Today’s Nuggets

Port Stike is Over

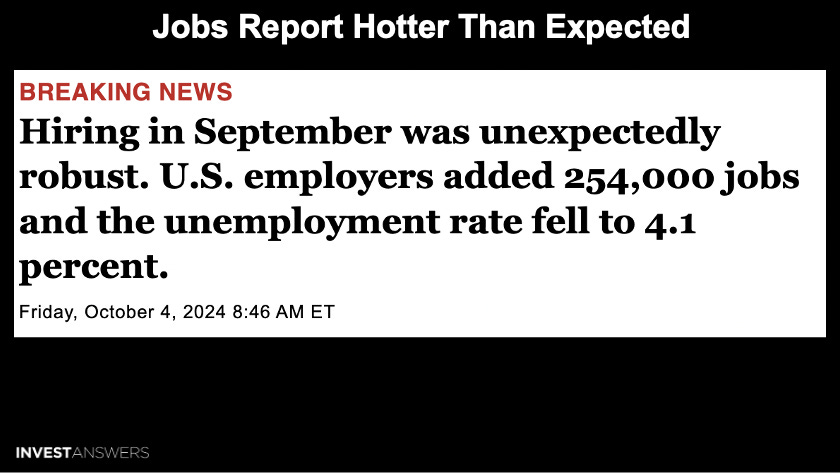

The Unexpectedly Robust Job Report

Leveraged Longs Getting Rekt

China to Unban Bitcoin?

HBO to Unveil Satoshi?

ETH Being Cannibalized by L2s

MicroStrategy About to Eclipse Grayscale

10/10 Expectations

Tesla’s Four New Batteries for 2026

Oil’s Biggest Spike in 2 Years

This story is about two big crises that were averted and the market is responding. It is Friday Fire, so we will talk about all the things that are on fine around the world:

The sentiment shift.

The strike that was averted.

A job report surprise.

How Bitcoin's been flat for seven months.

Is AI still king?

Tesla’s Robotaxi event.

The Fear and Greed are perking up.

We are still in the fear zone but it is getting slightly higher. This shows a little bit of recovery.

The port strike has been averted as workers agreed to a tentative deal after operations were shut down for nearly two days.

However, the agreement, which people thought they would never find, focuses on wage increases, not necessarily the banning of automation. The deal looks like they will get a wage hike of around 62% over six years and I am glad it is settled because that was supposedly a huge black swan.

I believed the jobs report would be in the toilet but that was not the case.

However, many of these jobs are temporary, seasonal jobs, getting ready for Christmas and Halloween.

Even names like Amazon will employ at least this amount or maybe 400,000 jobs through Christmas.

We will see exactly what happens, especially with downward revisions.

This is a Bitcoin monthly candle chart inspired by Captain Rational. It displays the flat price action that is causing people a lot of frustration and pain. There is nothing about the Bitcoin price over the past seven months that compares historically.

This is - by far - the most remarkable sideways action we have ever seen around a BTC all-time high.

What is crazy is the strength of the support here.

All we need is a couple of catalysts and then this thing will go up because very few people are selling.

On inspection, long-term holders do not appear to be involved in any sell-side action, which is good.

Long-term holders are sitting tight and see the flatness. They are not perturbed by it and are waiting.

Where is the Bitcoin coming from? Those with the leverage longs are getting liquidated and that is providing the supply.

It cleared around 9.2% of the open interest from futures markets representing the one standard deviation move. This is big enough to indicate that

Keep reading with a 7-day free trial

Subscribe to InvestAnswers Newsletter to keep reading this post and get 7 days of free access to the full post archives.