Today’s Nuggets

The Fourth Worst Day Ever

Grayscale’s Equilibrium is Nowhere to be Found

Hong Kong is Almost Here!

Stagflation is Here, Macroeconomic Environment Fragile

Investors Dealing with Indigestion and Anxiety?

ETFs’ Long Overdue Breather

Runes Trend Dead in 8 Days

Self-Custody Under Threat!

Bitcoin Versus Japanese Yen

Bitcoin Smoking Ethereum!

As a reminder for those interested in Bitcoin-only content then, the playlist can be found here:

https://www.youtube.com/playlist?list=PLWTRLGkkf1kTTbIDdv-P6ykul7a8iUXYf

*Some browsers do not show their YouTube playlists, so make sure you are using the Chrome browser.

Grayscale - as usual - took a big dump!

Fidelity, ARK, Bitwise, and Valkyrie also went down. It was an ugly day for the BTC ETFs overall.

However, despite their fourth-worst day, Bitcoin's price is exactly where it was last Friday.

So much for Michael Sonnenshein's statement that GBTC is reaching equilibrium…

Apparently, Grayscale's bleed does not matter anymore, as another $120 million left today is like clockwork.

The big question everyone is asking is, what is the influence of the ETFs on Bitcoin?

Yes, it indeed has an impact, as they have amassed a huge amount of Bitcoin in a short window of time. It did drive the price from $40,000 to $70,000.

It is clear that we are going through a stagnation period.

Retail is indeed arriving and I am performing a detailed cohort analysis to show you exactly who is stacking and who is not. Retail purchases are counteracting the slowdown in the ETFs.

Hong Kong and other buyers are on the way!

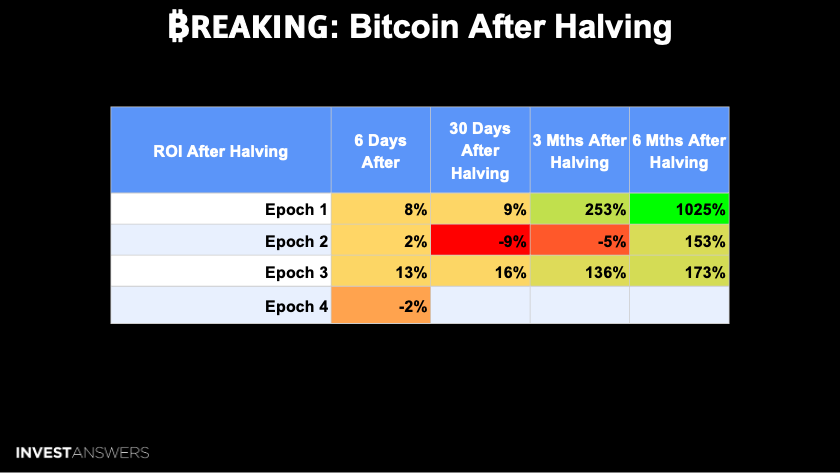

This table attempts to answer the question of what Bitcoin is going to do after the Halving.

Technically, we are in Epoch 5 but I am throwing out the first Epoch because it does not provide statistically relevant data. We are down 2% after the first six days, which is the worst start compared to the other three Epochs.

However, what is more interesting is the performance after 30 days and days 31-90. The real price action occurred during the 3-6 month period post-halving.

The current macroeconomic environment is very fragile, which means the world is in need of risk-off assets. By the way, gold experienced its worst daily dip in about two years yesterday.

Here is a chart to help visualize the table. The key takeaway is that

Keep reading with a 7-day free trial

Subscribe to InvestAnswers Newsletter to keep reading this post and get 7 days of free access to the full post archives.