Today’s Nuggets

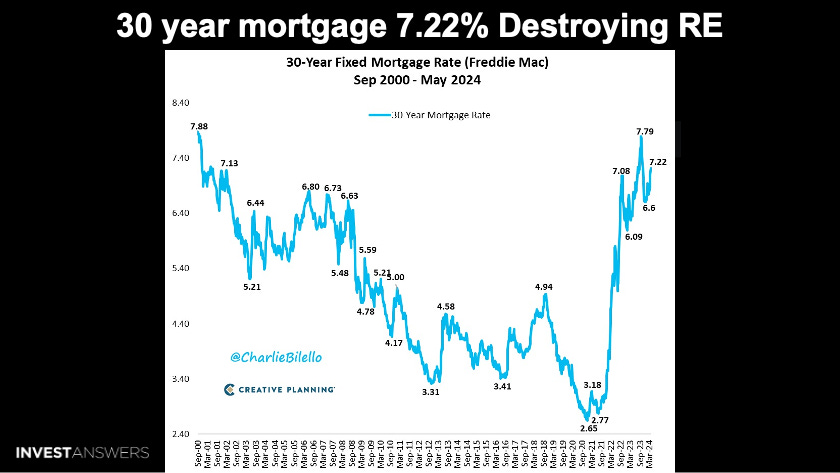

30-year Mortgage Rates Destroying the Real Estate Market

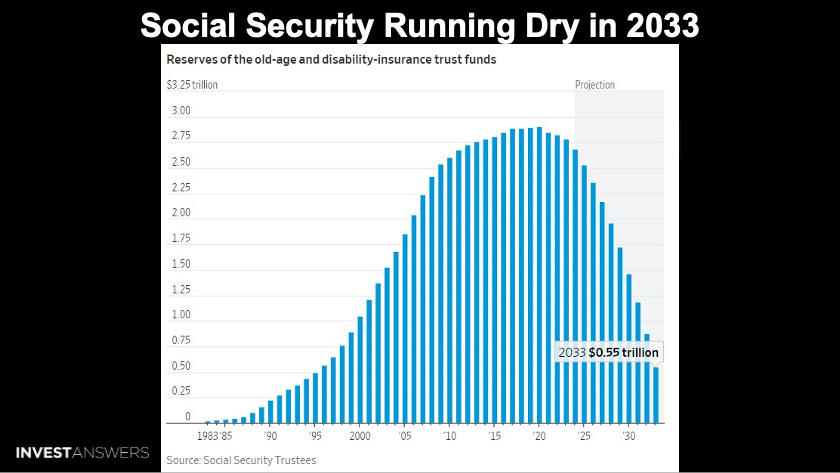

Social Security Running Dry by 2035

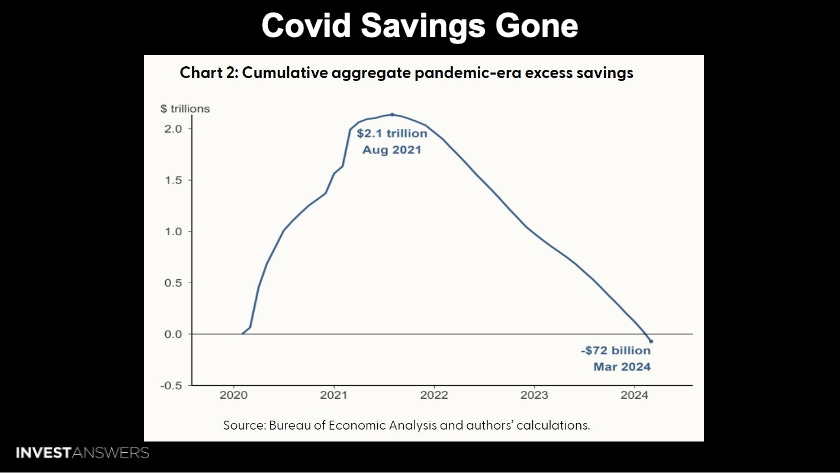

COVID Savings are Gone!

All BTC Miners are Underperforming Except…

Global Liquidity Ticks Up!

Are Current BTC Drawdowns Timid Compared to Previous Cycles?

