Today’s Nuggets

The ETHE Dump Continues

Will ICE Die Soon?

Voters Focused on the High Cost of Living

SEC No Longer Seeks to Prove Tokens like SOL are Securities

DePIN Wins

Solana Generates $5.5M Fees in a Day

X Passes Facebook and Instagram

Tesla’s Model Y Gets Highest Safety Score Ever

Tesla China Experiences Highest Sales Ever

Microsoft Tanks After Earnings

Bank of Japan Set to Cut Rates

In this OCTA, we break down how much money crypto is making. In the last bull market, crypto tokens made no money at all. This time, they are making boatloads of money.

We will examine where all the money is being made, which should prove an interesting adventure as we will see if the black hole continues.

Crypto Market Update:

The market cap is just shy of $2.4 trillion;

It looks like Bitcoin bottomed out and is now at ~$66,200; and

The Fear and Greed is at 67.

It is a week in and the dumpage has been pretty extreme out of Grayscale Ethereum Trust (ETHE).

I forecasted it would be high but did not expect 17% or $1.725 billion to come out in five days. The outflows are still negative at nearly half a billion dollars. As with GBTC, ETHE will bleed out and money will begin trickling in.

There are impressive flows from firms like BlackRock, which had $276 million, and Fidelity, which had $244 million. Bitwise had more than Fidelity, with $276 million.

I tend to focus on tokens with half a percentage or more of scheduled unlocks. The names on this are like those of Bitcoin miners, who just keep issuing shares and diluting their stockholders.

As usual, some coins just rain down tokens and will continue to do so. Even though the projects may be okay themselves, there is so much sales pressure coming that you will never be able to get anywhere. So be careful out there.

Volkswagon cannot figure out the software in a car, and it will take them five years after partnering with Rivian, which is embarrassing.

As I have been saying for a long time, ICE is dead.

At this rate, ICE vehicles will be dead in four years which is not too far off from 2028 to 2030, when they will be mostly gone.

Perhaps 20% of cars that will be sold will be ICE.

We already have many countries in the world where they are beyond 50% battery electric vehicles, such as Norway and China.

EVs are just better, cheaper, and faster.

Here is an image of the amount of debt the U.S. now has crossed over the $35 trillion level, or approximately $104K per American or $700,000 per taxpayer.

Only 50,000 million people in the U.S. pay reasonable taxes (like over $10,000 a year). I do not count you if you are paying $1,000 to $2,000.

If you are a taxpayer, you have been saddled with $700k, rising by the minute. This dynamic will not stop, which is why we have life rafts.

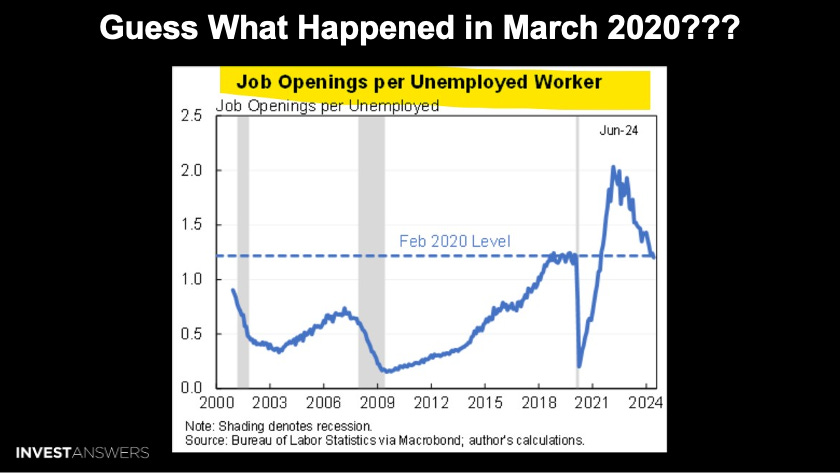

We are now at the Feb 2020 level of job openings per unemployed worker.

In February 2020, the number was 1.22. In March 2022, it was at 2.01. Since then, it has been back to where it was during COVID-19, which is quite scary.

If Jerome Powell is looking at this chart, he must be very alarmed.

The most important issue to voters is the high cost of living.

