Today’s Nuggets

Market Trends and Investment Flows

Dencun Technological Updates impact on Ethereum

Tokenomics and Crypto Market Fluctuations

Regulatory Actions and Investor Protections

Macroeconomic Observations

Employment Trends and AI Impact

Cryptocurrency Performance Analysis

Technological Advancements and Predictions

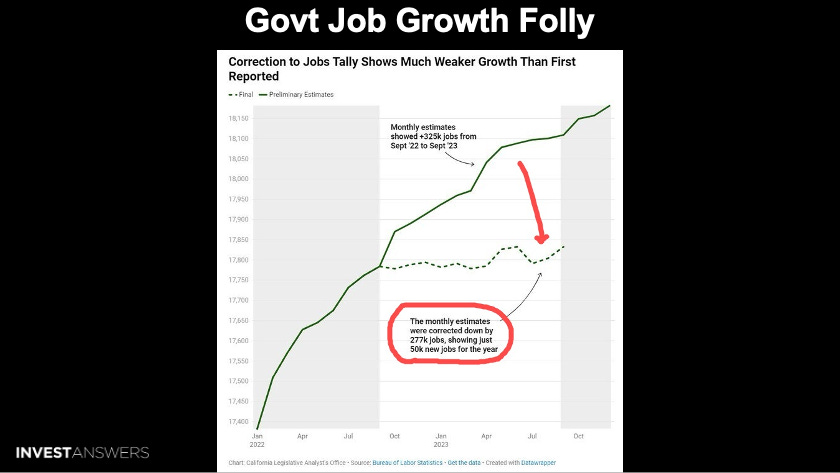

Government Job Growth Folly

STARTING WITH THE UGLY NEWS

The big unlocks this week with horrific tokenomics:

IMX = $92 million

ID = $131 million

YGG = $12.56 million

OP = $82 million

PRIME = $41.75 million

Sui = $7 million

Genesis is part of the whole kerfuffle with Grayscale and DCG. They lost $900 million of clients' money in their Gemini Earn program. They will pay $21 million to settle the case of the SEC to make all things well. This is how the SEC protects investors. If you think the SEC is protecting you, think again!

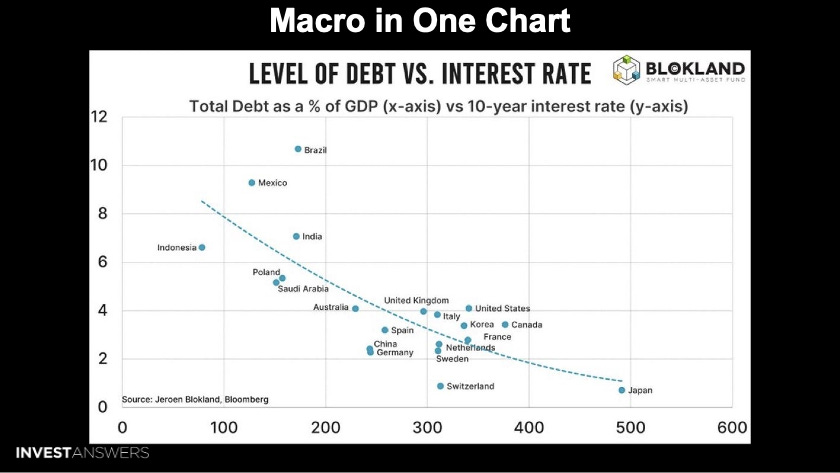

In this chart, with increasing debt levels, there is an incentive to maintain artificially low yields or interest on debt.

The takeaway? More debt correlates with lower yields. This approach is critical to stave off concerns over debt sustainability and avert a collapse of the world's debt-reliant economies and financial systems.

Japan is the best example. After seven years, Japan finally stated that it would no longer fight yield curve control. Everything in fiat is a house of cards!

Employment surveys overestimated job growth in higher-paying private-sector jobs and underestimated government job growth. The government pretends that everything is excellent and that the United States is adding lots of jobs.

For example, California added just 50,000 jobs (mostly part-time) between September 2022 and 2023, down from initial estimates of 325,000. So, all the stats and information you get from the government are erroneous.

The green on the right is the fastest-growing block of jobs in the U.S. today, and they are with the government. The second fastest growing piece, which is only slightly positive, is healthcare because of the aging population.

We must remember that

Keep reading with a 7-day free trial

Subscribe to InvestAnswers Newsletter to keep reading this post and get 7 days of free access to the full post archives.