Today’s Nuggets

Sell-Off Triggers $455 Million Liquidation

Sales Slump Continues

10+ BTC Wallets Back to Two-Year High Holding Levels

Ethereum Ecosystem Growth All on L2s

Tokenized Real-World Assets Coming to Solana

Layer 2 Gaming Coming to Solana

Apple’s Goggle-Gate

World’s New Largest Stock

Tesla’s Master Plan #4

We have 45 nuggets to catch you up in all things surrounding the markets!

Crypto Market Update:

The crypto market cap is $2.33 trillion and the volume is $100 billion. The volume is back but price action is not!

Bitcoin is at $64,800, and the dominance is 54.8.

Fear and Greed Index is at 74.

Token unlocks have been nasty and smashing altcoins for most of the summer. Marcus Thielen, founder of 10x Research, posted that a recent drop in altcoin prices was due to huge token unlocks. He noted that digital assets such as Aptos, IMEX, Starknet, Sei, and Arbitrum had unlocks, totaling half a billion dollars. This is why we built the crypto compendium to tell us what is crap.

Here are the unlocks for this week:

PIXEL = 7%

ID = 18%

ALT = 6.6%

YGG = 5% as it rains down tokens all the time; all of the gaming tokens are money grabs

TOR

DYDX

When a project rains down tokens perpetually, like the XRPs of the world, do not ever expect any price appreciation. That is just not how gravity works.

Sorry to be the bearer of bad news…

Fisker has officially filed for bankruptcy - a foregone conclusion…

It was a nasty week in crypto.

Everything outside of tokens like LDO bleed against Bitcoin.

It was murder-red this week:

Bitcoin -6.76%

Ethereum -6.79%

Solana -16.79%

Remember, we have come a long way in a short period. Bitcoin's price off the floor has still quadrupled, only a year and a half ago. The higher the volatility, the higher the returns are normally.

That is why we play this game…

People swear the sky has fallen…

The ETFs also dumped a lot on five out of six consecutive days. Today, we hit 64K on the nose, which could serve as a good floor. If I am not mistaken, the short-term holder cost basis is $63,853.

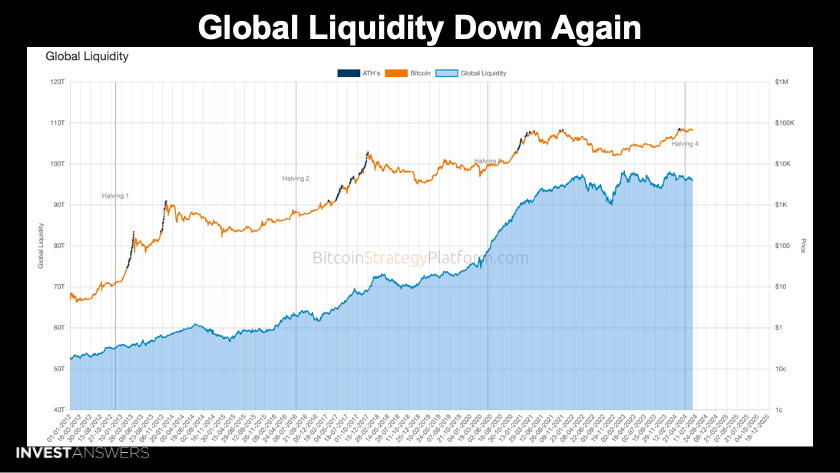

Global liquidity has ticked down a bit.

We had a pretty good liquidity pump in June, but it has declined since I showed you this past Tuesday.

Digital asset fund flows are also wicking down this week.

The digital asset investment products experienced an outflow of about $600 million last week, the largest since March 22nd, 2024. This is likely due to a more hawkish than expected FOMC meeting.

Historically, we do not get too many weeks in a row of negative flows.

Bitcoin is down $621 million;

ETH is up $13 million;

Solana is down $200,000;

Binance is up $300,000;

Litecoin is up $800,000; and

Short Bitcoin was the biggest mover, up $1.8 million.

June is down 4% in monthly returns - not the end of the world…

Bitcoin is down 2.7% over the last 90 days.

If you had just gone away for three months and come back, you would essentially be where you were three months ago. This is the post-halving period, so expect 90 days of stagnancy. Let us get to the middle of July and then, we will see what happens.

Toncoin is the winner so far, and Ondo is performing well. These new coins will pump up and then come back down again. On the far right, in red, you have SUI, ARB, APT, FET, and TAO.

Retail sales increased slower than expected in May as high interest rates and inflation continue to weigh on consumers.

Retail sales increased 0.1%, less than the 0.3% economists had expected. In April, retail sales ticked down 0.2%, according to revised data from the Commerce Department.

If you ask people at the Fed, they will say everything is rosy…

No… it is not.

California's unemployment rate of 5.3% is the worst in the United States.

We know all these unemployment numbers are garbage, as the Fed will tell you that unemployment ticked up from 3.9% to 4%, but when you look at the labor reports, it states that 600,000 jobs a month were created.

The 30-day volatility index is down significantly.

Alex Thorne from Galaxy shared his chart, which shows a historically low reading on the 30-day realized volatility metric. This is likely due to the summer doldrums, which come every year. The fun season for Bitcoin is September, October, and November.

Stack until then!

The Fear and Greed index is still very high at 74 despite the current sentiment in crypto. This surprises me, as it should not be this high.

We were at 20 last week, 39 the week before, and 47 the week prior.

Therefore, it is a good time to be in Bitcoin, not altcoins! Alts are getting completely smashed.

It took two years for this to happen and the people with 10+ Bitcoin in their wallets matched the previous all-time high.

The 10+ wallets collectively hold 16.16 million Bitcoin, about 84.8% of the total supply. This is an extremely important cohort and it is good to see the big money returning.

The retail investor always comes later in the cycle - which is very sad - because I always tell them to get in early and get in hard.

Here is a chart of the top-performing categories over the last 30 days.

Last week, it was real-world assets and this week, staking services eclipsed them.

They have also smashed the returns on Ethereum and Bitcoin.

This is a stunning statistic related to Ethereum transactions.

I always refer to layer 2s on Ethereum as band-aids. L2s do not solve the core problem, as reflected in this chart. The good news is that over the past few quarters, the L2s are growing. The bad news is Ethereum at the core chain transaction growth is flat. Transactions in the ETH ecosystem have grown about 84% since last year, but the contributions from the Layer 2s are remarkable.

Ethereum, along with all other Layer 2s, is doing 800 million transactions in a quarter.

This is a chart of the daily transactions by chain.

Solana now performs ~40M transactions per day - more than Ethereum and all of the L2s combined. I want to share this for perspective - we will see where it goes from here.

Polkadot has grown a bit, moving from 20,000 to 36,000 daily transactions.

This is yet another RWA initiative set to explode in the crypto space.

People think ETH is the only RWA chain - that is

Keep reading with a 7-day free trial

Subscribe to InvestAnswers Newsletter to keep reading this post and get 7 days of free access to the full post archives.