NUGGETS OF ALPHA

Breaking Down the Top 10 Disruptive Forces today

Sharing the common thread

Blockchain adoption popping off

Nvidia selects Intel for package production of 300,000+ H100 GPUs

The NVDA market cap is 5x of AMD, but net profit was 15x

Per ARK, the global market share of BEVs is about 12.5% and growing fast

Grayscale has lost 22% of its AuM in 14 days, while new ETFs acquired 170K BTC

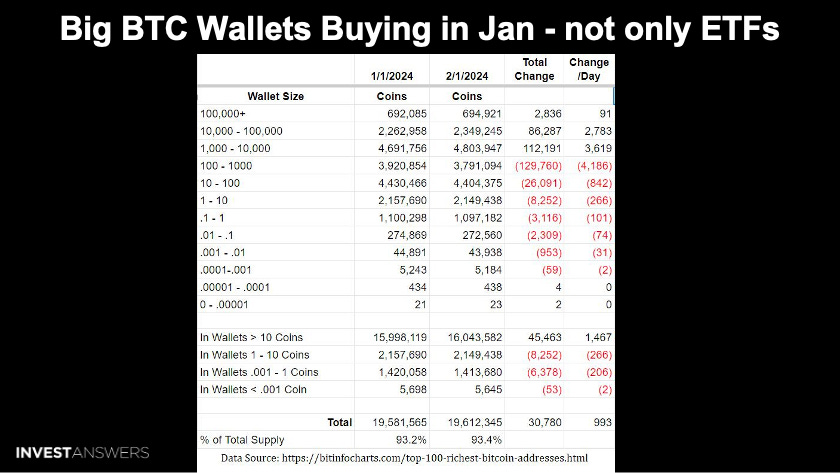

Whales were stacking alongside the ETFs this month

2024 has been a very bumpy start to the year. But you have to play where the puck is going, which I believe is disruption.

What's truly astonishing is the speed at which developments are unfolding. This narrative centers on my areas of interest: cryptocurrency, artificial intelligence, technology, and the disruptions they bring.

In just 14 days, Grayscale witnessed a 22% decline in its assets under management (AuM). Yet, the astonishing part is the rapid influx of investment into new ETFs, which have attracted 170,000 Bitcoin in merely two weeks of trading. This figure is almost equivalent to the total amount accumulated by MicroStrategy. When considering all ETFs and ETPs collectively, they now possess 3% of the entire Bitcoin supply.

This chart is not slowing down. The ETF BTC Stacking Trend continues straight up and to the right, and we do not know when it will slow down.

This highlights the activity of Bitcoin wallets making purchases in January. During this period, whales were actively accumulating, in tandem with the ETFs. An examination of the groups owning less than 1,000 BTC reveals they have been dispersing their holdings. The advice here is to emulate the actions of the whales!

Keep reading with a 7-day free trial

Subscribe to InvestAnswers Newsletter to keep reading this post and get 7 days of free access to the full post archives.