NUGGETS OF ALPHA

XRP is the only crypto that beat BTC over the last 7 days

Digital asset investment products saw outflows totaling $88m

Fear & Greed is now trending down to the lowest level since March

Crypto’s correlation with the equities market is disappearing

BTC whales appear to be transitioning to a regime of equilibrium

The SEC is being sued by Coinbase for not providing clarity

BNB has been defended at four separate price levels over the past week

Binance is experiencing a draining of BTC, ETH, and stablecoins

eToro is ending US customers’ access to DASH, MANA, ALGO, and MATIC

Tesla is up 150% in 150 days, hitting its 13th consecutive positive day

Despite the SEC’s actions, the cryptoverse is moving back towards alt season

72% of the BTC circulating supply is not readily available for trading or selling

Bitcoin has strengthened significantly relative to WTI crude oil in 2023

The risk of deflation in the US is now greater than the risk of high inflation

US CPI has moved down from a peak of 9.1% last June to 4.0% in May

Peak oil demand is over, as sales of cars powered by oil peaked six years ago

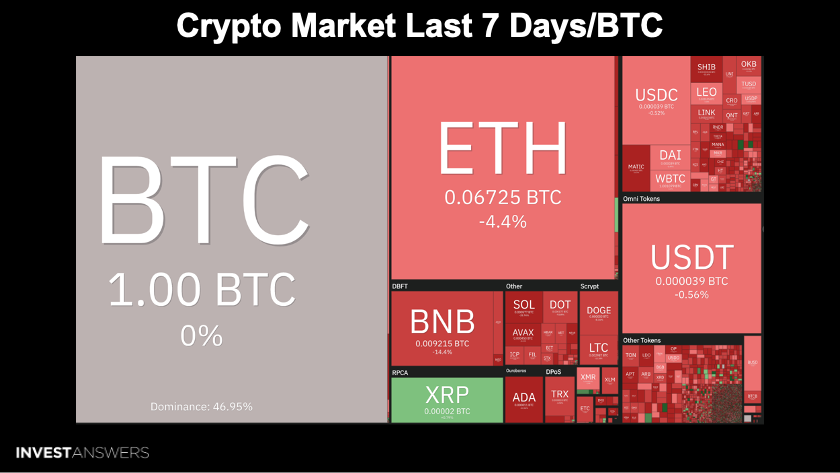

As a reminder, for the crypto market, we denominate everything in Bitcoin.

XRP is the only crypto that beat BTC over the last 7 days.

BTC beat the dollar this week up 0.52%.

Ethereum fell ~4% this week.

Digital asset investment products saw outflows totaling $88m, bringing this 8-week run of outflows to $417m. We believe that this is directly related to the SEC rattling the markets.

Fear & Greed is now trending down to 45. This is the lowest level since March.

The S&P 500 continues to climb while crypto markets lag behind. As frustrating as it is for BTC & ETH to watch equities gaining ground, a correlation break is historically good for the long-term ability of cryptocurrency markets to grow.

Bitcoin dipped below the 200-week moving average, bounced above, and then has been below it ever since. The good news is that support seems really stable around the $25.5-25.6K level for now. But being under the 200 WMA support is no man’s land.

