Today’s Nuggets

Whales Stopped Selling

GameStop Follows MSTR Strategy

US SBR Creation Underway

Saylor on BTC Game Theory

USA to Buy 5% of BTC Supply

Blackrock Brings ETF/P to Europe

Bitcoin Extremely Undervalued vs Gold and Real Estate

The 3 Bitcoin Eras

Is there more upside, or is the bull run done?

In this story, we will look at the previous cycles to identify who is stacking and some other on-chain data to determine if there is more upside or if the bull run is done.

We will attempt to identify how much is left in the cycle and what else is happening in the Bitcoin world. We will unpack this new era with diminishing returns and so much more.

Over the last five months, the supply from major players has declined.

The total reduction is about 290,000 Bitcoin. Currently, the average figures have begun to rise, reflecting an accumulation of supply among players with wallets with more than a thousand Bitcoins.

In plain English, the whales have stopped selling and are stacking once again.

Again, these things happen in cycles of fits and starts. Things go down. Things go up. Things chop-solidate sideways for a while. That is just the nature of markets.

By the way, all markets are the same - this is not unique to Bitcoin.

Gamestop wants to buy billions in Bitcoin and are borrowing at 0% to do that.

They have four and a half billion on their balance sheet that they are not using. They should use that to get rid of the fiat and borrow as well as 0%.

That is the winning strategy.

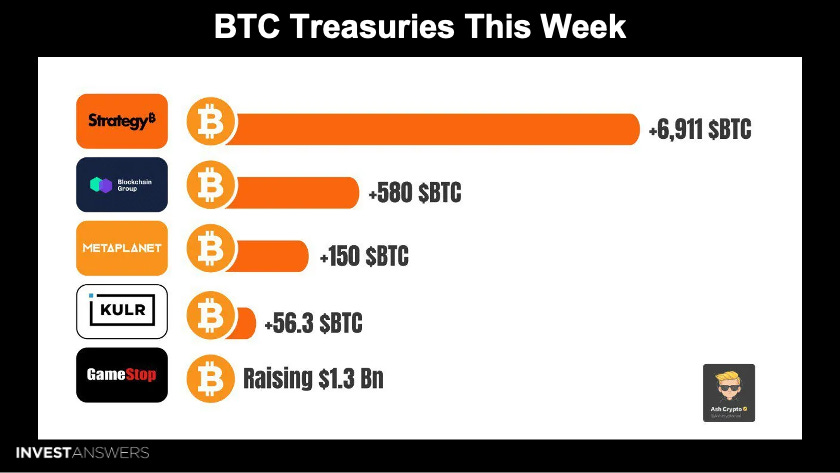

This is a beautiful chart that summarizes what happened just this week in terms of Bitcoin treasuries.

I remember seeing the anxiousness Michael Saylor had in the bear, and it was always about: can you get enough money fast enough to buy?

Now, the world knows GameStop is planning to deploy $1.3 billion to buy Bitcoin. First, where are they going to get it? Second, can the price stay low before they deploy the $1.3 billion?

This is likely the anxiety that the GameStop team probably has right now.

Ten of the last eleven days, the ETFs have been buying.

In fact, there were

Keep reading with a 7-day free trial

Subscribe to InvestAnswers Newsletter to keep reading this post and get 7 days of free access to the full post archives.