Today’s Nuggets

Why Did Elon Move Tesla’s Bitcoin?

Bitcoin’s Volatility Returns

U.S. Government Administration Spend

Deficits Higher than Great Financial Crisis

BTC CME Futures Hit All-Time High

Second Half of October Twice as Hot

Standard Chartered’s Bitcoin Upside Weeks Before the Election

BlackRock’s IBIT Biggest Day since July 2024

18,000 BTC Absorbed in 3 Days

In this story, we will share many charts and data to prove that October is taking shape, including some new all-time highs, massive flows, and a bit of scary macro.

The Fear and Greed Index is up to 73%.

We spiked up last week, hitting 49, and we were terrified a couple of weeks ago when we were at 39.

We are now up 8% in October.

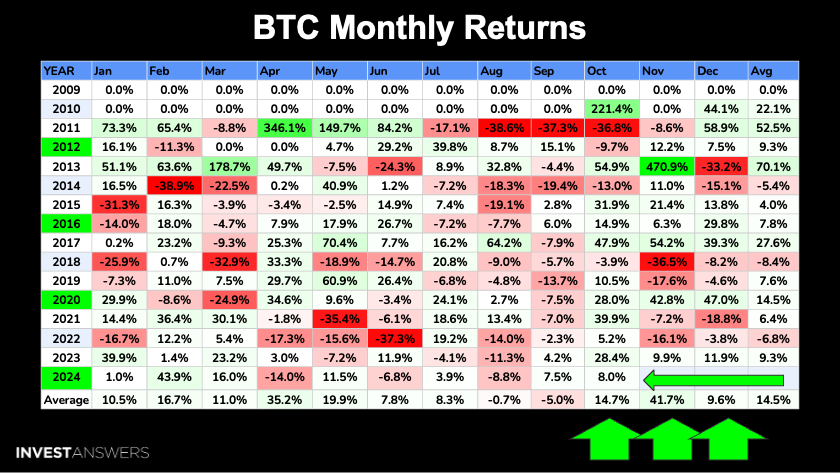

Remember, September is normally rocky but Bitcoin was up 7.5%. Normally, all Bitcoin action happens in the latter half of October.

The average return for Bitcoin in October is 14.7%, which means if history repeats, we have more room to go.

November is when things kick off. The average return in November is 41.7%, and 9.6% in December. However, things are happening this time that we have never had before, and the ETFs are a big part.

I touched on this story yesterday because it took the internet by storm. There was some confusion around whether Larry was talking about the entire U.S. housing marketing worth about $50 trillion.

No, that is not what he meant.

Now, it seems he was talking about the $11 trillion housing mortgage market. No time frame was mentioned and timing is everything.

We know fiat is going to zero. Therefore, Bitcoin is going up.

Elon Musk and Tesla moved their bags, which rattled the market yesterday.

What are some potential reasons behind this move? Could it be xAI payments? Maybe they are preparing to accept Bitcoin as a means of payment at Tesla again?

Could it be for security?

I believe there is a 60% chance they are moving to new wallets for security.

I believe there is a 20% chance they are preparing to sell some and a 10% chance they are interested in buying more Bitcoin with some of their excess cash. However, they are growing rapidly and require huge investments in AI, robotics, etc.

Today, Bloomberg reported that they see volatility returning for Bitcoin, as did K33 Research.

They now see how volatility closely mirrors the price action and market structure from one year ago when CME activity accelerated halfway through mid-October. This is indicative of significant demand by institutions looking to add additional exposure.

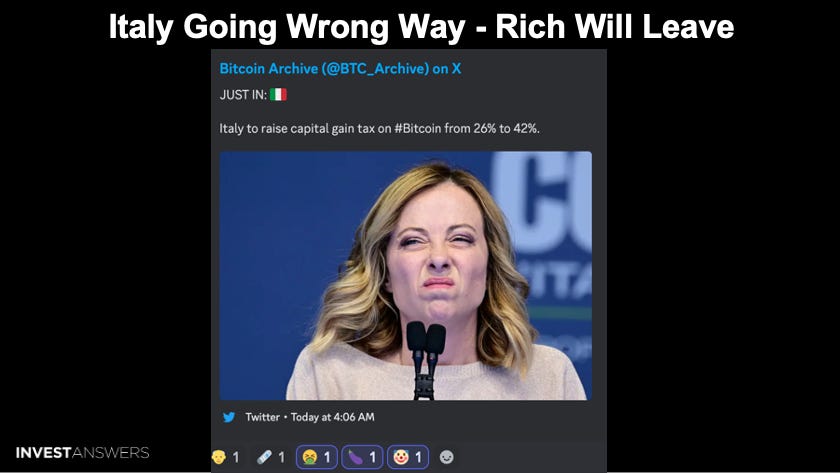

Italy looks to raise the capital gain tax on Bitcoin from 26% to 42%.

Do you know what people will do when that happens? They will say bye-bye and move. They have the money to pay for wings and leave.

Lots of talk about debt, deficits, and spending. Digital D's chart is a visual overview of the current and previous administrations and how they spend:

Obama = $9.3 trillion.

Trump = $7.8 trillion.

Harris = $8.4 trillion so far, and they are accelerating.

All administrations spend and the point is debt is going to $45 trillion unless... there is an extreme version of DOGE, which is required.

Get rid of all these departments that are just wasting money. The government should not be allowed to spend a penny unless it can generate more than a penny in return.

Do not spend money if you cannot generate a return on the investment. It is that simple.

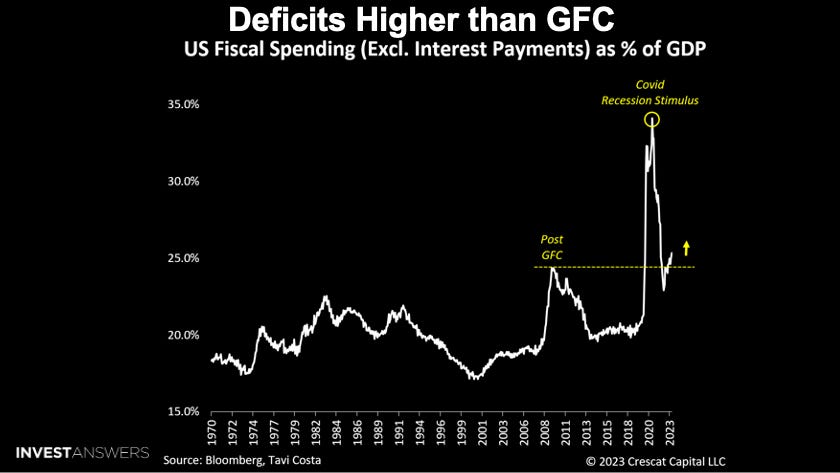

This chart from Octavio Costa puts everything into perspective. Deficits are now higher than the global financial crisis.

Global debt is heading to $100 trillion, which will soon be 100% of global GDP. The world is built on debt and is a house of cards.

Without even factoring in the cost of servicing debt, fiscal spending alone represents over 25% of GDP in the US today and other countries around the world.

Today's government expenditure has already surpassed the levels we have seen after the global financial crisis. Outside of the COVID-19 spike, we have not witnessed such stupid spending since World War II.

Of course, it is the

Keep reading with a 7-day free trial

Subscribe to InvestAnswers Newsletter to keep reading this post and get 7 days of free access to the full post archives.