NUGGETS OF ALPHA

HIMS is a telehealth platform that connects consumers to licensed healthcare professionals

The telehealth market is forecasted to quadruple to $120B by 2030

ENPH's primary solutions are solar panels and inverters for energy storage

The ENPH break-even point for installation costs is usually three years

HIMS has a strong cash position that is growing slightly and the debt is minimal

HIMS' stock dilution is 100% per year on average, dating back to 2020 with its IPO

ENPH recently approved a stock repurchase program of $1B worth of shares

ENPH won a large proportion of the IA Face Off 30,000-foot ratios

3-year CAGR for HIMS is only 2.7% versus 50.4% for ENPH

Since HIMS's IPO in 2020, it has gone down 40%, while ENPH is up over 400%

ENPH recently hit a perfect support level that has served ever since early 2021

ENPH is worth a nibble as a disruptive stock with great upside going forward

This lesson is a result of our recent IA Patreon Community poll. We went with #4 on the list, ENPH vs HIMS, because the others are apples to oranges comparisons eg Crypto vs Equity or Equity vs BTC Proxy.

This channel is about disruption and finding alpha wherever it may appear - check out our playlist above for a list of all Face Offs.

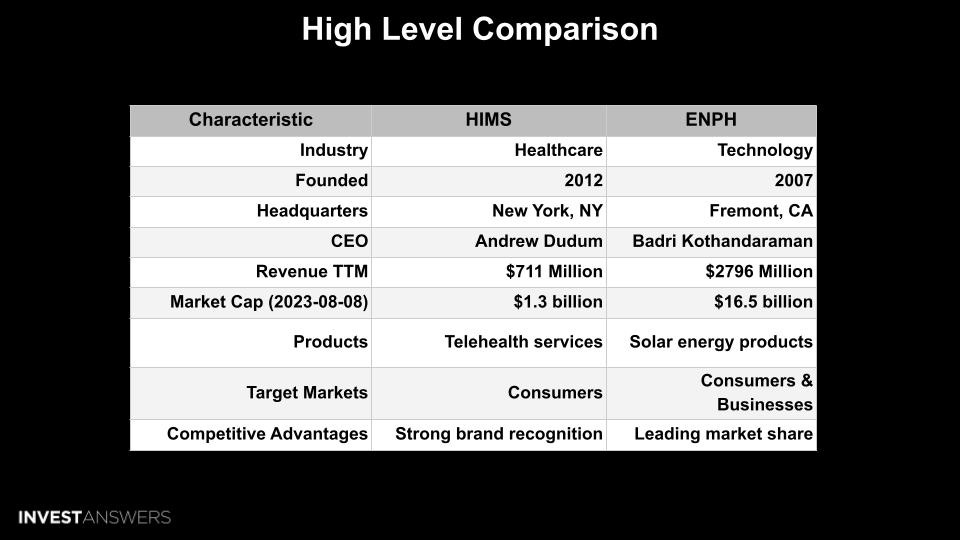

This chart summarizes the key differences between these two companies.

Hims & Hers Health (HIMS) is a telehealth platform that connects consumers to licensed healthcare professionals, enabling them to access high-quality medical care for numerous conditions related to mental health, sexual health, dermatology, primary care, and more. Many of the prescriptions for the ailments are branded by the company.

The telehealth market is forecasted to

Keep reading with a 7-day free trial

Subscribe to InvestAnswers Newsletter to keep reading this post and get 7 days of free access to the full post archives.