Solana Steals DePIN Ambient

Telco is Coming to the BlockChain

Tesla is the Biggest AGI Player

Today, we will take a quick trip around the world to share all of the financial data that I believe is very pertinent for us to be successful in the future. We have a packed lesson today covering a whole bunch of different things.

Crypto Market Update:

The global crypto market cap is $2.35 trillion.

The price of Bitcoin is $63,757.96.

The price of Ethereum is $3,074.73.

The Crypto Fear & Greed Index is currently Greed (68).

It is hard to believe how some people still own these tokens as they just rain down every week, which suppresses the price with these unlocks:

APT = 2.64%

DYDX = 0.79%, but raining tokens all year

STRK = 8.79%

CYBER = 5.98%

AEVO = 757.94% is crazy!

ARB = 3.49%

APE = 2.48%; if you ever aped into ape, you made a big mistake!

More ugly news…

30-year mortgage rates spiked once again to the second-highest level they have been at since the year 2000 at 7.22%. This is crushing the real estate market, putting houses out of reach for everybody.

Here is another industry that the Fed has destroyed!

This chart displays the economic output per country and by the citizens of those countries.

When this goes down, it impacts everybody.

All advanced economies experienced negative GDP growth per capita in Q4 2023.

This is not the direction that the world needs to be heading in.

More people are receiving Social Security benefits than are paying in and if nothing is done, the trust fund will run dry in 2035 at which point benefits will have to be cut. The alternative is to increase the retirement age.

It is criminal for people to have to pay for this thing when they never have a chance to collect it. People should have the option to opt in!

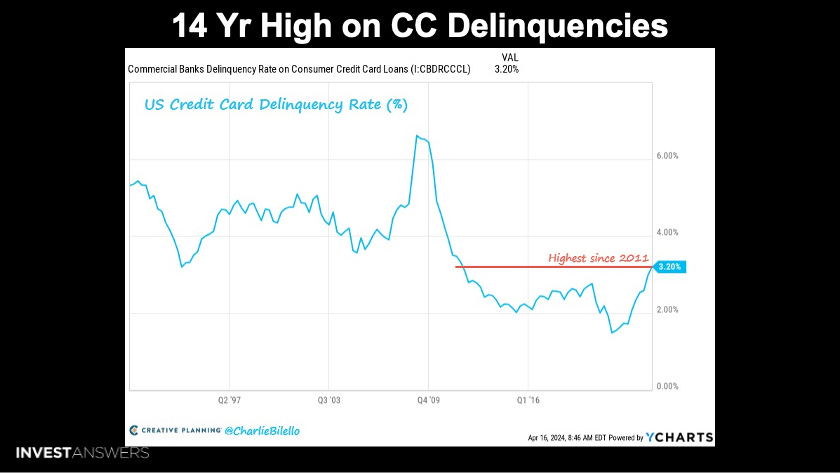

In the United States, credit delinquencies have also reached a 14-year high.

3.2 percent of people with credit card balances cannot make the payments.

Again, this is all because of high interest rates.

COVID-19 savings are gone as consumers have officially run out of stimulus money.

According to the Bureau of Economic Analysis, a deficit of $72 billion in savings exists. This is a very ugly setup for a Presidential election unless you start promising things like loan forgiveness, social checks, etc.

This all points to infinite money printing and a debt spiral headed out of control.

We have just experienced our fourth straight week of outflows for digital assets. This is a rare occurrence per history but it did begin to turn around last Friday.

The total deficit last week was $251M. This Monday was also positive, with about $210M of inflows.

As I always stress, surgically excise the winners!

The Bitcoin miners did well and outperformed Bitcoin in the previous bull market. However, this bull run is different as only one miner has outperformed being CleanSpark - which has been my favorite miner.

Since the bottom of the bear market:

Bitcoin is up +290%;

The average miner stock is up +200%; and

CleanSpark is up nearly +750%.

If we see a repeat of 2020-21, we could expect some miners to earn 10x or 20x the returns of BTC over the same period.

The Bitcoin miners have not had their moment.

Is there a chance that the miners are running late and will smash it in performance in the next 6-12 months? I do

Keep reading with a 7-day free trial

Subscribe to InvestAnswers Newsletter to keep reading this post and get 7 days of free access to the full post archives.