TODAY’S TAKE

Fed’s vice chair is warning that banks should be careful about crypto

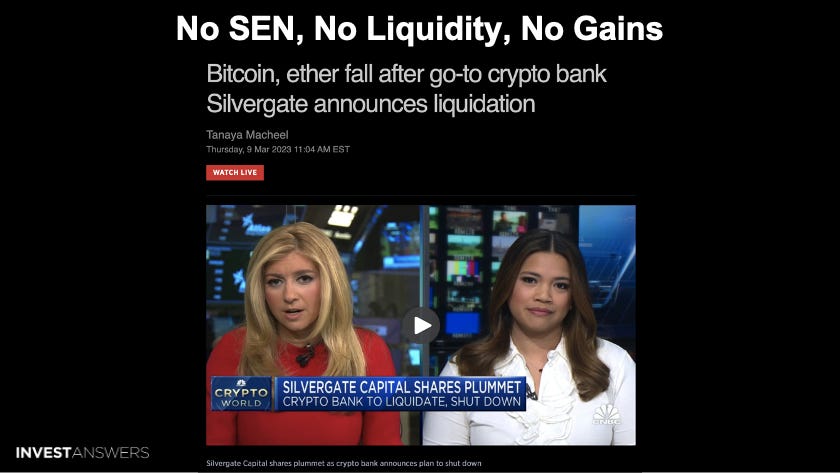

Crypto prices fell across the board after Silvergate’s closure announcement

Binance received intense scrutiny from John Reed Stark, former SEC attorney

Things are breaking fast from the Fed’s monetary tightening

Bitcoin dominance is now sitting at 40.37%, near the 39% historical floor

Bloomberg Intelligence flipped the odds in Grayscale’s favor to win its case

Jeremy Siegel stated on CNBC that the Fed’s policy is very misguided

Biden’s 2024 tax plan is targeting the crypto wash trading and capital gains

The brave new world manifesto has been repeatedly undermined by tumbling coin prices and failures like the TerraUSD stablecoin, hedge fund Three Arrows Capital, alongside lenders such as Voyager, BlockFi, and Celsius.

We must dig deeper into the data to understand what is happening behind the covers.

In remarks scheduled for delivery Thursday morning, Michael Barr, the Federal Reserve’s vice chair for supervision, said regulators are investigating crypto assets and will issue more guidance to banks that want to invest in them.

It appears that the “operation checkpoint” is getting tighter and tighter by the day.

“Sentiment towards crypto assets has been negative, and that hasn’t changed after Powell ramped up the Fed’s hawkish rhetoric earlier this week. As a result, the dollar and bond yields have risen sharply, weighing on all non-interest-bearing assets, including cryptos and gold,” Razaqzada wrote Thursday.

Crypto prices fell across the board after Silvergate, a bank at the center of the industry’s growth, decided to shut down.

Razaqzada noted that there could be a “sharp” follow-up technical sell-off if support gives way at around $21,400.

Businesses still have Signature Bank, whose Signet platform is comparable to Silvergate's SEN. However, signature has already said it plans to limit its crypto exposure in light of recent events. The industry will be closely monitoring this development, particularly following last week's coordinated effort by the Fed, the FDIC, and the OCC to warn banks about the liquidity risks of banking crypto companies.

"Binance is a shadow bank, minting their own counterfeit currency while providing limit-order books/brokerage/custody/clearing/settlement/etc. with no U.S. regulatory oversight or audit," John Reed Stark, a former attorney for the SEC, posted to Twitter. "It’s FTX redux and an epic bank run seems inevitable."

Binance has faced intense scrutiny in the months since FTX's implosion, with questions being raised over whether it can cover user withdrawals. In November, FTX buckled under the weight of $8 billion in customer withdrawals—a situation similar to a run on a bank that led to it declaring bankruptcy. "Once withdrawals are suspended, and a collapse begins, not only will Binance’s customers be cut off, but the customers also likely become unsecured creditors," Stark added, pointing to how users have been treated in the bankruptcy proceedings for collapsed crypto companies FTX, CelsiusCEL, Blockfi, and Voyager.

All of these banks are experiencing the Silvergate Capital contagion. Again, this is because things are breaking fast from the Fed’s monetary tightening.

In full disclosure, I sold BTC today as it broke through layer 3 of the IA Layer Out model at US$21,158.

“A break below this level would change the status of the current events from a ‘typical correction’ to a ‘methodical sell-off.’ In that case, the road to $18,000 for Bitcoin is open,” Kuptsikevich added. “The rally from the beginning of the year would look like a blip in a bear market, not the start of a long uptrend.”

