TODAY’S TAKE

Coinbase, Galaxy, and Paxos stopped accepting transfers via Silvergate Network

U.S. exchanges seeking new “on ramps” for crypto due to SEN demise

SEC Chair Gensler says crypto exchanges may not be ‘Qualified Custodians’

FTX identified deficit of $8.9 billion in customer funds

US$210M in longs liquidated due to Silvergate news breaking

British banks cracking down on crypto

Mt. Gox bankruptcy repayments unlikely to destabilize the Bitcoin price

People pushing CBDC and global tyranny backed Sam Bankman-Fried

European Central Bank directed all European banks to limit their crypto holdings

Bank of America and Citibank reported positive trends in crypto this week

United Arab Emigrants embracing Bitcoin and Lightning payments

Germany’s Deutsche Bank and DekaBank creating crypto on ramps

China, Hong Kong, and Singapore opening up to crypto

U.S. Congress pushing back on Biden Administration’s actions against crypto

A massive coordinated attack on crypto is happening from regulators at all levels. Is this all a coincidence, or is something awry?

If people try to ban something, you know it’s good stuff…TriFi either wants to kill crypto or get a piece of it.

I will tackle these five issues first and then add five more points for you to consider.

Coinbase, the largest cryptocurrency exchange in the U.S. in terms of trading volume, today announced it is halting payments to and from Silvergate bank.

Citing recent developments around the San Francisco-based crypto bank and “out of an abundance of caution,” Coinbase said it is “no longer accepting or initiating payments to or from Silvergate” and that it holds client funds at FDIC-insured U.S. banks and government money market funds "when a client has a large dollar balance."

The SEN network supplied by Silvergate allowed crypto companies to avoid ACH transfers, which can take several business days to complete. Silvergate said the network operated 24 hours a day, year-round, with “near real-time transfers and immediate availability of funds.” “We are losing the few rails we have to transfer traditional money,” Wu says. “If Silvergate goes out of business, it will push funds and market makers further offshore.”

Circle Internet Financial, the issuer of stablecoin USDC, said it’s “unwinding certain services” with Silvergate.

Cumberland, the crypto division of Chicago-based trading giant DRW, said it had “minimal exposure” on Silvergate over the last few months.

Digital asset exchange Kraken tweeted that it’s “actively monitoring concerns around Silvergate” and maintains a diverse set of banking partners.

Everyone is running for the hills and seeking new “on ramps” for crypto.

The SEC chair’s warning prompted swift reactions from crypto exchanges, stablecoin issuers, and trading desks. Coinbase Global, Galaxy Digital, and Paxos Trust announced they would no longer accept or initiate payments through Silvergate, as well as Gemini, Crypto.com, and CBOE Clear Digital.

The delay in filing the report raised concerns, as the bank stated that it is evaluating its ability to operate. Silvergate is one of the banks that was affected by the fallout of the FTX exchange. The bank also reported a $1 billion net loss in Q4 2022.

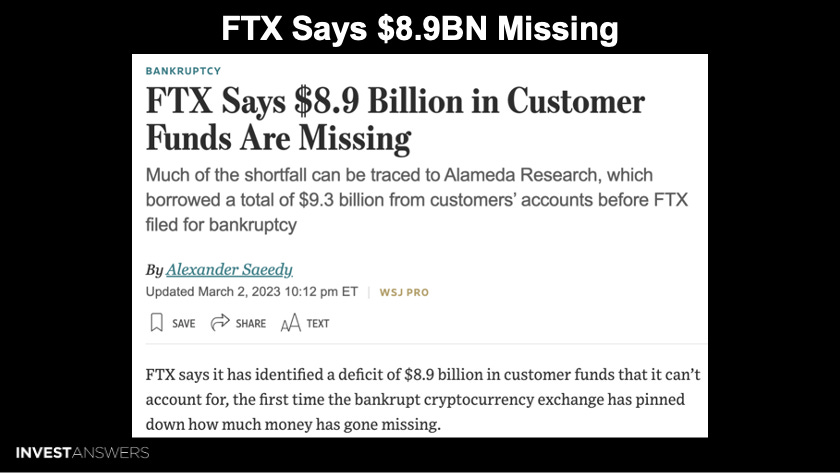

FTX says it has identified a deficit of $8.9 billion in customer funds that it cannot account for, the first time the bankrupt cryptocurrency exchange has pinned down how much money has gone missing.

In a public presentation released on Thursday, FTX said it had identified around $2.7 billion of customer assets, compared with $11.6 billion of balances outstanding on customer accounts. The estimated value of FTX’s assets and liabilities is based on crypto prices on the day of the company’s bankruptcy filing in early November.

Where are the coins? The bankruptcy team did not handle this well and is in need of some serious forensic help.

This is the most significant longs liquidation so far in 2023.

The UK banks are getting tougher on customers using crypto. In the past week, two of the country’s biggest banks—Nationwide and HSBC—cracked down by applying daily limits for buyers or restricting credit cards from making crypto purchases.

JP Morgan is calling Bitcoin a Ponzi once again.

The ECB is openly attacking Bitcoin.

While 850,000 Bitcoins went missing from the exchange in 2014, Mt. Gox has recovered 142,000 BTC along with 143,000 in bitcoin cash (BCH) and 69 billion in Japanese yen. This represents about 20% of the hack.

850,000 Bitcoin represents around 90% of the average supply active within the last day and 28% in the previous week. This is significant because active supply increases are normally associated with weakness in the BTC price.

According to Rich Falk-Wallace, CEO of Arcana, 16.8M ETH has been staked out of the 123M total outstanding (14% of the chain). Most other proof-of-stake chains have higher staking %s than ETH: AVAX: 55%, Solana: 70%, Cosmos: 62%, and Cardano: 72%.

The price is set at the margins, and 8,000 Bitcoins can dramatically move the market. However, given that the fiat onramps are being stifled and shut down, it is hard to find the liquidity for people to come in and buy.

Maybe all of this is orchestrated? Short-term, this could be bad for crypto, but long-term, it points to a good thing.

Some investigative reports on this development revealed that the European Central Bank directed all European banks to limit their cryptocurrency holdings to a hedge because of the many risk factors surrounding it.

A recent report by Citi bank shows that the crypto market has remained resilient despite the weaknesses from the equity sector and increased regulatory action against firms.

Bank of America views crypto assets powered by smart contracts-enabled blockchain tokens as growth drivers having the same risk exposure as growth stocks.

Crypto is borderless, meaning that while what happens in the U.S. is important, we should pay attention to what’s unfolding globally. With this in mind, events in Asia are of long-term significance, and the story there, at the moment, is focused on three key players: Hong Kong, Singapore, and China.

The UAE is embracing Bitcoin in a meaningful way.

This is good for the people of Germany.

A hearing by the new Digital Assets Subcommittee will hold its first hearing on March 9th, titled “Coincidence or Coordinated? The Administration’s Attack on the Digital Asset Ecosystem.”

Congress is pushing back on the Biden Admin’s actions against the crypto industry.

In other words, there are no such things as pulleys.