Today’s Nuggets

The Carry Trade Unwind 2.0

SEC’s Blatant Abuse of Power

ETH ETF Inflows Stall

TON is Back Online After DOGS Outage

The Largest Share of Global Equities Market

Mr. 100 Buys 500 in 24 Hours

Spot is in Control

PYUSD Breaks $1 Billion, All Growth on Solana

Nvidia Earnings Now Rival U.S. Jobs Report

Megapack Orders

It was hump day Wednesday and things are still volatile as we are still in a summery doldrum. We have a lot to cover with 50 nuggets in this lesson. As usual, I will try to be fair and balanced, covering the good, bad, and ugly.

Crypto Market Update:

The crypto market cap is still just under $2.1 trillion and it has been here for weeks and weeks.

Bitcoin is still just under $60K, and Ethereum is under $2,500.

The Fear and Greed Index is back at 30.

Overall, things are not too good.

It is the summer of raining crypto tokens, so be careful:

Portal = 4% (big unlock)

Torn = 2.4% (never heard it)

ZETA = 16% (massive unlock)

EUL, 1INC, OP, PRIME, MANTA, DYDX, and SUI are all unlocking as they do.

This is a very bad sign…

This index rose 0.6% year-over-year in July, the lowest in three years. In other words, employment in these industries has increased by only about 126,000 jobs over the last 12 months, as White-collar job growth has been steadily declining for the last three years.

In the past, a drop was only seen in 2000 to 2001 and in the 2008 global financial crisis. The truth is that the labor market is weakening badly. When these jobs go, the people beneath them also tend to go.

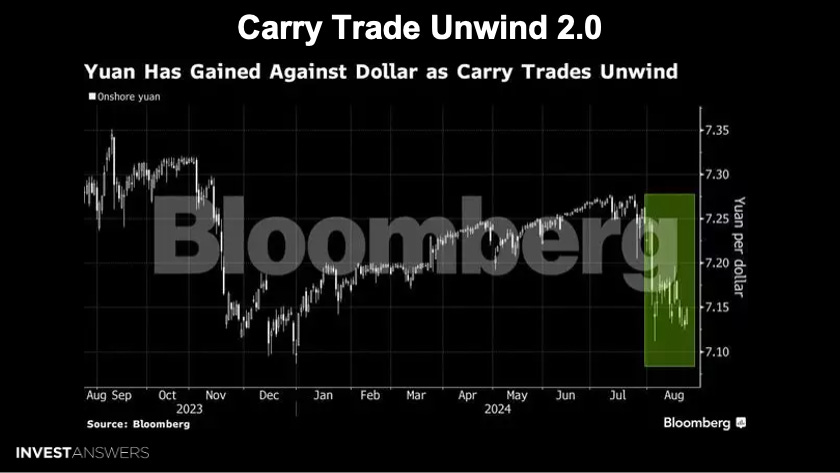

This is another scary sign, as there is now talk of a carry trade unwind 2.0.

The Chinese yuan has gained against the dollar as the carry trade unwinds. However, if the Fed rate cuts happen fast, it could trigger a $1 trillion flow of dollar-denominated asset-backed assets to China.

This potentially means that it would strengthen the yuan by 5% to 10%, driven by the declining appeal of the U.S. dollar and assets, especially if the U.S. achieves a soft landing without triggering a recession.

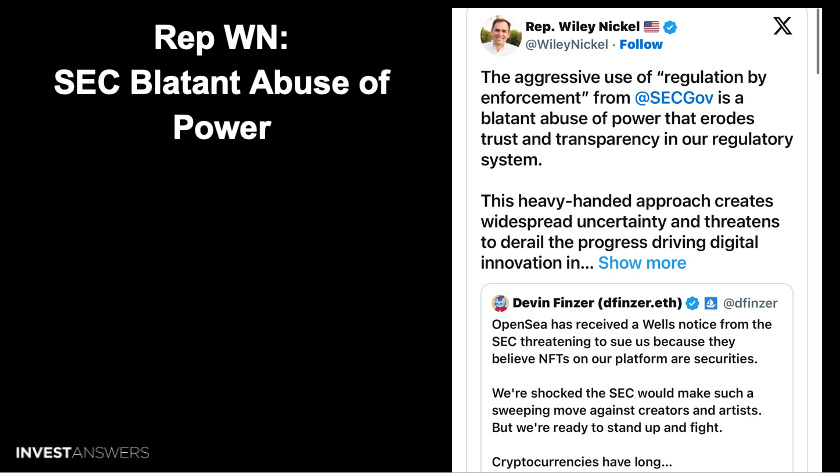

The SEC are still at their silly little games…

SEC commission has now gone on to classify non-fungible tokens, NFTs, on OpenSea as unregistered securities. This has sparked a ton of criticism, and why some people consider this misguided or silly because the nature of NFTs is to represent ownership and proof of authenticity of unique items such as digital art.

Has the Mona Lisa ever been called a security? The answer is no. The argument is that NFTs, like art, derive value from their uniqueness and, therefore, are not a security.

We shall see, but Gary Gensler still has it in for the crypto community.

This is Representative Wiley Nickel's comments on the SEC's actions.

Well said, Representative.

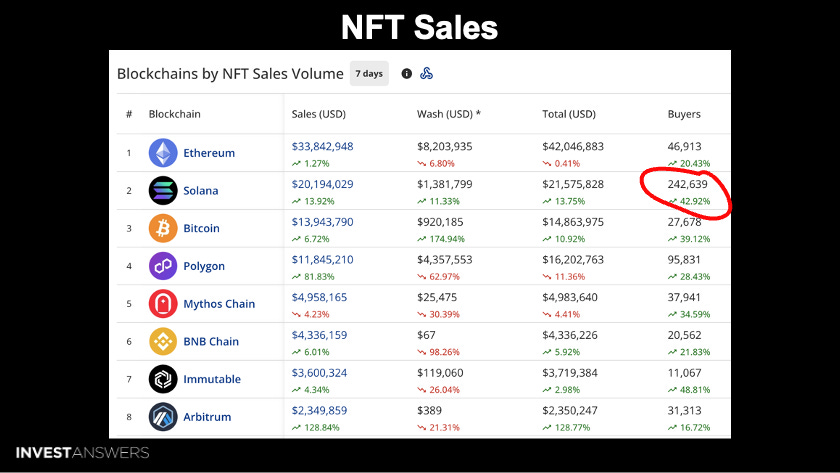

This is the top NFT sales by chain over the last week.

The biggest dollar amount is Ethereum at $38 million, but $8 million is wash sales when people buy and sell their own things to make it look like it is a highly sought-after item. So be careful of that.

Solana is number two at $20 million, followed by Bitcoin at number three and Polygon at number four.

The number of buyers on the Solana chain far exceeds all the other chains combined. It is up 43% for the week. The actual ticket value of the NFTs in the Solana blockchain is a lot cheaper than Ethereum.

Therefore,

Keep reading with a 7-day free trial

Subscribe to InvestAnswers Newsletter to keep reading this post and get 7 days of free access to the full post archives.