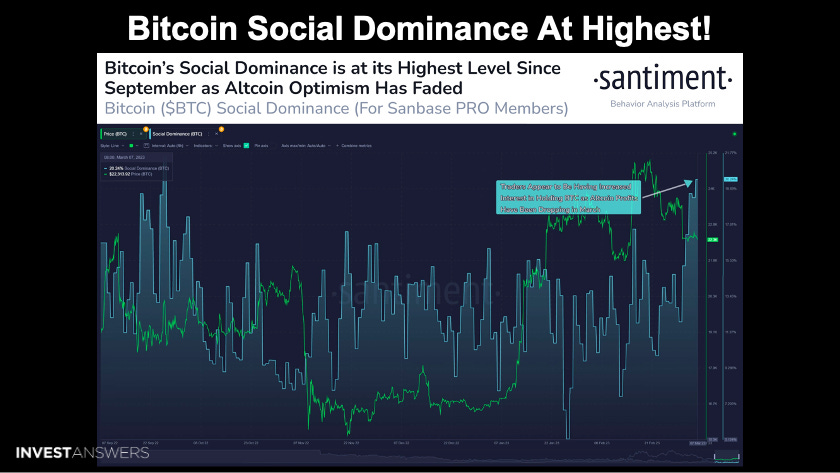

As I stated early this week, it was time for ALTs to rally, so I found that the santiment’s behavioral analysis produced some strange results…

Bitcoin dominance is now sitting at only 40.37%, near the 39% historical floor.

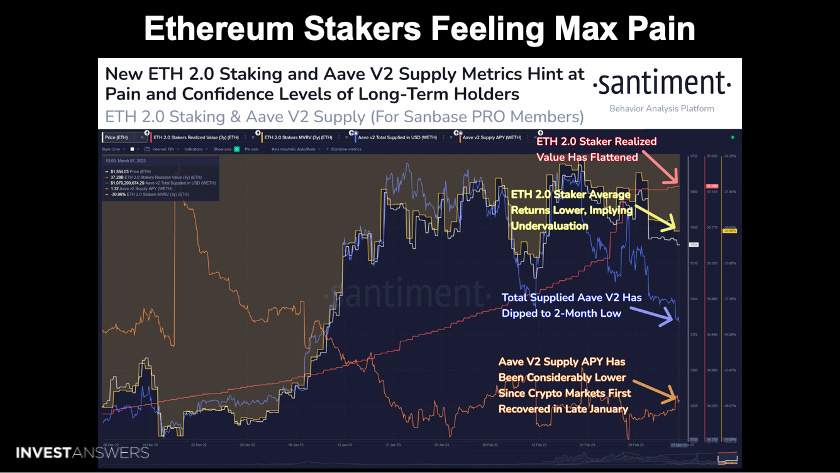

Santiment says the outlook is souring for ETH stakers as recent gains have retreated, and long-term stakers are down more than 30% on average.

Hashport Network has frozen bridged assets. We have gotten confirmation from Hedera that wallets are not affected - neither are native tokens being held in your wallet.

When this article was published, Grayscale Bitcoin Trust shares had risen for a second day since the asset manager’s oral arguments in its court case against the Securities and Exchange Commission were heard in Washington on Tuesday.

Following Tuesday's hearing, Bloomberg Intelligence, which previously favored the SEC with a 60% chance of winning the case, flipped the odds in Grayscale's favor giving the asset manager a 70% likelihood of prevailing. "We expect the court to vacate the SEC order rejecting Grayscale’s [ETF] application," James Seyffart, an ETF analyst with Bloomberg Intelligence, said in a Wednesday research note.

After offshore exchange FTX collapsed last year due to massive fraud, do we need another crypto exchange? Markus Maier and Philipp Banhardt, founders of crypto compliance firm Violet, think that is precisely what we need and have persuaded prominent investors to back their vision in the form of Mauve. This decentralized exchange has been described as the anti-FTX. The company will collaborate with several prominent investors, such as Coinbase Ventures, FinTech Collective, and the $20 billion hedge fund Brevan Howard.

My former professor, Jeremy Siegel, was on CNBC warning that the Fed’s Policy is very misguided.

The plan would also close the “like-kind exchange” loophole whereby crypto traders can sell their underwater crypto investments, claim a deductible loss, and immediately repurchase their tokens. Estimates from the Wall Street Journal suggest this could shore up $24 billion for the government.

Some of the administration’s tax priorities include quadrupling taxes on stock buybacks from 1% to 4%. Meanwhile, capital gains will be taxed at the same rate as wage income for those over $1 million annually.