Always, always, always question everything. Only the paranoid survive…

This will be a spicy one.

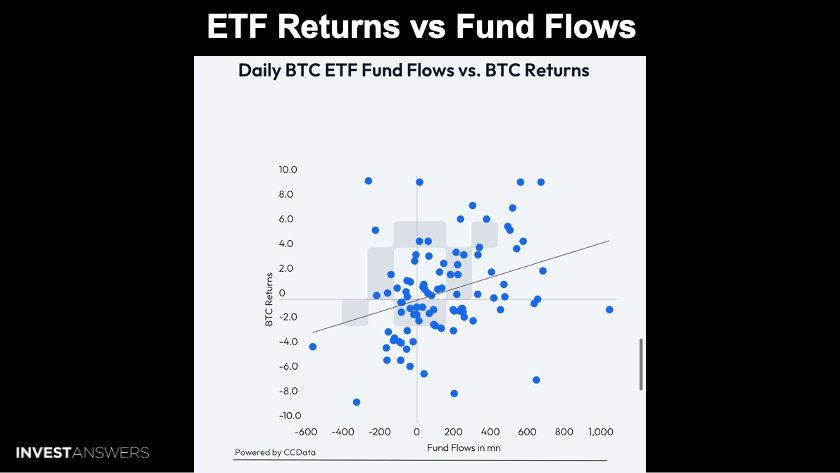

I am going to do a cursory analysis after the first 90 days of the ETFs to see if there is any correlation between ETF money flows:

If so, how?

How much influence do these ETFs have on the Bitcoin price?

What can we pull from mathematics when there are crazy money flows into Bitcoin?

What confused me the most was that a ton can be dumped and the price can go up. A ton of money can flow in and the price can go down.

The question is how and why.

Remember, I am just a guy on the internet who looks at numbers. I am just playing with numbers, which is all that I do. Let us dig in to see if we can find interesting patterns or correlations as we go forward.

The answer is hell yeah!

Political leaders who do that well can get into positions very early because they have that information asymmetry.

However, today, I will cover market-maker manipulation and whether that exists.

One thing I spotted on January 31st after the BTC ETFs I posted on X: T plus 1 means they have one day or two days to fulfill the ability to buy the Bitcoin.

Therefore, they pull in the cash from selling the shares and then have time to execute.

What if you could bring the price down? And there is tons of opportunity. If you are running an ETF and are only charging 25 basis points, the money is in the spreads.

A regression on BTC indicates about 10.7% of the variability in Bitcoin returns is explained by net inflows into spot Bitcoin ETFs, which is a pretty positive correlation but I am going to dig a little bit deeper than this.

Here is a chart covering the first 35 days of the BTC ETFs. Your money flow is in black and your price is colored.

The price went up most of the time but sometimes, even after large inflows, it went down.

That intrigued me, so I decided to analyze the first 92 days…

Retail investors think they are buying shares from BlackRock or Fidelity etc.

No,

Keep reading with a 7-day free trial

Subscribe to InvestAnswers Newsletter to keep reading this post and get 7 days of free access to the full post archives.