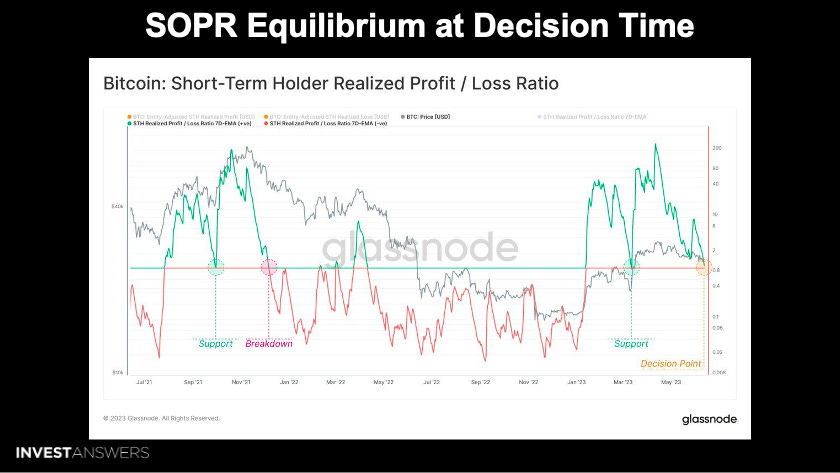

Since the beginning of the year, short-term Bitcoin holders (STHs) have been in a profitable regime. However, as the spot price continues to trend lower, the STH Realized Profit/Loss Ratio (SOPR) is approaching a decision point (equilibrium). If the SOPR bounces off the equilibrium position, it would be considered constructive. If the SOPR decisively breaks below the equilibrium position, it would suggest weakness in the market.

The STH Realized Profit/Loss Ratio (SOPR) is a metric that measures the ratio of realized profits to realized losses for all STHs. When the SOPR is above 1, it means that more STHs are realizing profits than losses. When the SOPR is below 1, it means that more STHs are realizing losses than profits.

The Bitcoin Accumulation Trend Score suggests a distribution dominant regime as the largest of Whales (>10K BTC) transition from a regime of heavy accumulation to one of equilibrium, counterbalancing the slight drop in distribution intensity from all other cohorts. Price is holding up well despite the low volume of activity in the market.

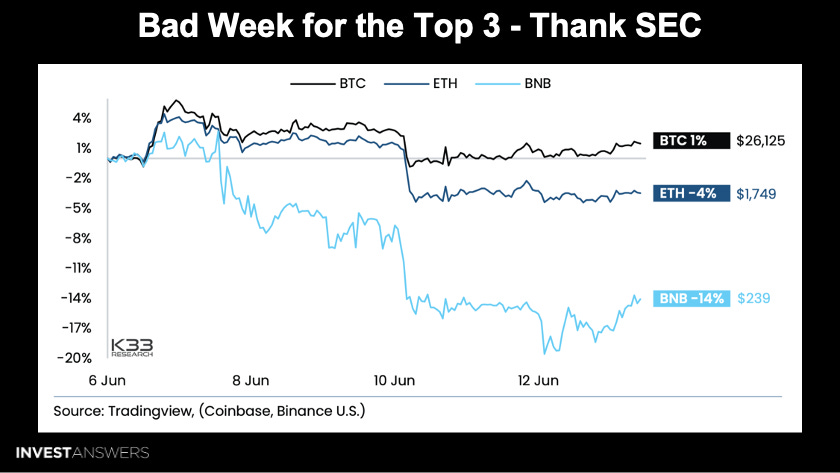

Bitcoin is up since we visited it last Tuesday. ETH and BNB got hit hard this week.

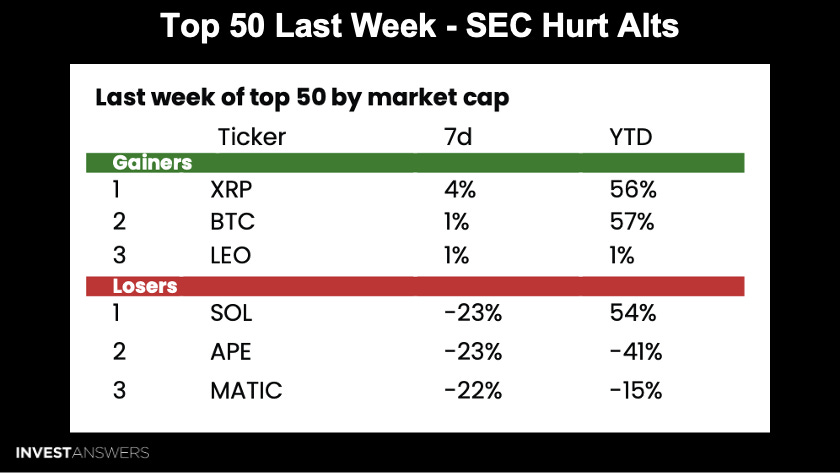

XRP is the winner from this last week, with Bitcoin and LEO up slightly.

SOL, APE, and MATIC all

Keep reading with a 7-day free trial

Subscribe to InvestAnswers Newsletter to keep reading this post and get 7 days of free access to the full post archives.