NUGGETS OF ALPHA

The SEC might try to end Coinbase and Binance so Wall Street can take over crypto

Smart contract platforms are the largest category on the SEC’s “security” list

Token inflation or “pocket lining” typically indicates a scam in crypto per IA

A decentralized network is less likely to be considered a security by the SEC

The Nakamoto coefficient is a measure of how decentralized a blockchain network is

Gensler is coming down hard on the whole space to save face post FTX debacle

The XRP SEC case is all about whether XRP is a security

If XRP is successful in its legal battle against the SEC, it will set a precedent that other cryptocurrencies can use in future cases.

Bitcoin is scarce and is being adopted globally, making it a “number go-up technology”

In the long run, Solana and Firedancer’s approach may prove to be a dominant blue ocean strategy in crypto

If Solana can survive, then it will probably 3x ETH during this next cycle

Get in early, and get in hard with high-conviction positions

Be prepared to adjust your investment strategy if your thesis changes.

I’ve been reflecting on exactly what the SEC is after to answer the following:

Why they are chasing Crypto and if we are safe?

How can we allocate our portfolios to protect ourselves?

Earlier in my career, I was inspired by Andy Groove, who wrote a book titled: Only the Paranoid Survive. In this book, he stressed that you must always be worried about what is around the corner, which I found is critical in life and investing.

Many people are beginning to think that this is the end game of the SEC.

Maybe everything is connected:

central banks

house of debt

launch of CBDCs

We need to remain paranoid, and we know after everything we have been through the last year, we cannot trust anything anyone says. Let’s consider that this all could be an angle for a greater plan!

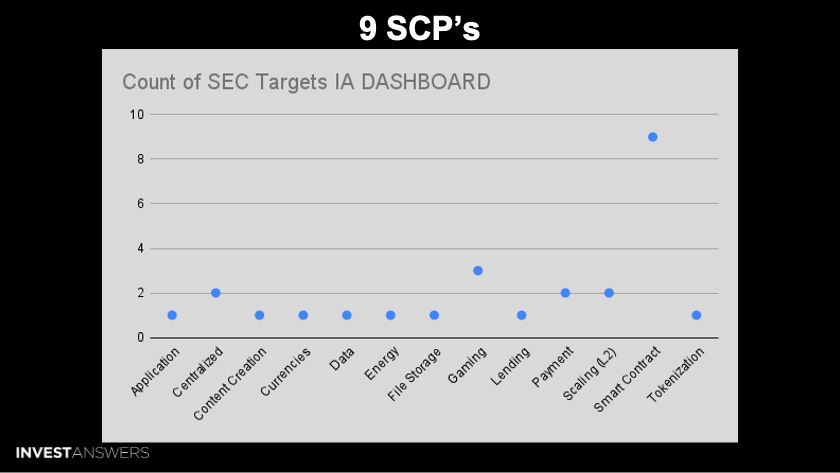

Is there any correlation between these listed and the SEC? This list includes both good names and scam coins. Let’s examine!

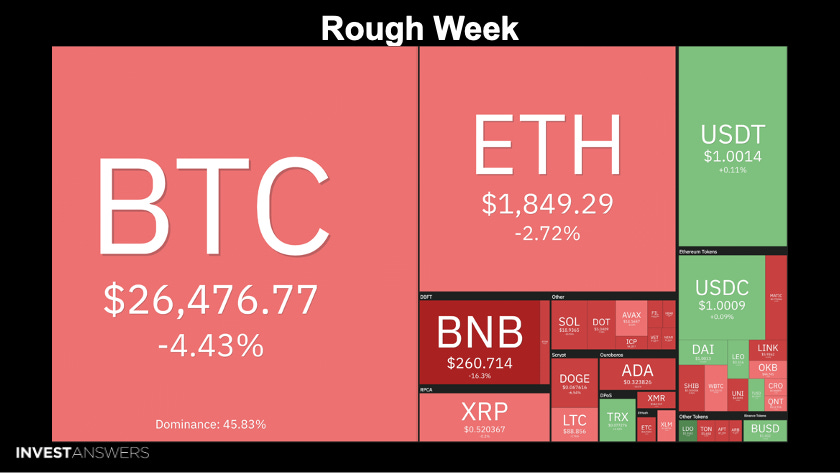

BNB down ~16%

ETH only down ~2.7%, beating BTC which is down ~4.4%

We will put all of this into perspective in this lesson.

I have never heard of many of these, but only 26 are in the top 500 Cryptos. The 13 mirror protocol assets have gone long by the wayside.

In early 2021, when I first started my YouTube channel, I worried that regulation would come for some of these tokens, qualify them as securities, and rake them over the coals. This was the inspiration behind the IA Crypto Compendium. I designed the IA Crypto Compendium to help me identify the assets with the least likely regulatory risk.

I took the top 26 names in the SEC list and plugged them into the IA Crypto Compendium to categorize them against 69 data points. The others on the SEC list either no longer exist or I could not find them in our data, so these are the ones that we will focus on.

The largest category is smart contract platforms, with nine out of the twenty-six focused on this area. And if you add “Scaling (L2),” this becomes 11 total. The second largest category is

Keep reading with a 7-day free trial

Subscribe to InvestAnswers Newsletter to keep reading this post and get 7 days of free access to the full post archives.