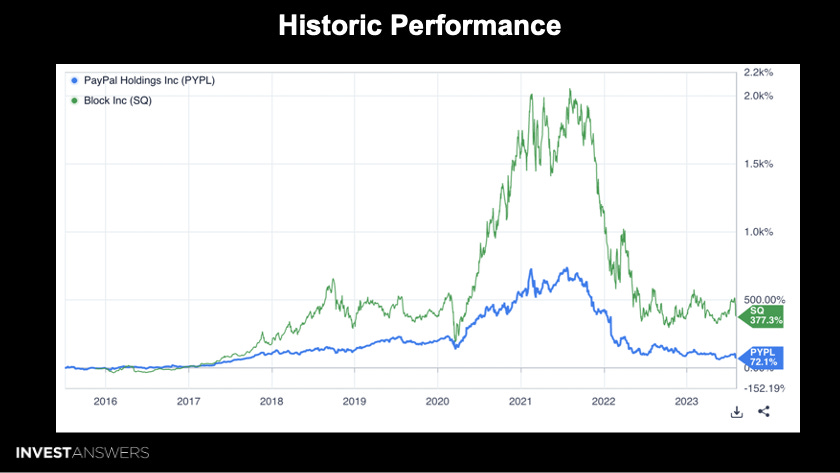

Since 2016 SQ has outperformed PYPL with ~377% versus ~72% growth

PYPL is more profitable and has a higher return on equity than SQ

SQ is more liquid and has a lower debt-to-equity ratio

PYPL recently announced it would issue its stablecoin, the PayPal Coin (PYUSD)

SQ is approaching crypto from a Bitcoin Maxi standpoint

PYPL wins our valuation chart from a profitability and growth perspective

SQ is issuing egregious compensation in proportion to the company's net income

Since 2016, PYPL has reduced its public stock supply by ~7.45% with buybacks

Since 2019, SQ has gone from 400M to 605M shares, a whopping 51.25% dilution

Face Offs are on Wednesdays, and the IA Patreon community votes to decide who will compete. This is our eighth episode with our first equity face off, as we now have a framework for comparing stocks. This series helps investors determine how to value and appraise assets, forecasting where they are going over the next few years, combined with their price targets.

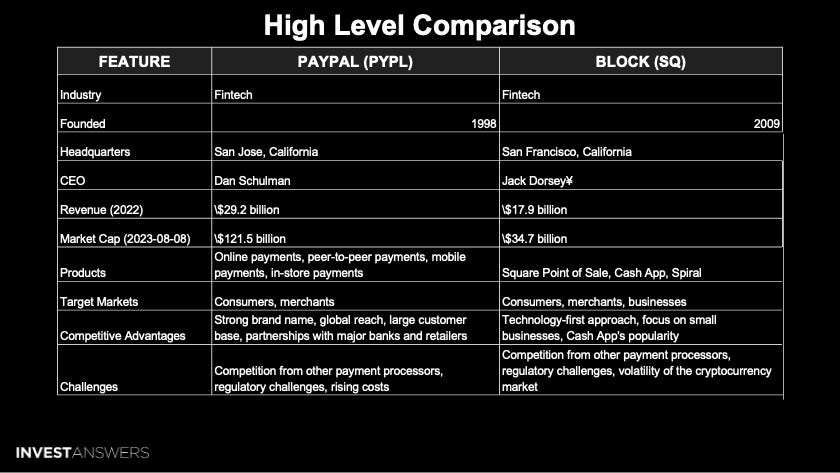

This matchup consists of Block (SQ) versus PayPal (PYPL):

PYPL is more profitable and has a higher return on equity than SQ

SQ is more liquid and has a lower debt-to-equity ratio

PYPL is growing at a slower rate than SQ

PYPL has a robust partnership ecosystem and a dominant marketplace position

Since 2016 SQ has

Keep reading with a 7-day free trial

Subscribe to InvestAnswers Newsletter to keep reading this post and get 7 days of free access to the full post archives.