In 2024, 41% of Americans surveyed claimed that the high cost of living inflation is their top issue, up from the previous all-time high of 35% of people worried about it in 2023 and 32% in 2022.

When you hear candidates talking about nonsensical stuff, do not listen because 41% of people in the US have this as their key issue. Nothing else.

Overall, it was mostly a red week:

ETH down

SOL down

TRON up

XRP up

TON up

BTC is almost back to break even at the time of this writing because it is up over $500 since this snapshot was taken.

ETH is down big at -5.15%.

SOL has rebounded a bit since this snapshot.

Again, this is how much the market can change in an hour. It is stunning!

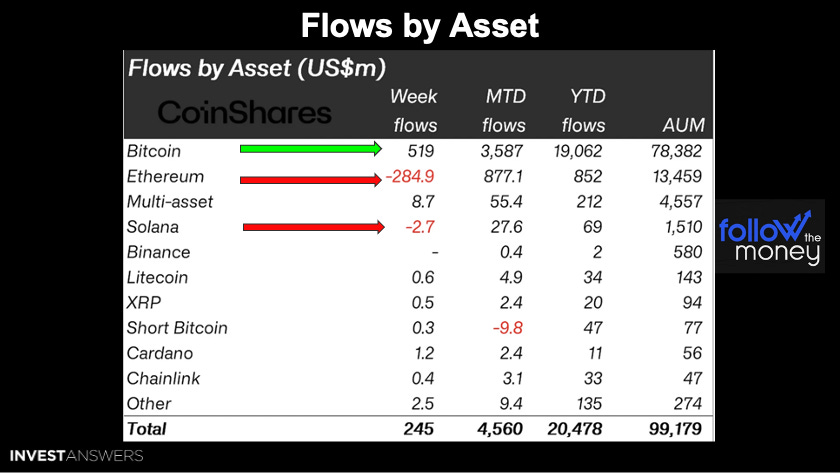

The digital asset funds were slightly positive.

Last week, there were a muted $245 million of inflows. The spot ETF saw some of the largest inflows and outflows, but the good news is that Bitcoin was more or less positive.

Bitcoin had $519 million come in.

Ethereum experienced $285 million out, which is very bad.

Solana was down $2.7 million, which is very small. This is 10% of what they took in for the month.

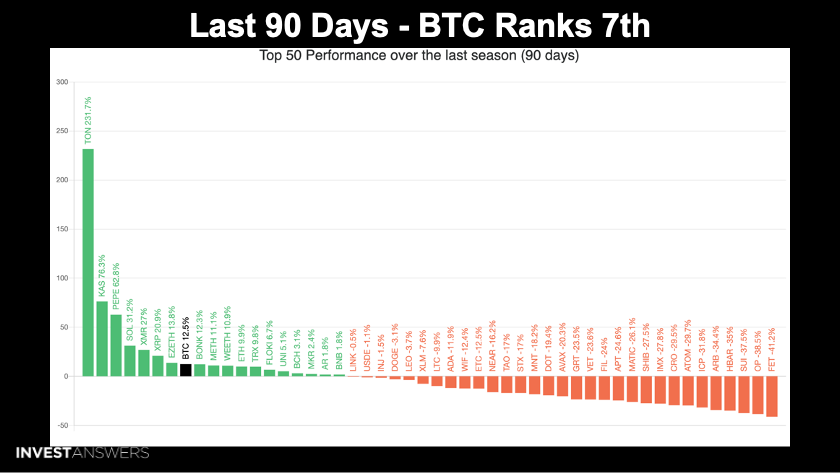

At a reading of 14, we are squarely in Bitcoin season.

Once again, this index calculates how Bitcoin performs against the top 50 altcoins.

Over the last 90 days, Bitcoin has ranked 7th.

The top performers have been Toncoin, Kasper, Pepe, Solana, XMR, XRP, and EZETH, all of which have beaten Bitcoin. Then, on the right-hand side is the stuff we have called ugly for years.

The Fear & Greed is at 67 right now.

It was 69 the last time I did this.

Remember, if you see Fear and Greed at around 20 or less,

Keep reading with a 7-day free trial

Subscribe to InvestAnswers Newsletter to keep reading this post and get 7 days of free access to the full post archives.